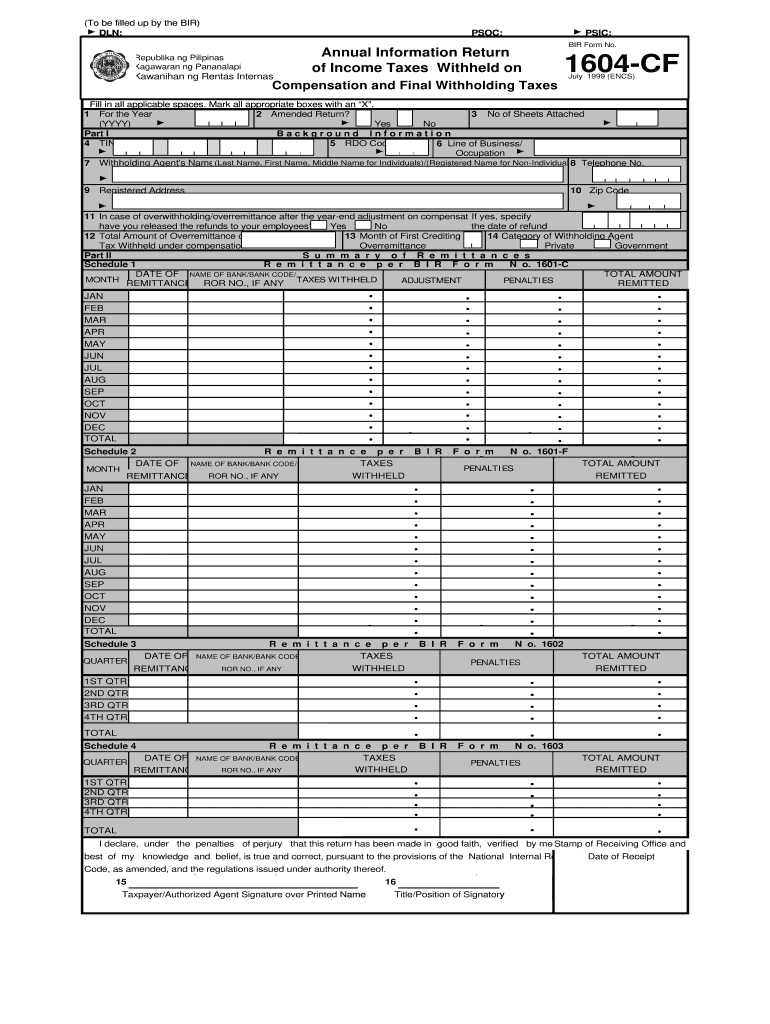

1604 Cf 1999

What is the 1604 CF?

The 1604 CF is a tax form used by businesses in the United States to report their income and expenses for a specific tax year. This form is essential for ensuring compliance with federal tax regulations. It is primarily utilized by corporations and partnerships to summarize their financial activities and calculate their tax liabilities. Understanding the purpose and requirements of the 1604 CF is crucial for accurate reporting and avoiding potential penalties.

Steps to Complete the 1604 CF

Completing the 1604 CF involves several key steps to ensure accurate filing. First, gather all necessary financial documents, including income statements, expense reports, and any other relevant records. Next, fill out the form by entering your business's financial information, such as total revenue and deductible expenses. Be sure to double-check all entries for accuracy. Once completed, review the form for any missing information or errors before submitting it to the appropriate tax authority.

Legal Use of the 1604 CF

The legal use of the 1604 CF is governed by tax laws and regulations set forth by the Internal Revenue Service (IRS). To be considered legally binding, the form must be completed accurately and submitted on time. Businesses must adhere to the guidelines established by the IRS to avoid issues such as audits or penalties. Utilizing a reliable electronic signature solution can help ensure that the submission process is secure and compliant with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the 1604 CF vary depending on the business structure and tax year. Generally, businesses must submit their forms by the due date specified by the IRS, which is typically the fifteenth day of the fourth month following the end of the tax year. It is essential to keep track of these deadlines to avoid late filing penalties. Additionally, businesses should be aware of any extensions that may be available for filing.

Form Submission Methods (Online / Mail / In-Person)

The 1604 CF can be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to the appropriate tax office. Online submission is often the most efficient and secure method, allowing for immediate processing. However, businesses may choose to mail a physical copy if preferred. It is important to follow the specific submission guidelines provided by the IRS for each method to ensure compliance.

Required Documents

To complete the 1604 CF accurately, several documents are required. These include financial statements, receipts for deductible expenses, and any prior year tax returns that may provide relevant information. Having these documents organized and readily available will facilitate a smoother filing process. It is advisable to maintain thorough records throughout the year to simplify the preparation of the 1604 CF.

Quick guide on how to complete 1604 cf

Complete 1604 Cf effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Handle 1604 Cf on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and electronically sign 1604 Cf with ease

- Obtain 1604 Cf and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1604 Cf to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1604 cf

Create this form in 5 minutes!

How to create an eSignature for the 1604 cf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 1604 cf?

The bir form 1604 cf is a crucial tax form used for the annual income tax return filing in the Philippines. It captures comprehensive details about an entity's income tax liabilities for the entire year, making it essential for businesses to stay compliant with tax regulations. By understanding this form, organizations can ensure accurate calculations and timely submissions.

-

How can airSlate SignNow help with submitting the bir form 1604 cf?

With airSlate SignNow, businesses can easily prepare, sign, and submit their bir form 1604 cf electronically. Our user-friendly platform allows for efficient document management, ensuring that you can complete the form accurately and conveniently. This simplifies the process and reduces the chances of errors or delays in submission.

-

What features does airSlate SignNow offer for handling the bir form 1604 cf?

airSlate SignNow provides a range of features to facilitate the handling of the bir form 1604 cf, including document templates, eSignature capabilities, and automated workflows. These features allow businesses to streamline the preparation and signing process, ensuring compliance and speed. Additionally, document storage and tracking help you manage submissions effectively.

-

Is airSlate SignNow a cost-effective solution for processing the bir form 1604 cf?

Yes, airSlate SignNow offers a cost-effective solution for processing the bir form 1604 cf. Our pricing plans are competitive and cater to various needs, ensuring that businesses of all sizes can afford to use our platform. Investing in our solution helps save time and reduce administrative costs associated with document handling.

-

Can airSlate SignNow integrate with other software for managing the bir form 1604 cf?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, making it easier to manage the bir form 1604 cf. By connecting with your existing tools, you can streamline your workflow and improve accuracy in your filing processes. This integration ensures a seamless experience for users handling tax documentation.

-

What are the benefits of using airSlate SignNow for the bir form 1604 cf?

Using airSlate SignNow for the bir form 1604 cf provides multiple benefits, such as enhanced efficiency, improved accuracy, and better collaboration among team members. Our platform allows for quick document sharing and signing, which speeds up the entire filing process. These advantages help businesses to maintain compliance and focus on their core operations.

-

Is it safe to use airSlate SignNow for the bir form 1604 cf?

Yes, it is safe to use airSlate SignNow for the bir form 1604 cf. We prioritize the security of our users' data, utilizing encrypted connections and secure storage options to protect sensitive information. This ensures your documents are safe while allowing you to manage your tax forms with confidence.

Get more for 1604 Cf

- Neuter certificate template 22770419 form

- Hockey canada medical information sheet

- Universal fingerprint form

- Cpa ontario medical absenteeism form cpa ontario medical absenteeism form

- Oasis c development testing and release an overview form

- Dog adoption application timmins ampamp district humane society form

- Certificate in law incomplete grade or deferred examination form

- Office of the registrar fax noonday 416 491 91 form

Find out other 1604 Cf

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT