Rev 419ex Form

What is the Rev 419ex

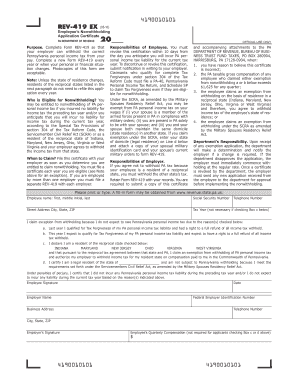

The Rev 419ex is a specific form used in Pennsylvania for employee nonwithholding applications. It serves as a declaration for individuals who wish to claim exemption from state income tax withholding. This form is particularly relevant for employees who meet certain criteria, allowing them to avoid unnecessary withholding from their paychecks. Understanding the purpose and implications of the Rev 419ex is essential for both employees and employers to ensure compliance with state tax regulations.

How to use the Rev 419ex

Using the Rev 419ex involves a straightforward process. First, individuals must determine their eligibility for exemption based on their income and tax situation. Once eligibility is confirmed, the form can be filled out with the necessary personal information, including name, address, and Social Security number. After completing the form, it should be submitted to the employer, who will then process the exemption request. It is crucial to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Rev 419ex

Completing the Rev 419ex requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary personal information, such as your name, address, and Social Security number.

- Review the eligibility criteria to confirm that you qualify for exemption.

- Fill out the form accurately, ensuring all sections are completed.

- Sign and date the form to validate your application.

- Submit the completed form to your employer and retain a copy for your records.

Legal use of the Rev 419ex

The legal use of the Rev 419ex is governed by Pennsylvania tax laws. To be considered valid, the form must be completed accurately and submitted in accordance with state regulations. Employees should understand that submitting the Rev 419ex does not exempt them from all tax obligations; it only applies to state income tax withholding. Employers are responsible for verifying the legitimacy of the exemption claims and must keep the forms on file as part of their payroll records.

Eligibility Criteria

Eligibility for the Rev 419ex is determined by specific criteria set forth by the Pennsylvania Department of Revenue. Generally, individuals must demonstrate that they had no tax liability in the previous year and expect to have none in the current year. Additionally, the individual must be a resident of Pennsylvania or work for an employer located in the state. Meeting these criteria is essential for successfully claiming an exemption from withholding.

Required Documents

When completing the Rev 419ex, no additional documents are typically required at the time of submission. However, it is advisable to have supporting documentation on hand, such as prior year tax returns, to substantiate your claim for exemption if needed. Keeping records of your income and tax filings can also help in case of any future inquiries from tax authorities.

Quick guide on how to complete rev 419ex

Easily Prepare Rev 419ex on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Rev 419ex on any device with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to Edit and eSign Rev 419ex Effortlessly

- Obtain Rev 419ex and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Rev 419ex and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 419ex

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form rev 419 and how is it used?

Form rev 419 is a specific document format utilized for various business processes. It allows users to collect signatures and necessary information efficiently, streamlining workflow. With airSlate SignNow, you can easily create, send, and manage form rev 419 electronically.

-

How does airSlate SignNow simplify completing form rev 419?

AirSlate SignNow provides an intuitive interface that simplifies the completion of form rev 419. Users can fill in the required fields and eSign directly within the platform. This eliminates the need for printing, scanning, or mailing documents, enhancing overall efficiency.

-

What are the pricing options for using airSlate SignNow with form rev 419?

AirSlate SignNow offers several pricing plans that cater to different business needs. These plans include access to a wide range of features to work with form rev 419. Customers can choose a plan that best fits their budget and requirements for document management.

-

Can I integrate form rev 419 with other applications?

Yes, airSlate SignNow allows seamless integration with various third-party applications. You can easily connect platforms like Google Drive, Salesforce, and more to manage your form rev 419 alongside your other business documents. This enhances collaboration and data sharing.

-

What are the security features for handling form rev 419?

AirSlate SignNow prioritizes security, providing robust features to protect your form rev 419 documents. Encryption and secure access controls ensure that your data is safe from unauthorized access. This gives you peace of mind while managing sensitive information.

-

How can form rev 419 benefit my business?

Using form rev 419 can signNowly streamline your business processes. With digital signing and document tracking features in airSlate SignNow, you reduce turnaround times and increase efficiency. This leads to better productivity and faster decision-making within your organization.

-

Is it easy to transition to airSlate SignNow for form rev 419?

Transitioning to airSlate SignNow for managing form rev 419 is designed to be straightforward. The platform includes user-friendly tutorials and customer support to assist you during the setup process. You'll be able to start sending and signing documents in no time.

Get more for Rev 419ex

Find out other Rev 419ex

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe