Bir Form 2550m Sample

What is the Bir Form 2550m Sample

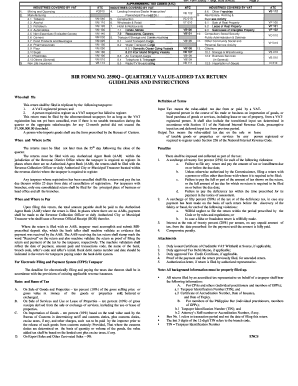

The Bir Form 2550m is a tax form used in the Philippines for the declaration of value-added tax (VAT) liabilities. It serves as a means for businesses to report their sales and the corresponding VAT due to the Bureau of Internal Revenue (BIR). This form is essential for ensuring compliance with tax regulations and for businesses to accurately calculate their tax obligations. A sample of the Bir Form 2550m can provide valuable insights into how to properly fill out the form, including required fields and necessary information.

Steps to Complete the Bir Form 2550m Sample

Completing the Bir Form 2550m involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather Necessary Information: Collect all relevant financial documents, including sales invoices and receipts, to determine your total sales and VAT collected.

- Fill Out Basic Information: Start by entering your taxpayer identification number (TIN), business name, and address at the top of the form.

- Report Sales: Input the total sales amount in the designated section, ensuring that you categorize sales appropriately, such as zero-rated or exempt sales.

- Calculate VAT: Determine the VAT due by applying the correct rate to the total sales amount, and enter this figure in the appropriate field.

- Review and Validate: Double-check all entries for accuracy, ensuring that all calculations are correct before submission.

How to Obtain the Bir Form 2550m Sample

The Bir Form 2550m sample can be obtained through various means. The most common way is to visit the official Bureau of Internal Revenue website, where downloadable PDF versions of the form are available. Additionally, local BIR offices may provide physical copies. It is also helpful to consult with tax professionals or accountants who can offer guidance and provide samples tailored to specific business needs.

Legal Use of the Bir Form 2550m Sample

The legal use of the Bir Form 2550m is crucial for compliance with tax laws in the Philippines. Submitting this form accurately and on time helps avoid penalties and ensures that businesses fulfill their tax obligations. It is important to note that the information provided must be truthful and complete, as discrepancies can lead to audits or legal repercussions. Utilizing a sample can help clarify the proper format and required details, fostering adherence to legal standards.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Bir Form 2550m is essential for timely compliance. Typically, this form is required to be filed monthly, with the deadline falling on the 20th day of the following month. For example, the form for sales in January must be submitted by February 20. It is advisable to keep track of these dates to avoid late fees and penalties, and to ensure that all tax obligations are met promptly.

Form Submission Methods (Online / Mail / In-Person)

The Bir Form 2550m can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt to file electronically through the BIR's online portal, which streamlines the process and offers immediate confirmation of receipt.

- Mail: Forms can be printed and mailed to the appropriate BIR office. Ensure that the form is sent well before the deadline to allow for processing time.

- In-Person: Submitting the form in person at a local BIR office is another option, allowing for direct interaction with BIR personnel for any questions or clarifications.

Quick guide on how to complete bir form 2550q

Complete bir form 2550q effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage bir form 2550q online on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and eSign bir 2550q with ease

- Obtain bir form 2550m and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select essential sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 2550q to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to bir form 2550q pdf 2018

Create this form in 5 minutes!

How to create an eSignature for the sample filled up bir form 2550q

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 2550q form no download needed

-

What is the process on how to fill up 2550m using airSlate SignNow?

To fill up 2550m using airSlate SignNow, start by uploading your document to the platform. Next, use the intuitive interface to add text fields, checkboxes, or signatures in the required areas. After organizing your document, simply send it out for eSignature, making the entire process efficient and straightforward.

-

Are there any costs associated with learning how to fill up 2550m on airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to make it accessible for all users. While there might be costs involved, the platform provides a cost-effective solution that improves the efficiency of filling out documents like the 2550m form. It’s recommended to explore the pricing options to find the best fit for your business needs.

-

What features does airSlate SignNow offer for filling up forms like 2550m?

When learning how to fill up 2550m on airSlate SignNow, users benefit from features like customizable templates, document tracking, and easy integrations with other software. These capabilities enhance the user experience, ensuring that filling out important forms is simple and efficient. The platform is designed to streamline the entire document signing process.

-

How do I ensure security while filling up 2550m with airSlate SignNow?

Security is paramount when learning how to fill up 2550m, and airSlate SignNow offers advanced security features to protect your data. With encryption, multi-factor authentication, and compliance with industry standards, users can confidently fill and send sensitive documents without worrying about unauthorized access.

-

Can I integrate airSlate SignNow with other software while filling out 2550m?

Yes, airSlate SignNow supports numerous integrations with popular software and applications. This flexibility allows you to easily import data or sync completed documents, making the process of filling up 2550m even more seamless. Explore the integration options available to enhance your workflow.

-

What benefits can I expect from learning how to fill up 2550m with airSlate SignNow?

Utilizing airSlate SignNow to fill up 2550m produces signNow benefits, including increased efficiency, reduced paperwork, and faster turnaround times. Users can quickly send documents for signatures and track the status in real-time. This modern approach saves time for both individuals and businesses.

-

Is there customer support available while using airSlate SignNow to fill up 2550m?

Absolutely! airSlate SignNow provides robust customer support to assist users in learning how to fill up 2550m and addressing any queries they might have. Whether through live chat, email, or phone, the support team is ready to help ensure that your experience is as smooth as possible.

Get more for sample filled up bir form 2550m

- Self placement form college of education illinois state

- Famu nursing michelle form

- Application for re admission form university system of georgia fvsu

- Fa form fvsu sap appeal form reviseddoc adobe livecycle designer template fvsu

- Transcript request form elms

- Education recommendation form liberty university liberty

- Multistate performance test synopsis july 24 2007 question 1

- International pensions direct 2013 2019 form

Find out other bir form 2550q online

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form