Swami Vivekananda Loan Application Form

What is the Swami Vivekananda Loan Application Form

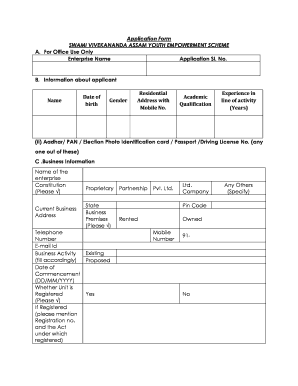

The Swami Vivekananda Loan Application Form is a crucial document designed for individuals seeking financial assistance under the Swami Vivekananda Youth Empowerment Scheme. This scheme aims to empower youth in Assam by providing them with loans to support their entrepreneurial ventures or educational pursuits. The application form collects essential information about the applicant, including personal details, financial background, and the purpose of the loan. Completing this form accurately is vital for the approval process and ensures that applicants receive the necessary support to achieve their goals.

Steps to Complete the Swami Vivekananda Loan Application Form

Completing the Swami Vivekananda Loan Application Form involves several key steps:

- Gather Required Information: Collect personal identification details, income information, and any documentation related to the loan purpose.

- Fill Out the Form: Carefully complete each section of the application, ensuring that all information is accurate and legible.

- Review Your Application: Double-check all entries for errors or omissions before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the correct authority.

Legal Use of the Swami Vivekananda Loan Application Form

The Swami Vivekananda Loan Application Form is legally binding once submitted, provided it meets specific requirements. It is essential to understand that the information provided must be truthful and accurate. Misrepresentation or fraudulent information can lead to legal consequences, including denial of the loan or further legal action. Ensuring compliance with all legal guidelines is crucial for a smooth application process and to uphold the integrity of the scheme.

Eligibility Criteria

To qualify for a loan under the Swami Vivekananda scheme, applicants must meet certain eligibility criteria. These typically include:

- Age requirements, usually between eighteen and thirty-five years.

- Residency in Assam, as the scheme is specifically targeted at the youth of this region.

- Demonstrated need for financial assistance, whether for business or educational purposes.

- Submission of all required documentation to support the application.

Required Documents

When applying for the Swami Vivekananda Loan, applicants must provide several key documents to support their application. These may include:

- A government-issued photo ID for identity verification.

- Proof of residency in Assam, such as a utility bill or rental agreement.

- Income statements or proof of financial status, like bank statements or salary slips.

- Documentation outlining the purpose of the loan, such as business plans or educational enrollment letters.

Form Submission Methods

Applicants can submit the Swami Vivekananda Loan Application Form through various methods to accommodate different preferences:

- Online Submission: Completing and submitting the form through the official online portal.

- Mail Submission: Printing the completed form and sending it via postal service to the designated office.

- In-Person Submission: Visiting the relevant office to submit the form directly to an official.

Quick guide on how to complete swami vivekananda loan application form

Complete Swami Vivekananda Loan Application Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Swami Vivekananda Loan Application Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Swami Vivekananda Loan Application Form without hassle

- Locate Swami Vivekananda Loan Application Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Swami Vivekananda Loan Application Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the swami vivekananda loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sawami Vivakanda Loan Assam program?

The Sawami Vivakanda Loan Assam program is a government initiative designed to provide financial support to entrepreneurs and small businesses in Assam. This program aims to facilitate access to affordable loans, empowering individuals to establish and grow their businesses, thereby contributing to the local economy.

-

Who is eligible for the Sawami Vivakanda Loan Assam?

Eligibility for the Sawami Vivakanda Loan Assam program typically includes small business owners and entrepreneurs who are residents of Assam. Applicants must meet certain criteria related to the business type and financial standing to qualify for the loan assistance.

-

What are the interest rates for the Sawami Vivakanda Loan Assam?

Interest rates for the Sawami Vivakanda Loan Assam vary based on the loan amount and terms set by the financial institution. Generally, these rates are competitive and designed to be affordable for small business owners looking to access funds through this scheme.

-

How can I apply for the Sawami Vivakanda Loan Assam?

To apply for the Sawami Vivakanda Loan Assam, interested applicants can visit their local bank or the official government website. The application process usually includes submitting required documents and a business plan that outlines how the funds will be utilized.

-

What documents are needed for the Sawami Vivakanda Loan Assam application?

Typically, applicants for the Sawami Vivakanda Loan Assam need to provide identification proof, business registration documents, financial statements, and a detailed project proposal. Additional documentation may be required depending on the specific requirements of the lending institution.

-

What are the benefits of the Sawami Vivakanda Loan Assam?

The benefits of the Sawami Vivakanda Loan Assam include access to low-interest loans, support for business growth, and financial empowerment for local entrepreneurs. By participating in this program, small businesses can gain the capital necessary to expand operations and create jobs.

-

Is there any repayment flexibility for the Sawami Vivakanda Loan Assam?

Yes, the Sawami Vivakanda Loan Assam program often offers flexible repayment options to ease the financial burden on borrowers. Terms may include grace periods and tailored repayment schedules to suit the income flow of small businesses.

Get more for Swami Vivekananda Loan Application Form

- Ic3 complaint referral form

- Application print out form

- Interaction checklist for augmentative communication form

- Polmed chronic forms

- Lesson 7 homework practice ratio and rate problems answer key form

- Slsa patrol log surf life saving nsw surflifesaving sportal com form

- Representative authority purpose of this form retu

- Clear form montana ab 26 rev 03 17 request for inf

Find out other Swami Vivekananda Loan Application Form

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy