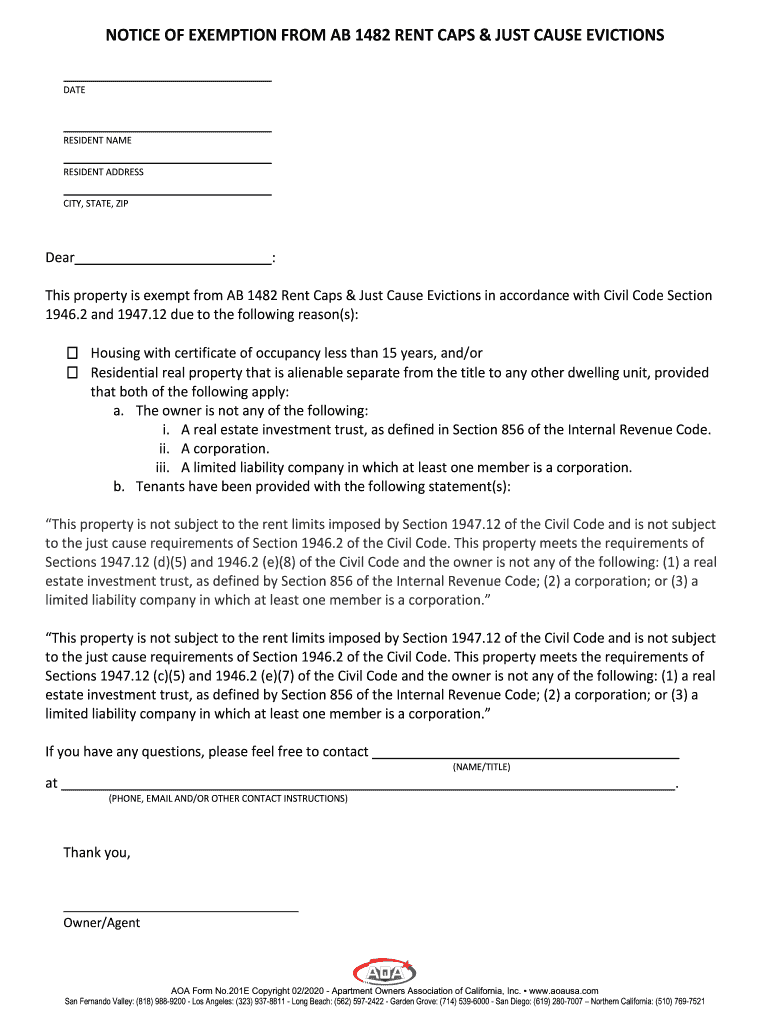

Ab 1482 Notice Sample Letter Form

Understanding IRS Notice 1482

The IRS Notice 1482 is a communication from the Internal Revenue Service that typically informs taxpayers about specific issues related to their tax filings. This notice may address discrepancies, additional information needed, or other important tax-related matters. Understanding the content of this notice is crucial for ensuring compliance and addressing any issues promptly.

Steps to Complete IRS Notice 1482

Completing the IRS Notice 1482 involves several key steps to ensure that all required information is accurately provided. Start by carefully reading the notice to understand what information the IRS is requesting. Gather all necessary documents related to your tax filings, including previous returns, W-2 forms, and any supporting documentation. Fill out the required sections of the notice, ensuring that all information matches your records. Review your completed notice for accuracy before submission.

Legal Use of IRS Notice 1482

The IRS Notice 1482 must be handled in accordance with federal tax laws. It is essential to respond to this notice within the timeframe specified to avoid penalties or further complications. The notice serves as a formal request for information, and failure to comply may result in additional scrutiny of your tax filings. Keeping a record of your response and any correspondence with the IRS is advisable for legal protection.

Filing Deadlines for IRS Notice 1482

Timely response to the IRS Notice 1482 is critical. The notice will specify a deadline for your response, which typically ranges from 30 to 90 days. It is important to adhere to this timeline to prevent potential penalties or interest on any unpaid taxes. Marking these deadlines on your calendar can help ensure that you respond promptly.

Required Documents for IRS Notice 1482

When responding to the IRS Notice 1482, you may need to provide various documents to support your case. Commonly required documents include copies of your tax returns, W-2 forms, 1099 forms, and any other relevant financial records. Ensure that all documents are complete and accurate to facilitate a smooth resolution process.

Who Issues the IRS Notice 1482

The IRS Notice 1482 is issued by the Internal Revenue Service, which is the federal agency responsible for tax collection and enforcement in the United States. This notice is part of their communication process to ensure that taxpayers are informed about their tax obligations and any issues that may arise during the filing process.

Penalties for Non-Compliance with IRS Notice 1482

Failure to respond to the IRS Notice 1482 can lead to several penalties, including additional taxes owed, interest charges, and potential legal action. It is crucial to take this notice seriously and respond within the specified timeframe to avoid these negative consequences. Understanding the implications of non-compliance can help motivate timely action.

Quick guide on how to complete ab 1482 notice sample letter 517503150

Complete Ab 1482 Notice Sample Letter effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Ab 1482 Notice Sample Letter on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Ab 1482 Notice Sample Letter with ease

- Locate Ab 1482 Notice Sample Letter and then click Get Form to commence.

- Use the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ab 1482 Notice Sample Letter and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ab 1482 notice sample letter 517503150

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Notice 1482 and how can it affect my business?

IRS Notice 1482 is a communication from the IRS that indicates there may be issues with a taxpayer's account. It can affect your business by potentially affecting your tax obligations or eligibility for certain tax benefits. Understanding the implications of IRS Notice 1482 is crucial for maintaining compliance and avoiding penalties.

-

How can airSlate SignNow help me manage IRS Notice 1482 documents?

airSlate SignNow offers an efficient platform for sending and eSigning documents related to IRS Notice 1482. By streamlining document workflows, you can easily organize and manage these important communications from the IRS. This helps ensure timely responses and keeps all parties informed, reducing the risk of misunderstandings.

-

Are there any costs associated with using airSlate SignNow for IRS Notice 1482 management?

Yes, airSlate SignNow offers flexible pricing plans tailored to various business needs. These plans provide full access to features that assist in managing IRS Notice 1482 documentation, making it cost-effective for businesses of all sizes. With the benefits it brings, the investment in airSlate SignNow often pays off by saving time and improving compliance.

-

What features does airSlate SignNow provide for handling IRS Notice 1482?

airSlate SignNow features secure eSigning, document templates, and automated workflows, specifically useful for managing IRS Notice 1482. These tools simplify the process of gathering signatures and ensuring that documents are completed accurately and on time. By using these features, you can focus on resolving the issues outlined in IRS Notice 1482 without getting bogged down by paperwork.

-

Can I integrate airSlate SignNow with other software to manage IRS Notice 1482?

Absolutely! airSlate SignNow offers integrations with various platforms such as CRMs, cloud storage, and accounting software. This enables you to seamlessly manage IRS Notice 1482 documents within your existing workflows, enhancing productivity and ensuring that all relevant information is easily accessible.

-

How can I ensure compliance when dealing with IRS Notice 1482 using airSlate SignNow?

By using airSlate SignNow, you can maintain compliance with IRS requirements when managing documents related to IRS Notice 1482. The platform provides an audit trail and comprehensive security features, which are critical for ensuring that your documentation is not only safe but also compliant with regulatory standards.

-

Is airSlate SignNow user-friendly for businesses new to managing IRS Notice 1482?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for businesses new to handling IRS Notice 1482. The intuitive interface and straightforward features allow users to quickly begin managing their documents without needing extensive training. This ease of use helps streamline the process from day one.

Get more for Ab 1482 Notice Sample Letter

Find out other Ab 1482 Notice Sample Letter

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online