W8 Form

What is the W8 Form

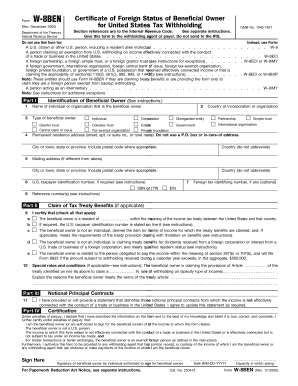

The W8 form, specifically the W-8BEN form, is a tax document used by foreign individuals and entities to certify their foreign status and claim tax treaty benefits. This form is crucial for non-U.S. residents who receive income from U.S. sources, such as interest, dividends, or royalties. By submitting the W8BEN, individuals can avoid or reduce the withholding tax on their U.S. income, as it provides the necessary information to the IRS regarding their eligibility for reduced tax rates under applicable tax treaties.

Steps to Complete the W8 Form

Completing the W8BEN form involves several key steps to ensure accuracy and compliance. First, gather your personal information, including your name, country of citizenship, and address. Next, provide your U.S. taxpayer identification number (if applicable) and foreign tax identifying number. It is essential to indicate the type of income you expect to receive and whether you are claiming benefits under a tax treaty. Finally, sign and date the form, ensuring that all information is complete and accurate before submission.

Legal Use of the W8 Form

The W8BEN form is legally binding when completed correctly, as it certifies your foreign status and claims any applicable tax treaty benefits. To be legally effective, the form must be signed and dated by the individual or an authorized representative. It is important to keep in mind that providing false information on the W8 form can lead to penalties, including potential fines and increased withholding tax rates. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding the completion of the form.

How to Obtain the W8 Form

The W8BEN form can be easily obtained through the IRS website or directly from financial institutions that require it for processing payments. The form is available as a downloadable PDF, which can be printed and filled out manually. Additionally, some financial institutions may provide an electronic version of the form for online completion. Ensure that you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

While the W8BEN form does not have a specific filing deadline like tax returns, it is essential to submit it to the withholding agent before any payments are made to ensure proper tax treatment. If the form is not submitted in a timely manner, the withholding agent may apply the maximum withholding tax rate on payments made to you. It is advisable to review any specific deadlines set by the financial institution or entity requesting the form, as these may vary.

Required Documents

To complete the W8BEN form, you will need several documents to verify your identity and foreign status. These typically include a valid passport or government-issued identification that shows your name and country of citizenship. Additionally, if you are claiming tax treaty benefits, you may need to provide documentation that supports your eligibility, such as proof of residency in your home country. Having these documents ready will facilitate the accurate completion of the form.

Quick guide on how to complete w8 form 53985

Complete W8 Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage W8 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign W8 Form effortlessly

- Find W8 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign W8 Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w8 form 53985

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chase w8ben form?

The chase w8ben form is a document used by non-U.S. residents to signNow their foreign status and claim tax benefits under an income tax treaty. Businesses must accurately complete this form to ensure compliance with U.S. tax regulations.

-

How can airSlate SignNow help with the chase w8ben form?

airSlate SignNow provides an intuitive platform for you to easily fill out, sign, and send the chase w8ben form securely. Our solution simplifies document management, allowing you to streamline the entire process and focus on your business.

-

Is there a cost associated with using airSlate SignNow to complete the chase w8ben form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents like the chase w8ben form. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you only pay for the features you need.

-

What features does airSlate SignNow offer for the chase w8ben form?

airSlate SignNow includes various features for efficiently handling the chase w8ben form, such as customizable templates, eSignature capabilities, and secure cloud storage. These features streamline the process, saving you time and resources.

-

Can I integrate airSlate SignNow with other applications while managing the chase w8ben form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Salesforce, allowing you to manage the chase w8ben form alongside your existing workflows and tools.

-

What are the security measures in place for the chase w8ben form using airSlate SignNow?

airSlate SignNow prioritizes document security, employing encryption and secure data storage protocols. This protects sensitive information in the chase w8ben form and ensures compliance with industry standards.

-

How does signing the chase w8ben form with airSlate SignNow work?

Signing the chase w8ben form with airSlate SignNow is quick and simple. Users can digitally sign their documents with just a few clicks, making it easy to obtain the necessary signatures and complete the process efficiently.

Get more for W8 Form

- Ring blank size chart form

- Livingston cover sheet 210931292 form

- Lis61 form

- Dos ny gov licensing lc instructions form

- Fda form 3419

- Gst payment challan format in excel

- Protect your workers with a heat illness prevention plan constructconnect form

- Insurance payment policy please read and theraplay nyc form

Find out other W8 Form

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple