Form 592 a Payment Voucher for Foreign Partner or Member 2024-2026

What is the Form 592 A Payment Voucher For Foreign Partner Or Member

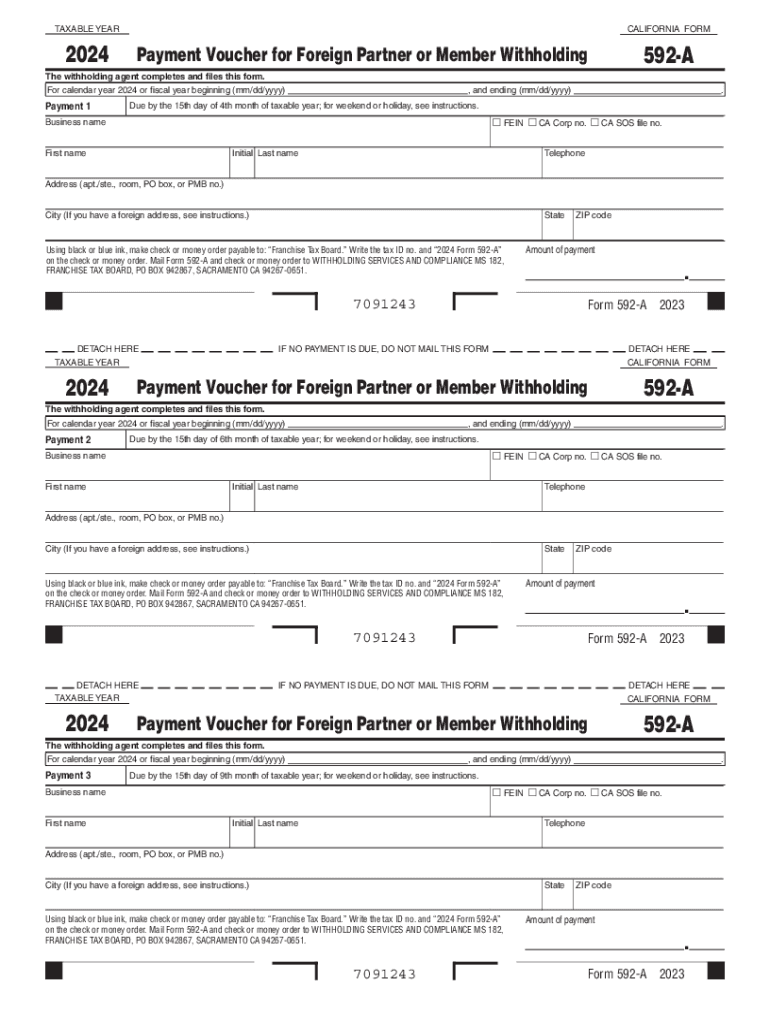

The Form 592 A Payment Voucher is a crucial document used in the United States for reporting and remitting tax payments on behalf of foreign partners or members of a partnership. This form is specifically designed for partnerships that have foreign partners who may not be subject to U.S. tax withholding. The voucher serves as a means for the partnership to fulfill its tax obligations to the state, ensuring that the correct amount is paid on behalf of the foreign partner or member.

How to use the Form 592 A Payment Voucher For Foreign Partner Or Member

To effectively use the Form 592 A Payment Voucher, partnerships must first determine the tax liability for their foreign partners. Once the amount is calculated, the partnership fills out the voucher with the necessary information, including the name and identification number of the foreign partner. The completed form is then submitted along with the payment to the appropriate tax authority. It is essential to ensure that all details are accurate to avoid any complications or delays in processing.

Steps to complete the Form 592 A Payment Voucher For Foreign Partner Or Member

Completing the Form 592 A Payment Voucher involves several key steps:

- Gather necessary information about the foreign partner, including their name, address, and identification number.

- Calculate the total tax liability for the foreign partner based on the partnership's earnings.

- Fill out the Form 592 A with the calculated tax amount and the required partner information.

- Review the form for accuracy and completeness before submission.

- Submit the completed form along with the payment to the designated tax authority.

Filing Deadlines / Important Dates

It is vital for partnerships to be aware of the filing deadlines associated with the Form 592 A Payment Voucher. Generally, the form must be submitted by the due date of the partnership's tax return. This ensures that the payment is processed in a timely manner and helps avoid penalties for late submissions. Partnerships should also keep track of any updates to deadlines that may arise due to changes in tax regulations or policies.

Key elements of the Form 592 A Payment Voucher For Foreign Partner Or Member

The Form 592 A Payment Voucher includes several key elements that must be accurately completed:

- Partner Information: This section requires the name, address, and identification number of the foreign partner.

- Tax Amount: The total tax liability that the partnership is remitting on behalf of the foreign partner.

- Signature: The form must be signed by an authorized representative of the partnership to validate the submission.

- Payment Method: Indicate how the payment will be made, whether by check or electronic payment.

Legal use of the Form 592 A Payment Voucher For Foreign Partner Or Member

The legal use of the Form 592 A Payment Voucher is essential for compliance with U.S. tax laws. Partnerships must ensure that they are using the form correctly to report and remit taxes for foreign partners. Failure to use the form appropriately can result in penalties and legal repercussions. It is advisable for partnerships to consult with a tax professional to ensure compliance with all applicable regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 592 a payment voucher for foreign partner or member

Create this form in 5 minutes!

How to create an eSignature for the form 592 a payment voucher for foreign partner or member

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 592 2024?

Form 592 2024 is a tax form used by California residents to report and pay withholding on income earned by non-residents. It is essential for ensuring compliance with state tax regulations. Understanding how to fill out form 592 2024 can help avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow help with form 592 2024?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including form 592 2024. With its user-friendly interface, you can easily manage your tax documents and ensure they are signed and submitted on time. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan includes features that support the signing and management of documents like form 592 2024. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the management of documents like form 592 2024, making it easier to organize and retrieve important tax forms. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Is airSlate SignNow compliant with legal standards for form 592 2024?

Yes, airSlate SignNow complies with all legal standards for electronic signatures, ensuring that documents like form 592 2024 are legally binding. This compliance provides peace of mind when sending sensitive tax documents. You can trust that your signed forms will be recognized by tax authorities.

-

Can I integrate airSlate SignNow with other software for form 592 2024?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing form 592 2024. Whether you use CRM systems or accounting software, these integrations allow for seamless document handling and improved efficiency.

-

What are the benefits of using airSlate SignNow for form 592 2024?

Using airSlate SignNow for form 592 2024 offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing you to focus on your business rather than administrative tasks. Additionally, it helps ensure that your tax documents are handled efficiently.

Get more for Form 592 A Payment Voucher For Foreign Partner Or Member

- Tax forms the city of maumee oh

- H20222022instagram photos and videos form

- Schedule b interest dividends and certain capital gains and 627571471 form

- 2021 form 3581 tax deposit refund and transfer request

- Ia 1065 instructions 41 017 iowa department of revenue form

- Injured spouse claims vermont department of taxes form

- Do not file this draft form cloudfrontnet

- Dr 133 florida department of revenue form

Find out other Form 592 A Payment Voucher For Foreign Partner Or Member

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast