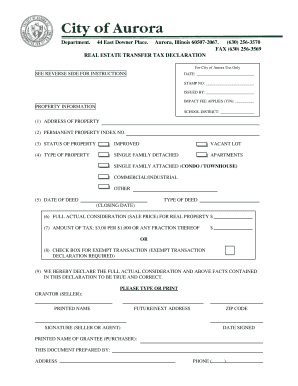

Aurora Transfer Stamps Form

What is the Aurora Transfer Stamps

The Aurora transfer stamps are essential documents used in real estate transactions within the City of Aurora. These stamps signify that the appropriate transfer tax has been paid when property changes ownership. The city requires these stamps to ensure compliance with local tax regulations, making them a vital aspect of the property transfer process. Understanding the purpose and function of these stamps helps property owners and buyers navigate the legal requirements associated with real estate transactions.

How to use the Aurora Transfer Stamps

Using the Aurora transfer stamps involves several steps to ensure that the transfer of property is legally recognized. First, the seller or their representative must obtain the necessary stamps before the property deed is recorded. This process typically requires submitting a completed city of Aurora statement of open accounts, which details any outstanding taxes or fees associated with the property. Once the transfer stamps are acquired, they must be affixed to the deed before submission to the county recorder's office. This step is crucial for the legal validation of the property transfer.

Steps to complete the Aurora Transfer Stamps

Completing the Aurora transfer stamps requires a systematic approach to ensure compliance with local regulations. The following steps outline the process:

- Gather necessary documents, including the property deed and the city of Aurora statement of open accounts.

- Submit the statement to the appropriate city department to confirm that all taxes and fees are paid.

- Obtain the Aurora transfer stamps from the city office after verification.

- Affix the stamps to the property deed.

- File the stamped deed with the county recorder's office to finalize the transfer.

Legal use of the Aurora Transfer Stamps

The legal use of Aurora transfer stamps is governed by local tax laws and regulations. These stamps serve as proof that the required transfer tax has been paid, which is essential for the validity of the property transfer. Failure to obtain and use the appropriate transfer stamps can result in penalties, including fines or delays in the recording of the property deed. Therefore, it is crucial for sellers and buyers to understand the legal implications of these stamps in the context of real estate transactions.

Required Documents

To obtain the Aurora transfer stamps, specific documents are required to ensure a smooth process. These documents typically include:

- The property deed, which outlines the details of the property being transferred.

- The city of Aurora statement of open accounts, confirming that all taxes and fees related to the property are settled.

- Any additional documentation requested by the city office, which may vary based on the specific circumstances of the property transfer.

Who Issues the Form

The forms associated with the Aurora transfer stamps are issued by the City of Aurora's finance department or the relevant city agency responsible for managing property taxes. This department oversees the collection of transfer taxes and ensures that all transactions comply with local regulations. By working directly with this office, property owners can obtain the necessary stamps and ensure their property transfers are legally valid.

Quick guide on how to complete aurora transfer stamps

Complete Aurora Transfer Stamps seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it in the cloud. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Aurora Transfer Stamps on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Aurora Transfer Stamps effortlessly

- Locate Aurora Transfer Stamps and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device of your choosing. Edit and eSign Aurora Transfer Stamps to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aurora transfer stamps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are aurora transfer stamps?

Aurora transfer stamps are essential tools for businesses looking to simplify document management and eSigning processes. They serve as a reliable method for authenticating signatures and ensuring that transferred documents maintain their integrity. Utilizing aurora transfer stamps can streamline your workflows signNowly.

-

How do I use aurora transfer stamps in airSlate SignNow?

Using aurora transfer stamps in airSlate SignNow is straightforward. After uploading your document, you can easily add these stamps during the signing process. This feature allows you to enhance the credibility of your documents with minimal effort, making it a valuable addition to your digital toolkit.

-

Are aurora transfer stamps customizable?

Yes, aurora transfer stamps in airSlate SignNow can be customized to meet your specific needs. You can adjust the size, color, and text to ensure that the stamp accurately represents your brand. Customization helps make your documents more professional and tailored to your organization's requirements.

-

What is the pricing for using aurora transfer stamps?

Pricing for using aurora transfer stamps in airSlate SignNow is based on the subscription plan you choose. Each plan provides different features and functionalities, ensuring you get the best value for your needs. For detailed pricing information, visit our pricing page to find the plan that suits your business requirements.

-

What benefits do aurora transfer stamps offer?

Aurora transfer stamps offer several benefits, including enhanced document security and improved workflow efficiency. They help verify the authenticity of electronically signed documents, which is crucial for legal compliance. By utilizing aurora transfer stamps, businesses can build trust and streamline their signing processes.

-

Can I integrate aurora transfer stamps with other applications?

Yes, airSlate SignNow provides integration capabilities with various applications, allowing you to incorporate aurora transfer stamps seamlessly. Whether you use CRM systems or project management tools, these integrations can help you maximize your workflow efficiency. Check our integrations page for available options.

-

Are there any limitations on using aurora transfer stamps?

While aurora transfer stamps are versatile, there may be some limitations based on the plan selected with airSlate SignNow. Certain advanced features may only be available in higher-tier subscriptions. Be sure to review the specific feature availability to make the most of your aurora transfer stamps.

Get more for Aurora Transfer Stamps

Find out other Aurora Transfer Stamps

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors