R&D Sales Tax Exemption Form Winthrop University

What is the R&D Sales Tax Exemption Form Winthrop University

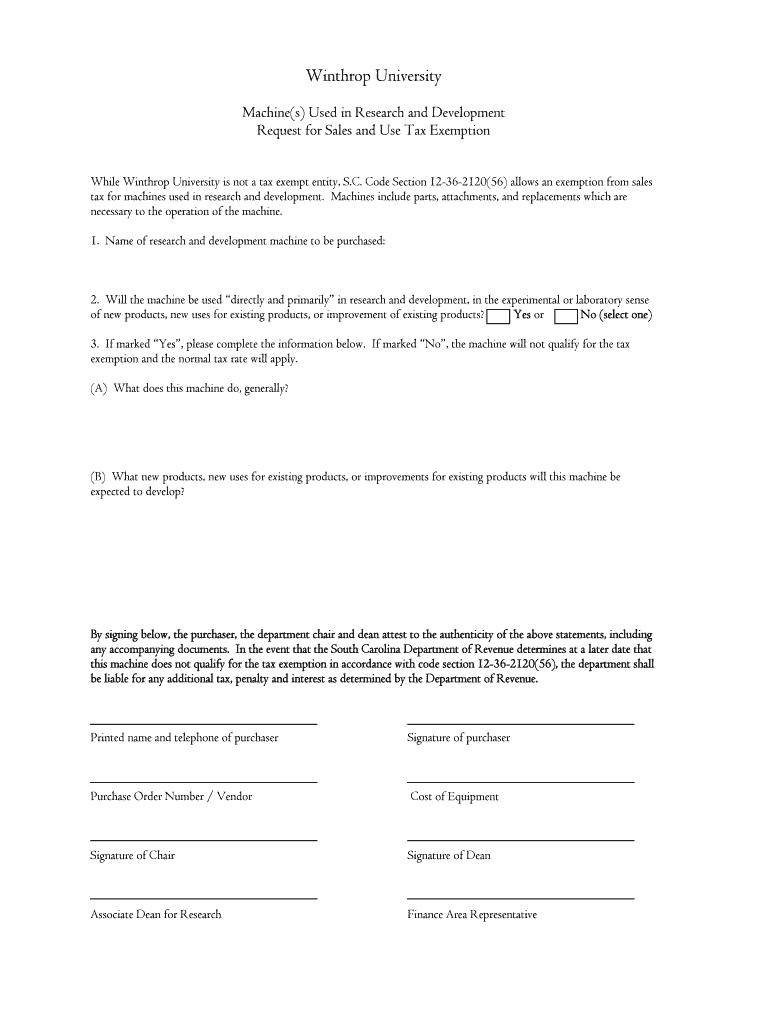

The R&D Sales Tax Exemption Form from Winthrop University is a specialized document designed for entities engaged in research and development activities. This form allows eligible organizations to claim exemptions from sales tax on purchases related to R&D projects. The exemption is intended to support innovation and development within the academic and business communities by reducing the financial burden of sales tax on essential materials and services.

How to use the R&D Sales Tax Exemption Form Winthrop University

Using the R&D Sales Tax Exemption Form involves several key steps. First, ensure that your organization qualifies for the exemption by meeting specific criteria related to R&D activities. Next, complete the form accurately, providing all required information, including the nature of your research and the items for which you seek exemption. Once completed, submit the form to the appropriate department at Winthrop University to receive the exemption approval. It is essential to retain a copy of the form for your records and future reference.

Steps to complete the R&D Sales Tax Exemption Form Winthrop University

Completing the R&D Sales Tax Exemption Form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation that demonstrates your organization's R&D activities.

- Fill out the form with accurate information, including your organization's name, address, and tax identification number.

- Clearly describe the R&D activities and the specific items or services for which you are claiming the exemption.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated office at Winthrop University.

Eligibility Criteria

To qualify for the R&D Sales Tax Exemption Form, organizations must meet specific eligibility criteria. Typically, this includes being a registered entity engaged in qualified research activities as defined by state and federal guidelines. The research must aim to develop or improve products, processes, or technologies. Additionally, the items purchased must be directly related to the R&D efforts to qualify for the exemption.

Required Documents

When submitting the R&D Sales Tax Exemption Form, certain documents may be required to support your claim. These documents often include:

- Proof of your organization’s registration and tax identification number.

- Detailed descriptions of the R&D projects and related expenses.

- Invoices or receipts for the items or services for which the exemption is being claimed.

Form Submission Methods

The R&D Sales Tax Exemption Form can typically be submitted through various methods, ensuring convenience for users. Common submission methods include:

- Online submission via the university’s designated portal.

- Mailing a hard copy of the completed form to the appropriate department.

- In-person submission at the university’s administrative office.

Quick guide on how to complete rampampampd sales tax exemption form winthrop university

Complete [SKS] seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize signNow parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rampampampd sales tax exemption form winthrop university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R&D Sales Tax Exemption Form Winthrop University?

The R&D Sales Tax Exemption Form Winthrop University is a document that allows eligible businesses to claim exemptions on sales tax for research and development purchases. This form is essential for organizations looking to maximize their tax savings while investing in innovation.

-

How can airSlate SignNow help with the R&D Sales Tax Exemption Form Winthrop University?

airSlate SignNow streamlines the process of completing and submitting the R&D Sales Tax Exemption Form Winthrop University. With our easy-to-use platform, you can quickly fill out, eSign, and send the form, ensuring compliance and efficiency in your tax exemption claims.

-

What are the pricing options for using airSlate SignNow for the R&D Sales Tax Exemption Form Winthrop University?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget while efficiently managing the R&D Sales Tax Exemption Form Winthrop University.

-

What features does airSlate SignNow provide for managing the R&D Sales Tax Exemption Form Winthrop University?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the R&D Sales Tax Exemption Form Winthrop University. These tools enhance your document management process, making it easier to handle tax exemption forms efficiently.

-

Are there any benefits to using airSlate SignNow for the R&D Sales Tax Exemption Form Winthrop University?

Using airSlate SignNow for the R&D Sales Tax Exemption Form Winthrop University offers numerous benefits, including reduced processing time and improved accuracy. Our solution minimizes errors and ensures that your forms are submitted correctly and on time.

-

Can I integrate airSlate SignNow with other software for the R&D Sales Tax Exemption Form Winthrop University?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for the R&D Sales Tax Exemption Form Winthrop University. This integration allows you to connect with your existing tools, making document management even more efficient.

-

Is airSlate SignNow secure for handling the R&D Sales Tax Exemption Form Winthrop University?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your R&D Sales Tax Exemption Form Winthrop University is handled with the utmost care. Our platform employs advanced encryption and security measures to protect your sensitive information.

Get more for R&D Sales Tax Exemption Form Winthrop University

- Cfwb 015 referral to employer for employee income information acs division of child protection form cfwb 015 referral to

- Cfwb 015 referral to employer for employee income information cfwb 015 referral to employer for employee income information

- Appraisal experience log formtrainee appraisers

- Small egg packers application for license form

- Appraisal experience log example 1085967 form

- Oklahoma deconfliction form

- Az state massage board form

- Permission slip bmiddleburgmartialartsbbcomb form

Find out other R&D Sales Tax Exemption Form Winthrop University

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online