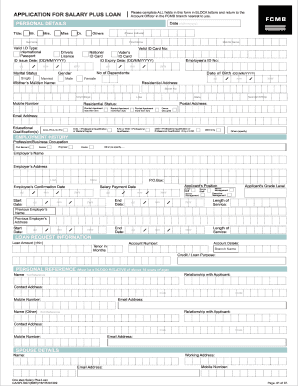

Fcmb Loan for Salary Earners Form

What is the FCMB Loan for Salary Earners

The FCMB Loan for Salary Earners is a financial product designed specifically for individuals who receive a regular salary. This loan aims to provide financial assistance for various personal needs, such as home improvements, education, or unexpected expenses. It typically offers competitive interest rates and flexible repayment terms, making it accessible for those with a steady income.

How to Obtain the FCMB Loan for Salary Earners

To obtain the FCMB Loan for Salary Earners, applicants must meet specific eligibility criteria. Generally, this includes being a salaried employee with a stable income, having a good credit history, and providing necessary documentation. The application process can often be completed online, allowing for a convenient and efficient experience. Applicants should prepare their identification documents, proof of income, and any other required paperwork to expedite the process.

Steps to Complete the FCMB Loan for Salary Earners

Completing the FCMB Loan for Salary Earners involves several key steps:

- Gather necessary documents, including identification and proof of income.

- Visit the FCMB website or app to access the loan application form.

- Fill out the application form with accurate information.

- Submit the application and wait for approval, which may take a few days.

- Upon approval, review the loan agreement, and sign electronically.

Legal Use of the FCMB Loan for Salary Earners

The FCMB Loan for Salary Earners is legally binding once the loan agreement is signed by both parties. It is essential to understand the terms and conditions outlined in the agreement, including interest rates, repayment schedules, and any penalties for late payments. Compliance with local laws and regulations is necessary to ensure that the loan remains valid and enforceable.

Eligibility Criteria

Eligibility for the FCMB Loan for Salary Earners typically includes the following criteria:

- Must be a salaried employee with a regular income.

- Age requirement, usually between eighteen and sixty-five years.

- Good credit history and no outstanding debts with the bank.

- Provision of necessary identification and proof of employment.

Required Documents

Applicants must provide several documents to support their loan application. Commonly required documents include:

- Valid government-issued identification, such as a driver's license or passport.

- Recent pay stubs or proof of salary.

- Employment verification letter from the employer.

- Bank statements for the past three to six months.

Quick guide on how to complete fcmb loan for salary earners

Easily Prepare Fcmb Loan For Salary Earners on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Fcmb Loan For Salary Earners on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Edit and eSign Fcmb Loan For Salary Earners Effortlessly

- Locate Fcmb Loan For Salary Earners and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight relevant portions of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and eSign Fcmb Loan For Salary Earners and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fcmb loan for salary earners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FCMB loan for salary earners?

The FCMB loan for salary earners is a financial product specifically designed to provide personal loans to employees with stable salaries. This loan helps individuals meet their financial needs, whether it's for emergencies, home improvements, or personal projects, with favorable terms and low-interest rates.

-

What are the eligibility criteria for the FCMB loan for salary earners?

To qualify for the FCMB loan for salary earners, applicants must be permanent employees of a reputable organization and possess a valid salary account with FCMB. Additionally, the applicant's monthly salary must meet the minimum requirement set by the bank to ensure repayment capacity.

-

What are the loan limits associated with the FCMB loan for salary earners?

The FCMB loan for salary earners offers various loan amounts depending on the applicant's salary and creditworthiness. Typically, these loans can range from a few hundred thousand to several million Naira, making them accessible for different financing needs.

-

What repayment terms are available for the FCMB loan for salary earners?

Repayment terms for the FCMB loan for salary earners are flexible and can be spread over several months, usually from 6 to 36 months. This allows borrowers to choose a repayment plan that best fits their financial situation, making loan management easier.

-

How can I apply for the FCMB loan for salary earners?

To apply for the FCMB loan for salary earners, you can visit the nearest FCMB branch or apply online through the bank’s website. You will need to complete an application form and provide necessary documentation like your ID, proof of employment, and salary account details.

-

What benefits come with the FCMB loan for salary earners?

The FCMB loan for salary earners offers numerous benefits including competitive interest rates, quick approval processes, and flexible repayment plans. Additionally, customers enjoy financial support without the need for collateral, allowing for greater access to funds.

-

Are there any hidden fees with the FCMB loan for salary earners?

FCMB is transparent about its charges, and there are generally no hidden fees associated with the FCMB loan for salary earners. The bank outlines all applicable fees during the application process, enabling borrowers to make informed decisions.

Get more for Fcmb Loan For Salary Earners

Find out other Fcmb Loan For Salary Earners

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will