Aig Pension Forms 2013-2026

What is the AIG Pension Form?

The AIG Pension Form is a crucial document used for managing pension-related transactions within the AIG pension system. This form is specifically designed to facilitate the direct deposit of pension funds, ensuring that recipients receive their benefits in a timely and secure manner. It is essential for individuals who are enrolled in a pension program to understand the purpose and requirements of this form to maintain their financial stability during retirement.

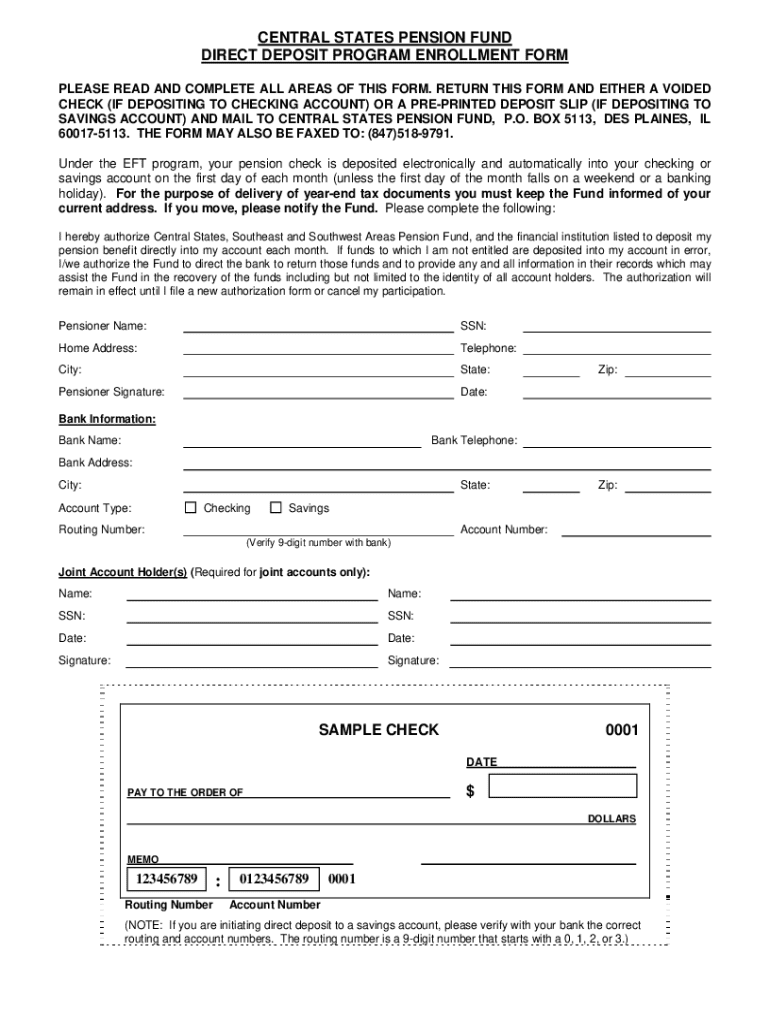

Steps to Complete the AIG Pension Form

Completing the AIG Pension Form involves several straightforward steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your Social Security number, account details, and any relevant identification. Next, carefully fill out each section of the form, ensuring that all information is accurate and legible. After completing the form, review it for any errors or omissions before submitting it. It is advisable to keep a copy of the completed form for your records.

Legal Use of the AIG Pension Form

The AIG Pension Form must be completed and submitted in accordance with legal standards to ensure its validity. This includes adhering to specific regulations set forth by the Employee Retirement Income Security Act (ERISA) and other relevant federal and state laws. Ensuring compliance with these regulations not only protects your rights as a pension holder but also secures the legitimacy of your pension benefits.

Required Documents for the AIG Pension Form

When submitting the AIG Pension Form, certain documents may be required to verify your identity and eligibility. Commonly required documents include a government-issued ID, proof of residency, and any previous pension statements. Having these documents ready can expedite the processing of your form and help avoid delays in receiving your pension benefits.

Form Submission Methods

The AIG Pension Form can typically be submitted through various methods to accommodate different preferences. Common submission methods include online submission via the AIG portal, mailing a physical copy to the designated address, or delivering it in person at an AIG office. Each method has its own processing times, so choosing the most convenient option is essential for timely pension fund access.

Eligibility Criteria for the AIG Pension Form

To successfully complete the AIG Pension Form, individuals must meet specific eligibility criteria. Generally, this includes being a participant in an AIG pension plan, having reached the appropriate age for pension benefits, and fulfilling any service requirements outlined in the plan documentation. Understanding these criteria is vital for ensuring that you can effectively utilize the pension form and receive your benefits.

Quick guide on how to complete pension direct deposit form

Utilize the simpler approach to handle your Aig Pension Forms

The traditional methods for finalizing and endorsing documents consume an excessive amount of time compared to modern paperwork management systems. Previously, you would search for appropriate social forms, print them out, fill in all the information, and dispatch them via mail. Now, you can discover, complete, and sign your Aig Pension Forms in one browser tab with airSlate SignNow. Preparing your Aig Pension Forms is more straightforward than ever.

Steps to finalize your Aig Pension Forms with airSlate SignNow

- Access the category page you require and find your state-specific Aig Pension Forms. Alternatively, utilize the search option.

- Ensure the version of the form is accurate by viewing it.

- Select Get form and enter editing mode.

- Fill in your document with the necessary information using the editing tools.

- Review the added information and click the Sign tool to endorse your form.

- Opt for the most convenient method to create your signature: generate it, draw your signature, or upload an image of it.

- Click DONE to store changes.

- Download the document to your device or go to Sharing settings to send it digitally.

Robust online tools like airSlate SignNow streamline the process of completing and submitting your forms. Use it to discover how quickly document management and approval procedures should actually take. You’ll conserve a signNow amount of time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pension direct deposit form

How to make an eSignature for your Pension Direct Deposit Form in the online mode

How to create an eSignature for your Pension Direct Deposit Form in Chrome

How to make an electronic signature for signing the Pension Direct Deposit Form in Gmail

How to generate an eSignature for the Pension Direct Deposit Form from your smart phone

How to create an electronic signature for the Pension Direct Deposit Form on iOS

How to create an eSignature for the Pension Direct Deposit Form on Android OS

People also ask

-

What are Aig Pension Forms and how can airSlate SignNow help?

Aig Pension Forms are essential documents used to manage retirement benefits and pension plans. With airSlate SignNow, you can easily create, send, and eSign these forms, ensuring a streamlined process for managing your retirement documentation. Our platform simplifies the workflow, making it efficient and secure.

-

How much does it cost to use airSlate SignNow for Aig Pension Forms?

The pricing for using airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective. You can select from different subscription tiers that fit your business needs, allowing you to manage Aig Pension Forms without breaking the bank. Check our website for detailed pricing options.

-

Can I integrate airSlate SignNow with other software for Aig Pension Forms?

Yes, airSlate SignNow offers integrations with a variety of popular software applications, making it easier to manage Aig Pension Forms. You can connect it with tools like Google Drive, Salesforce, and more, allowing for a seamless workflow across platforms. This integration helps streamline your document management process.

-

What features does airSlate SignNow offer for managing Aig Pension Forms?

airSlate SignNow provides a range of features tailored for Aig Pension Forms, including eSignature capabilities, document templates, and real-time tracking. These features enhance your ability to manage forms efficiently, ensuring that you can send, receive, and sign documents without hassle. Our user-friendly interface makes the entire process straightforward.

-

Is airSlate SignNow secure for handling Aig Pension Forms?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Aig Pension Forms. We utilize advanced encryption methods and comply with industry standards to ensure your sensitive information remains protected throughout the signing process. Your peace of mind is our top priority.

-

How can I get started with airSlate SignNow for Aig Pension Forms?

Getting started with airSlate SignNow for Aig Pension Forms is easy. Simply sign up for an account, and you can begin creating and sending your pension forms for eSignature immediately. Our intuitive platform guides you through the setup process, making it accessible for users of all skill levels.

-

What are the benefits of using airSlate SignNow for Aig Pension Forms?

Using airSlate SignNow for Aig Pension Forms offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our eSignature solutions eliminate the need for paper-based processes, allowing you to manage your pension forms digitally and efficiently. This not only enhances productivity but also reduces the risk of errors.

Get more for Aig Pension Forms

Find out other Aig Pension Forms

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document