Modification Hardship Form

What is the Modification Hardship

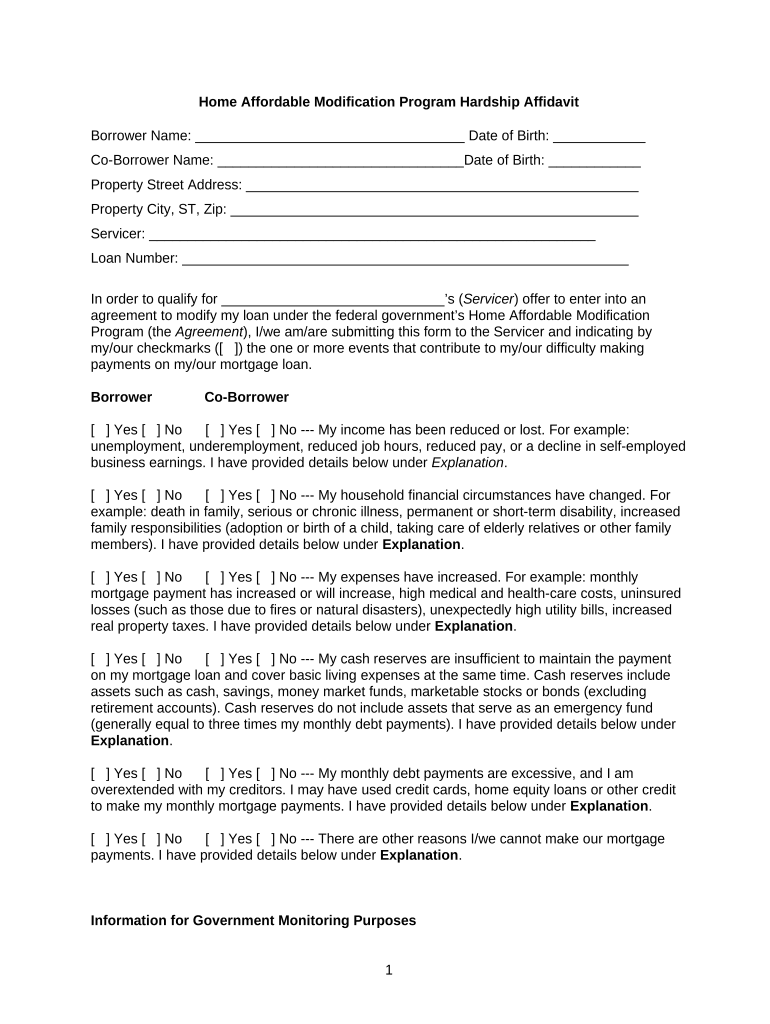

The modification hardship refers to a situation where a borrower faces financial difficulties that hinder their ability to meet mortgage payment obligations. This process allows homeowners to request adjustments to their mortgage terms, making payments more manageable. Common causes of hardship include job loss, medical emergencies, or significant life changes. Understanding the definition and implications of modification hardship is crucial for homeowners seeking relief from financial strain.

How to Complete the Modification Hardship

Completing a modification hardship involves several steps to ensure that the request is properly submitted and considered. Initially, gather all necessary financial documents, including income statements, tax returns, and a detailed account of monthly expenses. Next, fill out the modification hardship application accurately, ensuring that all information reflects your current financial situation. It is essential to provide a clear explanation of your hardship, as this will be a key factor in the approval process. Finally, submit the application through the appropriate channels, whether online or via mail, and keep copies of all documents for your records.

Key Elements of the Modification Hardship

Several key elements must be included in a modification hardship application to increase the chances of approval. These elements typically include:

- Personal Information: Full name, address, and contact details.

- Financial Documentation: Proof of income, bank statements, and expense reports.

- Hardship Explanation: A detailed narrative outlining the circumstances leading to the financial difficulties.

- Proposed Modifications: Suggestions for changes to the mortgage terms, such as reduced payments or extended loan terms.

Including these components helps lenders assess the situation comprehensively and make informed decisions regarding the modification request.

Eligibility Criteria for Modification Hardship

Eligibility for a modification hardship typically hinges on specific criteria that borrowers must meet. Generally, homeowners must demonstrate a legitimate financial hardship that affects their ability to make mortgage payments. Additionally, lenders may require that the property be the borrower's primary residence, and the mortgage must be in good standing prior to the hardship. Each lender may have unique requirements, so it is important to review the specific guidelines provided by the lending institution.

Required Documents for Modification Hardship

When applying for a modification hardship, borrowers should prepare a comprehensive set of documents to support their application. Required documents often include:

- Income verification, such as pay stubs or tax returns.

- Bank statements for the last two to three months.

- A detailed list of monthly expenses.

- A hardship letter explaining the circumstances affecting the borrower's financial situation.

Having these documents ready can facilitate a smoother application process and help lenders assess the request more efficiently.

Form Submission Methods for Modification Hardship

Submitting a modification hardship application can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer online portals where borrowers can upload their applications and supporting documents directly.

- Mail Submission: Borrowers may choose to send their applications via postal mail, ensuring that all documents are securely packaged.

- In-Person Submission: Some lenders allow borrowers to submit applications in person at local branches, providing an opportunity for direct communication.

Choosing the appropriate method can depend on individual circumstances and the specific requirements of the lender.

Quick guide on how to complete modification hardship

Easily prepare Modification Hardship on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Modification Hardship on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and electronically sign Modification Hardship effortlessly

- Find Modification Hardship and click on Get Form to start.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redacted sensitive information with the tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Modification Hardship and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a hardship modification?

A hardship modification is an adjustment made to the terms of a loan or mortgage due to the borrower's financial difficulty. This can include changes in interest rates, payment schedules, or loan amounts. It's an essential solution for those facing economic challenges and seeking relief from their financial obligations.

-

How can airSlate SignNow assist with hardship modification applications?

AirSlate SignNow streamlines the process of submitting hardship modification applications by allowing users to easily create, sign, and send documents electronically. Our platform ensures that all necessary paperwork is completed accurately and efficiently. This simplifies your experience and helps you focus on addressing your financial challenges.

-

Is there a cost associated with using airSlate SignNow for hardship modifications?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our solutions are designed to be cost-effective, making it easier for businesses to handle hardship modifications without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing hardship modification documents?

AirSlate SignNow provides features such as customizable templates, document tracking, and secure eSignatures to facilitate the hardship modification process. Additionally, users can create automated workflows and receive real-time notifications, ensuring efficient management of all documentation. This suite of features helps you stay organized and focused on your financial recovery.

-

Can I integrate airSlate SignNow with other tools for hardship modification processes?

Absolutely! AirSlate SignNow offers integrations with various third-party applications, allowing you to streamline your hardship modification processes seamlessly. By connecting our platform to your existing tools, you can enhance productivity and improve collaboration among your teams. This ensures that all documents related to hardship modifications are managed effectively.

-

What benefits do I gain by using airSlate SignNow for hardship modifications?

Using airSlate SignNow for hardship modifications provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution allows for faster turnaround times, ensuring your applications are processed promptly. This means you're more likely to receive the relief you need in challenging financial situations.

-

Is airSlate SignNow suitable for individual users looking for hardship modification solutions?

Yes, airSlate SignNow is designed to be user-friendly, making it an ideal choice for individual users in need of hardship modification assistance. Our platform accommodates a wide range of users, from businesses to individuals, so you can easily manage your documents during this difficult time. Don't hesitate to utilize our services for a smoother application process.

Get more for Modification Hardship

- Form 1041 schedule k 1

- Instructions for form 9465 rev october 2020 instructions for form 9465 installment agreement request for use with form 9465 rev

- Form 8863 instructions fill out and sign printable pdf

- 2020 schedule d form 1041 capital gains and losses

- 2020 form 8814 parents election to report childs interest and dividends

- 2020 form 8938 statement of specified foreign financial assets

- 2020 form w 2as

- 2020 schedule b form 990 990 ez or 990 pf schedule of contributors

Find out other Modification Hardship

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors