Rpd41260 Form

What is the RPD-41260?

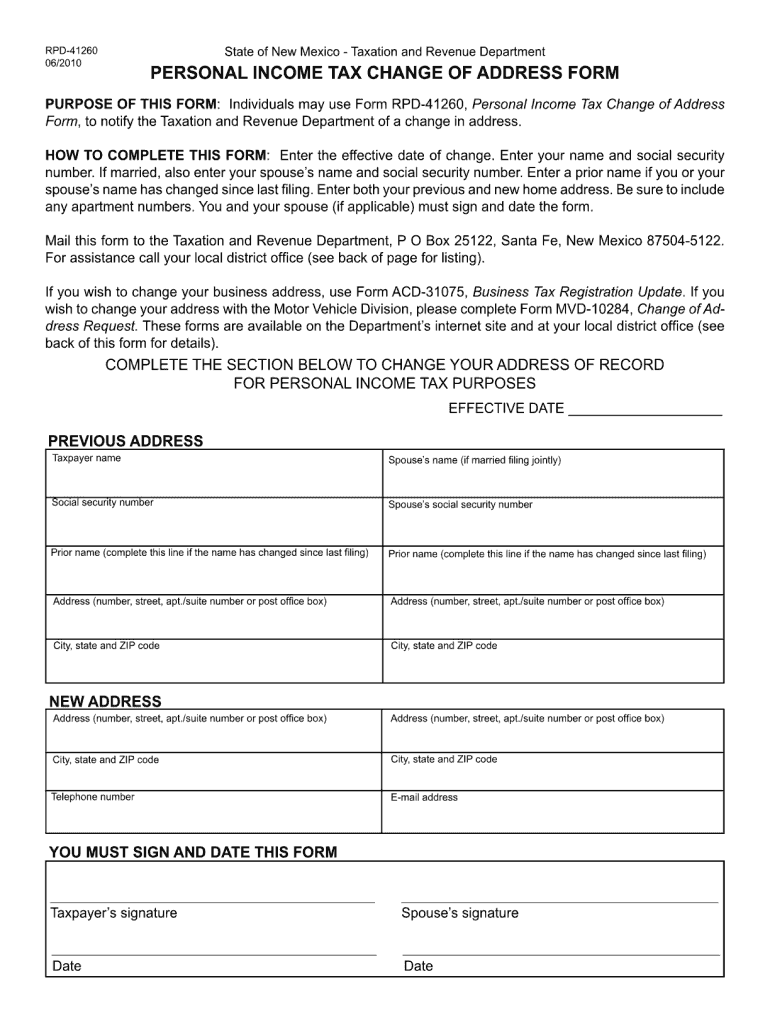

The RPD-41260, commonly referred to as the change of address form, is a crucial document used in New Mexico for updating an individual's or business's address with the state. This form is essential for ensuring that all official correspondence, including tax notifications and other important communications, are sent to the correct location. The RPD-41260 is used by residents and businesses alike, making it a vital tool for maintaining accurate records with the New Mexico Taxation and Revenue Department.

How to Use the RPD-41260

To effectively use the RPD-41260, individuals must fill out the form with accurate information regarding their previous and new addresses. It is important to provide all required details, including the taxpayer identification number, to ensure proper processing. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the individual or business. Utilizing electronic submission can expedite the processing time, ensuring a quicker update to your address in state records.

Steps to Complete the RPD-41260

Completing the RPD-41260 involves several straightforward steps:

- Download the RPD-41260 form from the New Mexico Taxation and Revenue Department's website.

- Fill in your personal information, including your name, previous address, and new address.

- Provide your taxpayer identification number to link the address change to your records.

- Review the form for accuracy to avoid any processing delays.

- Submit the completed form either electronically or by mailing it to the appropriate department.

Legal Use of the RPD-41260

The RPD-41260 is legally recognized as a valid method for notifying the state of a change of address. It complies with state regulations, ensuring that any updates made through this form are officially recorded. Proper use of the RPD-41260 helps prevent issues related to miscommunication or delays in receiving important documents from the state, thus protecting the rights and responsibilities of the taxpayer.

Required Documents

When submitting the RPD-41260, no additional documents are typically required. However, it is advisable to have your taxpayer identification number and any previous correspondence from the New Mexico Taxation and Revenue Department on hand. This information can help facilitate the completion of the form and ensure that your address change is processed smoothly.

Form Submission Methods

The RPD-41260 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many users prefer to submit the form electronically through the New Mexico Taxation and Revenue Department's website, which may offer a quicker processing time.

- Mail Submission: Alternatively, individuals can print the completed form and mail it to the designated address provided on the form.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at a local office is also an option.

Quick guide on how to complete rpd41260

Effortlessly Prepare Rpd41260 on Any Device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documentation, as you can access the correct forms and securely save them on the internet. airSlate SignNow equips you with all the necessary resources to create, modify, and electronically sign your documents swiftly without interruptions. Manage Rpd41260 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Rpd41260 with Ease

- Find Rpd41260 and click on Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your adjustments.

- Choose your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Rpd41260 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd41260

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nmsos change of address form?

The nmsos change of address form is a specific document designed for individuals who need to officially inform the New Mexico Secretary of State about a change in their mailing address. This form is essential for maintaining accurate records and ensuring that you receive important notifications regarding your business or personal affairs.

-

How can airSlate SignNow help with the nmsos change of address form?

With airSlate SignNow, you can easily fill out, sign, and eSubmit your nmsos change of address form online. Our user-friendly platform streamlines the process, allowing you to complete it quickly and efficiently without any hassle.

-

Is there a cost associated with using airSlate SignNow for the nmsos change of address form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including the ability to eSign and manage documents like the nmsos change of address form. You can choose a plan that suits your budget while gaining access to our comprehensive features and support.

-

What features does airSlate SignNow provide for completing the nmsos change of address form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time document tracking, which make completing the nmsos change of address form seamless. Our platform also allows you to collaborate with others, ensuring all necessary changes are made promptly.

-

Can I integrate airSlate SignNow with other software for my nmsos change of address form?

Absolutely! airSlate SignNow offers integrations with numerous third-party applications, enabling you to streamline your workflow when managing your nmsos change of address form. This flexibility allows for a more efficient process tailored to your specific business needs.

-

What are the benefits of completing the nmsos change of address form online with airSlate SignNow?

Completing the nmsos change of address form online with airSlate SignNow offers numerous benefits, including faster processing times, easy document access, and enhanced security. Our platform ensures that your information is protected while making it convenient to manage address changes from anywhere.

-

How secure is airSlate SignNow when handling my nmsos change of address form?

Security is a top priority at airSlate SignNow. When you handle your nmsos change of address form through our platform, you can be assured that your data is encrypted and stored securely, complying with industry standards to protect your sensitive information.

Get more for Rpd41260

- Claim form rocky mountain reserve

- Maryland form 4b and 4c

- Application and adoption agreement n b5z form

- Fab fun bike ride fab fun ride registration amp release form frontenacarchbiosphere

- How to fill property return form

- California unconditional waiver and release upon final payment civil code 3262d3 california lien release form

- The come home to portsmouth down payment and closing cost form

- Plumbing permit application generic form

Find out other Rpd41260

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure