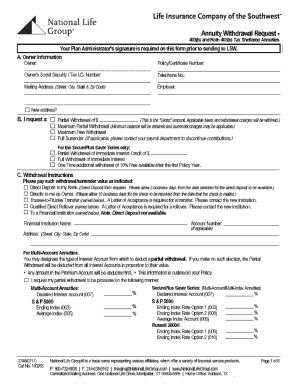

Lsw 403b Form

What is the LSW 403b?

The LSW 403b is a retirement savings plan designed for employees of non-profit organizations, educational institutions, and certain government entities. This plan allows participants to contribute a portion of their salary on a pre-tax basis, which can grow tax-deferred until withdrawal. The LSW 403b is managed by the Life Insurance Company of the Southwest and is governed by specific IRS regulations that outline contribution limits and withdrawal options. Understanding the structure of the LSW 403b is essential for maximizing retirement savings and ensuring compliance with federal guidelines.

How to use the LSW 403b

Using the LSW 403b involves several key steps. First, employees must enroll in the plan through their employer, which typically provides information about contribution limits and investment options. Once enrolled, participants can choose how much to contribute from their salary, selecting either a fixed amount or a percentage. Funds can be allocated among various investment options, including mutual funds and annuities, depending on the plan's offerings. Regularly reviewing investment performance and adjusting contributions as needed is also advisable to align with retirement goals.

Steps to complete the LSW 403b

Completing the LSW 403b involves a straightforward process:

- Enrollment: Obtain the necessary forms from your employer and fill them out accurately.

- Contribution Selection: Decide on the amount or percentage of salary to contribute.

- Investment Choices: Choose from the available investment options provided by the plan.

- Review and Submit: Ensure all information is correct before submitting the enrollment form to your employer.

After submission, it is important to monitor the account regularly to ensure it aligns with retirement objectives.

Legal use of the LSW 403b

The legal use of the LSW 403b is governed by IRS regulations, which dictate how contributions and withdrawals must be handled. Participants must adhere to contribution limits set by the IRS to avoid penalties. Withdrawals are generally allowed after reaching age fifty-nine and a half, but early withdrawals may incur penalties unless specific conditions are met. It is essential to understand these legal parameters to ensure compliance and optimize the benefits of the plan.

Required Documents

To enroll in the LSW 403b, certain documents are typically required:

- Enrollment Form: A completed form provided by your employer.

- Identification: A government-issued ID may be necessary for verification.

- Beneficiary Designation: A form to designate beneficiaries for the account.

Having these documents ready can streamline the enrollment process and ensure compliance with plan requirements.

Eligibility Criteria

Eligibility for the LSW 403b is generally limited to employees of qualifying non-profit organizations, educational institutions, and certain government entities. Specific criteria may vary by employer, but typically, full-time employees are eligible to participate. Part-time employees may also qualify, depending on the employer's policies. It is important to check with your employer for detailed eligibility requirements and to ensure you meet them before enrolling.

Quick guide on how to complete lsw 403b

Complete Lsw 403b seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files swiftly without any holdups. Manage Lsw 403b on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Lsw 403b effortlessly

- Locate Lsw 403b and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Lsw 403b and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lsw 403b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an lsw annuity and how does it work?

An lsw annuity is a financial product designed to provide a steady income stream, typically during retirement. It involves investing a lump sum with LSW, which then pays out regular annuity payments back to the investor over a predetermined period. Understanding how the lsw annuity functions can help you make informed decisions about your financial future.

-

What are the key benefits of choosing an lsw annuity?

Choosing an lsw annuity offers several advantages, including guaranteed income, tax-deferred growth, and the flexibility to customize your investment plan. By utilizing an lsw annuity, you can ensure financial stability during retirement while benefiting from the secure investment features it provides.

-

How do I purchase an lsw annuity?

Purchasing an lsw annuity typically involves contacting a licensed insurance agent or financial advisor who specializes in annuities. They will guide you through the process of selecting the right type of lsw annuity for your needs, helping you complete the necessary paperwork and making sure you understand your investment options.

-

What factors affect the pricing of lsw annuities?

The pricing of lsw annuities can be influenced by several factors, including your age, health status, and the amount invested. Additionally, the specific type of lsw annuity you choose—whether fixed, variable, or indexed—will also impact the overall cost and potential returns. It's important to review these elements with a financial professional to ensure you understand the pricing structure.

-

Are there any fees associated with lsw annuities?

Like many financial products, lsw annuities may come with various fees such as administrative charges, surrender charges, and investment management fees. It is crucial to inquire about these fees upfront to grasp the total cost of your lsw annuity and how it may affect your overall returns. Transparency regarding fees will lead to better decision-making in your investment strategy.

-

Can I access my funds in an lsw annuity before maturity?

While lsw annuities are designed for long-term investment, you may access your funds before maturity. However, withdrawing money early can lead to surrender charges and tax implications, so it's advisable to carefully consider your options and consult with a financial advisor before making any withdrawals.

-

What types of lsw annuities are available?

There are several types of lsw annuities available, including fixed, variable, and indexed annuities. Each type offers distinct features and benefits catered to different financial goals and risk tolerance levels. Evaluating these options can help you determine which lsw annuity best aligns with your retirement plans.

Get more for Lsw 403b

Find out other Lsw 403b

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast