Pennsylvania Locality Tax Form

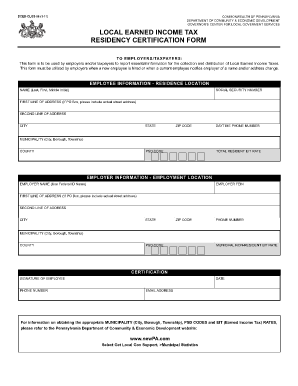

What is the Pennsylvania Locality Tax Form

The Pennsylvania Locality Tax Form, often referred to as the dced clgs 06, is a document used by residents of Pennsylvania to report and pay local income taxes. This form is essential for ensuring compliance with local tax regulations, which vary by municipality. The form captures income earned within a specific locality and ensures that the appropriate taxes are remitted to local authorities. Understanding this form is crucial for both individuals and businesses operating within Pennsylvania.

How to use the Pennsylvania Locality Tax Form

Using the Pennsylvania Locality Tax Form involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial documents, including W-2s and other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and calculate the local tax owed based on the rates applicable to your municipality. Finally, submit the completed form to the appropriate local tax authority, ensuring that you keep a copy for your records.

Steps to complete the Pennsylvania Locality Tax Form

Completing the Pennsylvania Locality Tax Form requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation, such as W-2 forms and 1099s.

- Enter your personal information accurately, including your full name and address.

- Report your total income from all sources, ensuring it aligns with your documentation.

- Calculate the local tax based on your income and the applicable local tax rate.

- Review the form for accuracy before submission.

- Submit the form either online, by mail, or in-person, depending on your local tax authority's requirements.

Legal use of the Pennsylvania Locality Tax Form

The Pennsylvania Locality Tax Form is legally binding when completed and submitted according to state and local regulations. It serves as an official declaration of income and tax liability, making it important for taxpayers to ensure accuracy. Failure to file or inaccuracies can lead to penalties, making it essential to understand the legal implications of submitting this form. Compliance with local tax laws not only upholds legal responsibilities but also contributes to community funding.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania Locality Tax Form vary based on local regulations. Generally, taxpayers should submit their forms by April fifteenth of each year, coinciding with the federal tax deadline. However, some municipalities may have different deadlines, so it is advisable to check with local tax authorities for specific dates. Timely submission is crucial to avoid late fees and penalties.

Penalties for Non-Compliance

Non-compliance with the Pennsylvania Locality Tax Form can result in significant penalties. Taxpayers who fail to file on time may incur late fees, which can accumulate over time. Additionally, failure to pay the correct amount of tax owed can lead to further penalties, including interest charges. In severe cases, local tax authorities may initiate collection actions, making it essential for individuals and businesses to adhere to filing requirements and deadlines.

Quick guide on how to complete pennsylvania locality tax form

Complete Pennsylvania Locality Tax Form seamlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the correct format and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Pennsylvania Locality Tax Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Pennsylvania Locality Tax Form effortlessly

- Locate Pennsylvania Locality Tax Form and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Pennsylvania Locality Tax Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania locality tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dced clgs 06 1 11 and how does it relate to airSlate SignNow?

dced clgs 06 1 11 refers to a specific guideline or requirement that can be addressed through effective document management solutions. airSlate SignNow supports organizations in complying with such requirements by providing an easy-to-use eSigning platform to manage and execute necessary documents efficiently.

-

How can airSlate SignNow enhance my workflow regarding dced clgs 06 1 11?

By utilizing airSlate SignNow, businesses can streamline the signing process for documents related to dced clgs 06 1 11. The platform offers customizable templates and automated workflows that help ensure compliance while minimizing errors and delays in document execution.

-

What pricing options are available for airSlate SignNow if I need it for dced clgs 06 1 11?

airSlate SignNow offers various pricing plans tailored to meet different needs. Whether you're a small business or a larger organization needing to handle documents related to dced clgs 06 1 11, you'll find flexible pricing that accommodates your budget while providing all the essential features.

-

What features should I look for in airSlate SignNow concerning dced clgs 06 1 11?

Key features to consider when using airSlate SignNow for dced clgs 06 1 11 include robust security measures, customizable templates, and mobile access. These features ensure that you can manage document signing securely and efficiently, meeting the requirements without hassle.

-

How does airSlate SignNow support integration with other tools when managing dced clgs 06 1 11?

airSlate SignNow offers seamless integration with numerous applications such as CRM systems, document storage solutions, and project management tools. This flexibility allows businesses handling dced clgs 06 1 11 to incorporate eSigning into their existing workflows effortlessly.

-

Can airSlate SignNow help with compliance for dced clgs 06 1 11?

Yes, airSlate SignNow is designed to assist businesses in staying compliant with regulations like dced clgs 06 1 11. The platform keeps detailed audit trails and timestamped records of every transaction, which are essential for proving compliance and accountability.

-

What are the benefits of using airSlate SignNow for documents related to dced clgs 06 1 11?

Using airSlate SignNow for documents associated with dced clgs 06 1 11 provides several benefits, including faster turnaround times and reduced costs. The platform’s user-friendly interface simplifies the signing process and enhances the overall efficiency of document management.

Get more for Pennsylvania Locality Tax Form

Find out other Pennsylvania Locality Tax Form

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free