Ohio Farm Tax Exempt Form

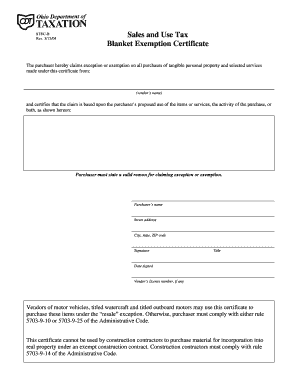

What is the Ohio Farm Tax Exempt Form

The Ohio Farm Tax Exempt Form is a crucial document that allows eligible farmers to purchase certain goods and services without paying sales tax. This form is designed specifically for agricultural producers who meet specific criteria set by the state. By using this form, farmers can reduce their operating costs, thereby enhancing their profitability. The exemption applies to items that are directly related to farming operations, such as seeds, fertilizers, and equipment.

How to use the Ohio Farm Tax Exempt Form

Using the Ohio Farm Tax Exempt Form involves several straightforward steps. First, ensure that you meet the eligibility criteria, which typically include being a registered farmer in Ohio. Once confirmed, fill out the form accurately, providing all required information about your farming operations. Present the completed form to vendors when making purchases to claim your tax exemption. It is essential to keep a copy of the form for your records, as you may need it for future reference or audits.

Steps to complete the Ohio Farm Tax Exempt Form

Completing the Ohio Farm Tax Exempt Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your farm's registration number and details about the items you intend to purchase.

- Fill out the form, ensuring that all sections are completed, including your name, address, and the nature of your farming activities.

- Review the form for accuracy and completeness to avoid delays or issues.

- Sign and date the form as required.

- Present the form to your supplier at the time of purchase.

Eligibility Criteria

To qualify for the Ohio Farm Tax Exempt Form, applicants must meet specific eligibility criteria. Generally, this includes being a farmer engaged in agricultural production, which may encompass crops, livestock, or other agricultural products. Additionally, the applicant must demonstrate that the purchases made with the exemption are directly related to farming operations. It is advisable to consult the Ohio Department of Taxation for detailed eligibility requirements to ensure compliance.

Required Documents

When applying for the Ohio Farm Tax Exempt Form, certain documents may be required to verify your eligibility. These documents typically include:

- A valid Ohio farm registration number.

- Proof of agricultural production, such as sales receipts or invoices.

- Any additional documentation that may support your claim for tax exemption.

Having these documents ready can streamline the process and help ensure that your application is processed without delays.

Form Submission Methods

The Ohio Farm Tax Exempt Form can be submitted through various methods, depending on the preferences of the farmer and the requirements of the vendor. Farmers can present the completed form in person at the time of purchase, or they may also submit it via mail if required by the vendor. Some suppliers may allow electronic submission, so it is advisable to check with each vendor for their preferred submission method.

Quick guide on how to complete ohio farm tax exempt form

Effortlessly Complete Ohio Farm Tax Exempt Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Ohio Farm Tax Exempt Form seamlessly on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and eSign Ohio Farm Tax Exempt Form Effortlessly

- Find Ohio Farm Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ohio Farm Tax Exempt Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio farm tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio agriculture tax exemption form?

The Ohio agriculture tax exemption form is a document that allows qualified agricultural producers to obtain a sales tax exemption for certain purchases related to agricultural activities. It is essential for farmers and agricultural businesses in Ohio to complete and submit this form to save on costs associated with farming supplies and equipment.

-

Who qualifies for the Ohio agriculture tax exemption form?

To qualify for the Ohio agriculture tax exemption form, individuals or businesses must be engaged in the farming of agricultural products. This typically includes producing crops, livestock, or other goods intended for sale. Understanding the qualifications will help ensure you can benefit from sales tax exemptions.

-

How can I complete the Ohio agriculture tax exemption form using airSlate SignNow?

With airSlate SignNow, you can easily complete the Ohio agriculture tax exemption form online. Our platform allows you to fill out, sign, and send your forms electronically, simplifying the process while ensuring that you meet all necessary requirements for submission to the state.

-

What are the benefits of using airSlate SignNow for the Ohio agriculture tax exemption form?

Using airSlate SignNow for the Ohio agriculture tax exemption form offers several benefits, including an easy-to-navigate interface, secure document management, and the ability to track the status of your submissions. This streamlined approach saves time and enhances productivity for agricultural businesses.

-

Is there a cost associated with using airSlate SignNow for the Ohio agriculture tax exemption form?

airSlate SignNow offers competitive pricing for its services, including the completion of the Ohio agriculture tax exemption form. We provide a range of subscription plans to accommodate different needs, ensuring you have access to an affordable solution for document eSigning and management.

-

Can I integrate airSlate SignNow with other software for the Ohio agriculture tax exemption form?

Yes, airSlate SignNow can easily integrate with various software solutions, enhancing your ability to manage the Ohio agriculture tax exemption form. This integration allows for seamless data transfer and improves workflow efficiency, making it easier to handle all your documentation needs.

-

How secure is the information I submit with the Ohio agriculture tax exemption form through airSlate SignNow?

airSlate SignNow prioritizes the security of your information. When submitting the Ohio agriculture tax exemption form, our platform uses bank-grade encryption and secure cloud storage to protect your sensitive data, ensuring that your documents remain confidential and secure.

Get more for Ohio Farm Tax Exempt Form

Find out other Ohio Farm Tax Exempt Form

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word