Borrower Authorization Form

What is the Borrower Authorization Form

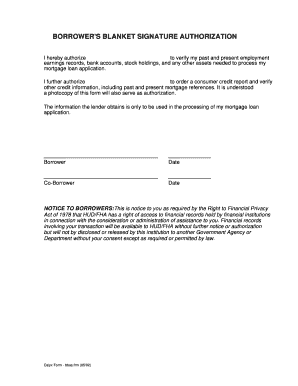

The borrower authorization form is a crucial document that allows lenders to obtain necessary information about a borrower’s financial history and creditworthiness. This form grants permission for the lender to access the borrower’s credit report and other pertinent financial details. It is commonly used in the context of mortgage applications, where lenders need to verify the borrower’s ability to repay the loan. The FHA blanket signature authorization is a specific type of borrower authorization that facilitates this process for Federal Housing Administration loans.

Steps to Complete the Borrower Authorization Form

Completing the borrower authorization form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, Social Security number, and contact details. Next, clearly indicate your consent for the lender to access your financial information. It's important to read the terms carefully before signing. After filling out the form, review it for any errors or omissions. Finally, submit the form to your lender, either electronically or via traditional mail, depending on their requirements.

Legal Use of the Borrower Authorization Form

The borrower authorization form must adhere to specific legal standards to be considered valid. It is essential to comply with regulations set forth by the Fair Credit Reporting Act (FCRA), which governs how lenders can access and use credit information. The form should clearly state the purpose of authorization and the scope of information being requested. Additionally, the borrower must provide informed consent, ensuring they understand their rights regarding the use of their personal information.

Key Elements of the Borrower Authorization Form

Several key elements must be included in the borrower authorization form to ensure its effectiveness and legality. These elements typically include:

- Borrower Information: Full name, address, and Social Security number.

- Consent Statement: A clear statement granting permission for the lender to access credit information.

- Purpose of Authorization: Explanation of why the information is being requested.

- Signature: The borrower's signature and date to validate the authorization.

How to Obtain the Borrower Authorization Form

Obtaining the borrower authorization form is a straightforward process. Most lenders provide this form as part of their loan application package. You can also find it on the lender's official website or request it directly from a loan officer. If you are looking for a specific version, such as the FHA blanket signature authorization, ensure that you specify this when making your request. Additionally, many online platforms offer templates that can be customized to meet your needs.

Form Submission Methods

Submitting the borrower authorization form can typically be done through various methods, depending on the lender’s preferences. Common submission methods include:

- Online Submission: Many lenders allow electronic submission through their secure portals.

- Mail: You can print the completed form and send it via postal service.

- In-Person: Some borrowers may choose to deliver the form directly to their lender's office.

Quick guide on how to complete borrower authorization form 1175083

Complete Borrower Authorization Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delay. Manage Borrower Authorization Form across any platform with the airSlate SignNow apps available for Android and iOS, and enhance any document-centric task today.

How to adjust and eSign Borrower Authorization Form with ease

- Obtain Borrower Authorization Form and click Get Form to begin.

- Make use of the tools we offer to finish your form.

- Emphasize relevant sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you’d prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Borrower Authorization Form to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower authorization form 1175083

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FHA blanket signature authorization?

An FHA blanket signature authorization is a specific document that allows lenders to obtain necessary signatures from borrowers for various transactions. This authorization simplifies the process of signing multiple documents related to FHA loans, ensuring compliance with regulatory requirements. Utilizing airSlate SignNow can streamline this process signNowly.

-

How much does airSlate SignNow cost for FHA blanket signature authorization?

airSlate SignNow offers flexible pricing plans suitable for businesses of any size. The cost for utilizing features related to FHA blanket signature authorization varies depending on the selected plan. Our pricing is transparent and designed to deliver maximum value for your document signing needs.

-

What features does airSlate SignNow provide for FHA blanket signature authorization?

airSlate SignNow offers a variety of features to facilitate FHA blanket signature authorization, including user-friendly document workflows, secure eSignatures, and real-time tracking. These features enhance the efficiency of the signing process and ensure that all signatures are collected promptly. Plus, the platform allows for customized templates to meet specific needs.

-

What are the benefits of using airSlate SignNow for FHA blanket signature authorization?

Using airSlate SignNow for FHA blanket signature authorization offers numerous benefits, including increased efficiency and reduced turnaround times for document signing. The platform's intuitive interface means users can easily manage documents, and its security compliance ensures that sensitive information remains protected. Overall, it's a cost-effective solution for seamless document management.

-

Can airSlate SignNow integrate with other systems for FHA blanket signature authorization?

Yes, airSlate SignNow can integrate with various third-party applications and services, allowing for a smoother process when handling FHA blanket signature authorization. Whether you're using CRMs, ERPs, or cloud storage solutions, our platform is designed to connect easily. This integration capability enhances productivity by eliminating data silos.

-

Is airSlate SignNow legally compliant for FHA blanket signature authorization?

Absolutely, airSlate SignNow adheres to all applicable laws and regulations regarding electronic signatures, including those related to FHA blanket signature authorization. Our solution is designed to ensure that electronic documents are legally binding and secure. Customers can confidently use our platform for their signing needs.

-

How user-friendly is airSlate SignNow for FHA blanket signature authorization?

airSlate SignNow is exceptionally user-friendly, featuring a straightforward interface that makes it easy for anyone to navigate. The platform allows users to easily prepare, send, and sign documents related to FHA blanket signature authorization without extensive training. This simplicity helps to enhance user adoption and satisfaction.

Get more for Borrower Authorization Form

Find out other Borrower Authorization Form

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later