Maryland Form 130

What is the Maryland Form 130

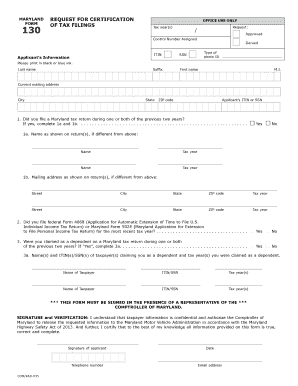

The Maryland Form 130, also known as the State of Maryland Physicians Certification of Incapacity form, is a legal document used primarily to certify an individual's incapacity. This form is often utilized in various healthcare and legal contexts, ensuring that the necessary medical and legal standards are met when determining an individual's ability to make decisions regarding their health and finances. The form is essential for individuals who may need assistance or representation due to health-related issues.

How to use the Maryland Form 130

To use the Maryland Form 130 effectively, individuals must first ensure that the form is filled out accurately by a qualified physician. The physician must provide a detailed assessment of the individual's condition, confirming their incapacity. Once completed, the form can be used in various situations, such as for healthcare decisions, legal matters, or financial management. It is crucial to keep copies of the completed form for personal records and to share with relevant parties, such as family members or legal representatives.

Steps to complete the Maryland Form 130

Completing the Maryland Form 130 involves several key steps:

- Obtain the form: The form can be downloaded from official state resources or requested from healthcare providers.

- Consult with a physician: Schedule an appointment with a licensed physician who is qualified to assess the individual's condition.

- Fill out the form: The physician must complete the required sections, providing detailed information about the individual's incapacity.

- Review the form: Ensure that all information is accurate and complete before signing.

- Distribute copies: Keep a copy for personal records and provide copies to family members, legal representatives, or healthcare providers as needed.

Legal use of the Maryland Form 130

The Maryland Form 130 is legally binding when completed correctly and signed by a licensed physician. It serves as a formal declaration of an individual's incapacity, which may be required in legal proceedings or healthcare decisions. Compliance with relevant laws and regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), is essential to ensure the privacy and protection of the individual's information. Properly executed, this form can help facilitate important decisions regarding the individual's care and management.

Key elements of the Maryland Form 130

The key elements of the Maryland Form 130 include:

- Patient Information: Basic details about the individual, including name, date of birth, and contact information.

- Physician's Certification: A statement from the physician confirming the individual's incapacity, including the nature and extent of the condition.

- Signature and Date: The physician's signature and the date the certification was completed, which are crucial for the form's validity.

- Additional Notes: Any relevant comments or additional information that may assist in understanding the individual's condition.

Form Submission Methods

The Maryland Form 130 can be submitted using various methods, depending on the requirements of the receiving entity. Common submission methods include:

- Online: Some healthcare providers or legal entities may offer electronic submission options.

- Mail: The completed form can be sent via postal service to the appropriate office or individual.

- In-Person: Individuals may also choose to deliver the form directly to the relevant party, ensuring it is received and acknowledged.

Quick guide on how to complete maryland form 130

Handle Maryland Form 130 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Maryland Form 130 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Maryland Form 130 with ease

- Obtain Maryland Form 130 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal value as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Modify and eSign Maryland Form 130 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 130

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is MD 130 in the context of airSlate SignNow?

MD 130 refers to a specific feature set offered by airSlate SignNow, designed for document management and electronic signatures. This functionality allows businesses to streamline their document workflows, ensuring compliance and security while enhancing productivity.

-

How much does the MD 130 package cost?

The pricing for the MD 130 package varies depending on the specific needs and scale of your business. With airSlate SignNow, you get a cost-effective solution that provides great value for your electronic signing and document management needs.

-

What are the key features included in the MD 130 solution?

The MD 130 solution includes features like secure electronic signatures, customizable templates, and real-time tracking of document status. These tools empower businesses to manage their documents efficiently while ensuring a seamless signing experience.

-

How can MD 130 benefit my business?

MD 130 can signNowly benefit your business by enhancing operational efficiency and reducing paperwork. With airSlate SignNow, you can automate workflows, improve signature turnaround times, and maintain a higher level of security for important documents.

-

Does MD 130 integrate with other software?</question>

Yes, MD 130 integrates seamlessly with various software and applications, including CRM systems, cloud storage, and productivity tools. This flexibility allows businesses to incorporate airSlate SignNow into their existing workflows easily.

-

Is it easy to get started with MD 130?

Absolutely! Getting started with MD 130 is straightforward with airSlate SignNow’s user-friendly interface. You can quickly sign up, configure your settings, and start sending documents for eSignature within minutes.

-

Can I customize my documents with the MD 130 feature?

Yes, customization is a key aspect of the MD 130 feature. You can create personalized templates, add fields as needed, and ensure your documents reflect your brand’s identity effectively through airSlate SignNow.

Get more for Maryland Form 130

- Vsa01 form

- Cigna prior authorization form

- Sos hear form

- Waste disposal agreement format in india

- Victim rights request form

- Misissippi state tax commission title division form 79 008 co warren ms

- A non resident disposing of taxable canadian property form

- Prince william juvenile amp domestic relations district court form

Find out other Maryland Form 130

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile