Nys Tax Exempt Form St 119

What is the NYS Tax Exempt Form ST-119?

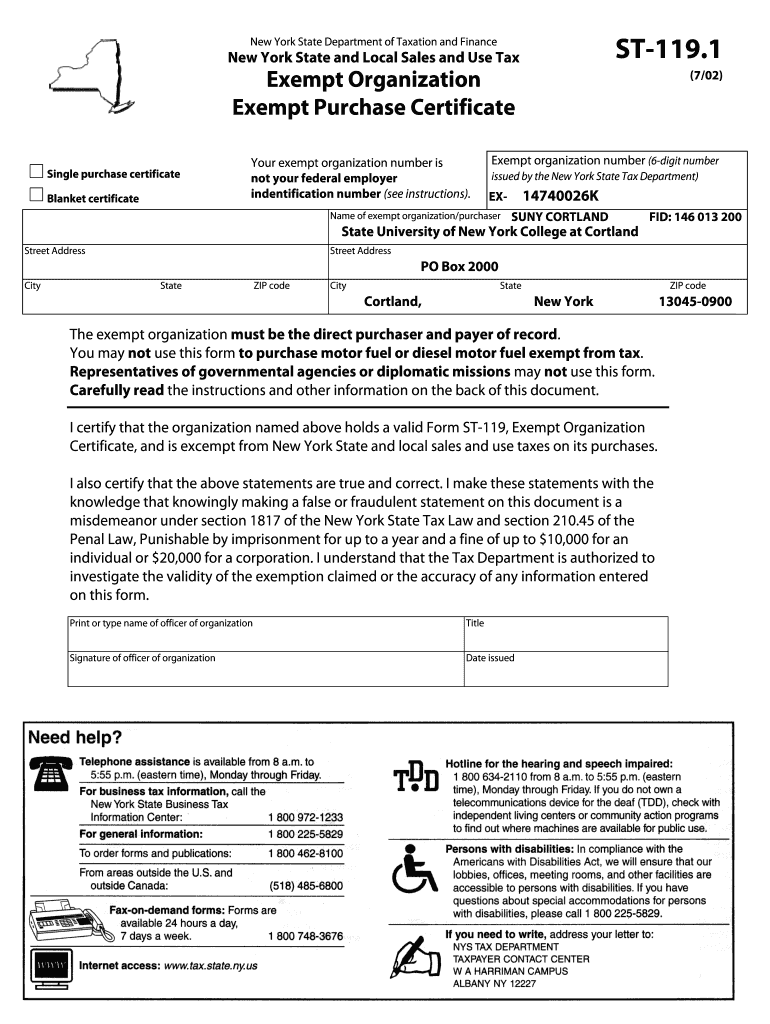

The NYS Tax Exempt Form ST-119 is a crucial document used in New York State for claiming tax-exempt status. This form is primarily utilized by organizations that qualify for exemption from sales and use taxes. It allows eligible entities, such as nonprofit organizations, government agencies, and certain educational institutions, to purchase goods and services without incurring sales tax. Understanding this form is essential for organizations seeking to maximize their financial resources while complying with state tax regulations.

How to Use the NYS Tax Exempt Form ST-119

Using the NYS Tax Exempt Form ST-119 involves a straightforward process. First, ensure that your organization qualifies for tax-exempt status under New York State law. Once confirmed, the form must be filled out accurately, providing necessary details such as the organization's name, address, and tax identification number. After completing the form, it should be presented to vendors at the time of purchase to validate the tax-exempt status. This process helps ensure that your organization does not pay unnecessary sales tax on eligible purchases.

Steps to Complete the NYS Tax Exempt Form ST-119

Completing the NYS Tax Exempt Form ST-119 requires careful attention to detail. Follow these steps:

- Gather your organization's information, including the legal name, address, and tax identification number.

- Indicate the type of organization and the reason for the tax exemption.

- Provide the signature of an authorized representative of the organization.

- Review the completed form for accuracy before submission.

Once filled out, the form can be used for multiple transactions, but it is advisable to keep a record of each use for your organization’s financial documentation.

Key Elements of the NYS Tax Exempt Form ST-119

The NYS Tax Exempt Form ST-119 includes several key elements that are essential for proper completion and usage:

- Organization Information: This includes the name, address, and tax identification number of the entity claiming exemption.

- Exemption Reason: A clear statement of the basis for the tax-exempt status, such as nonprofit status or government affiliation.

- Authorized Signature: The form must be signed by an individual with the authority to bind the organization.

These elements ensure that the form is valid and can be accepted by vendors during transactions.

Legal Use of the NYS Tax Exempt Form ST-119

The legal use of the NYS Tax Exempt Form ST-119 is governed by New York State tax laws. Organizations must ensure that they meet the eligibility criteria for tax exemption, as misuse of the form can lead to penalties. The form serves as proof of tax-exempt status, and vendors are required to accept it when making tax-exempt sales. It is important for organizations to keep the form updated and to provide it only to vendors who are authorized to accept it for tax-exempt purchases.

Eligibility Criteria for the NYS Tax Exempt Form ST-119

To qualify for the NYS Tax Exempt Form ST-119, organizations must meet specific eligibility criteria set by New York State. Generally, the following types of entities may qualify:

- Nonprofit organizations recognized under IRS Section 501(c)(3).

- Government entities, including federal, state, and local agencies.

- Certain educational institutions that are exempt from federal income tax.

Organizations should verify their eligibility before applying for and using the ST-119 form to ensure compliance with state regulations.

Quick guide on how to complete nys tax exempt form st 119

Easily Prepare Nys Tax Exempt Form St 119 on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to acquire the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly without delays. Manage Nys Tax Exempt Form St 119 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Nys Tax Exempt Form St 119 Effortlessly

- Obtain Nys Tax Exempt Form St 119 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information before clicking on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks on any device you choose. Modify and eSign Nys Tax Exempt Form St 119 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys tax exempt form st 119

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form in New York?

A tax exempt form in New York is a document that allows qualifying organizations to purchase items without paying sales tax. This form is essential for nonprofits and certain government entities. By utilizing the tax exempt form New York, businesses can streamline their purchasing process and save on costs.

-

How can airSlate SignNow help with the tax exempt form New York?

airSlate SignNow simplifies the process of managing your tax exempt form New York by allowing you to send, receive, and eSign documents effortlessly. Our platform ensures that all parties can sign the form electronically, eliminating the need for paper-based transactions. With airSlate SignNow, you can quickly handle tax exempt forms while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for tax exempt form New York?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for managing your tax exempt form New York. Our plans are cost-effective, allowing businesses to benefit from electronic signing without breaking the bank. You can choose a plan that fits your requirements and budget.

-

What features does airSlate SignNow provide for eSigning tax exempt forms?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking for your tax exempt form New York. You can create and manage personalized templates for quick access and repeat use. Additionally, our platform ensures the security and confidentiality of your documents.

-

Can I integrate airSlate SignNow with other applications for handling tax exempt forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications and tools to help you manage your tax exempt form New York efficiently. Whether it's CRM systems or accounting software, you can connect airSlate SignNow to other platforms to streamline your workflow.

-

Is airSlate SignNow mobile-friendly for managing tax exempt forms?

Yes, airSlate SignNow is mobile-friendly, allowing you to manage your tax exempt form New York on-the-go. Our mobile application provides the same functionalities as the desktop version, giving you the flexibility to send, sign, and track forms from your smartphone or tablet. Never miss a signing opportunity again!

-

How secure is airSlate SignNow for eSigning tax exempt forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the tax exempt form New York. We utilize advanced encryption and secure data storage to protect your information. Trust airSlate SignNow to keep your documents safe throughout the eSigning process.

Get more for Nys Tax Exempt Form St 119

- Fly fishing checklist form

- Genentech confirmation of infusion or injection form needy meds 80460209

- Internode change of ownership form

- Visio kelly employee election form 11 05 08 pdf

- Essay structure pdf form

- Application for diplomatic official visa to indonesia form

- Post continuous member transmittal form

- City of oxnard water conservation master plan form

Find out other Nys Tax Exempt Form St 119

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement