Form 1099 MISC IRS Gov 2018

What is the Form 1099 MISC IRS gov

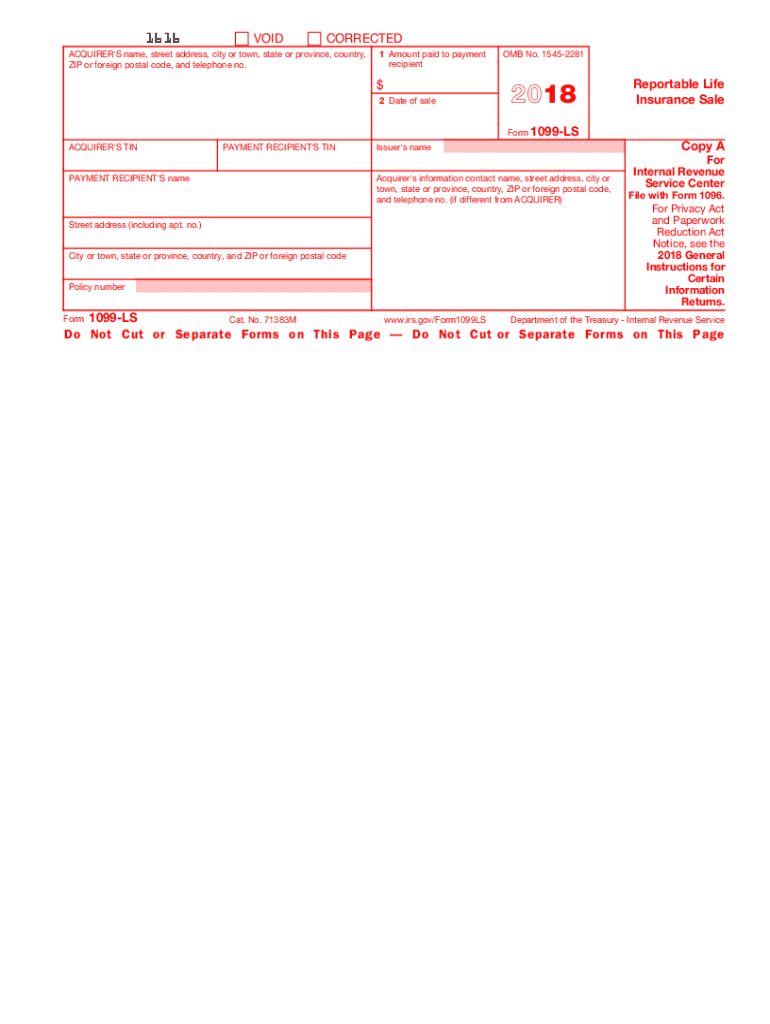

The Form 1099 MISC is a tax form used by the Internal Revenue Service (IRS) to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. The information reported on this form is crucial for both the payer and the recipient, as it helps ensure accurate income reporting and tax compliance.

How to use the Form 1099 MISC IRS gov

To use the Form 1099 MISC, businesses must first determine if they have made qualifying payments during the tax year. Payments that typically require reporting include rent, royalties, and services provided by non-employees. Once the payments are identified, the payer fills out the form with the recipient's information, including their name, address, and taxpayer identification number (TIN). After completing the form, it must be distributed to the recipient and filed with the IRS.

Steps to complete the Form 1099 MISC IRS gov

Completing the Form 1099 MISC involves several key steps:

- Gather necessary information about the recipient, including their name, address, and TIN.

- Identify the total amount paid to the recipient during the tax year.

- Fill in the appropriate boxes on the form, indicating the type of payment made.

- Provide your business information, including your name, address, and TIN.

- Review the form for accuracy before submitting it to the IRS and providing a copy to the recipient.

Filing Deadlines / Important Dates

It is important to adhere to specific deadlines when filing the Form 1099 MISC. Generally, the form must be provided to recipients by January thirty-first of the year following the tax year in which payments were made. Additionally, the form must be filed with the IRS by the end of February if submitting by paper, or by the end of March if filing electronically. Staying aware of these dates helps avoid penalties for late filing.

Legal use of the Form 1099 MISC IRS gov

The legal use of the Form 1099 MISC is essential for compliance with IRS regulations. Businesses are required to issue this form for any payments made to non-employees that total $600 or more during the tax year. Failure to provide the required forms can result in penalties for the payer. It is crucial for businesses to maintain accurate records of payments to ensure proper reporting and compliance with tax laws.

Penalties for Non-Compliance

Non-compliance with the requirements for the Form 1099 MISC can lead to significant penalties. The IRS imposes fines for failing to file the form, filing it late, or providing incorrect information. Penalties can vary based on the size of the business and the length of the delay, with fines increasing for repeated offenses. Understanding these penalties can motivate businesses to prioritize accurate and timely reporting.

Quick guide on how to complete form 1099 misc irs gov

Complete Form 1099 MISC IRS gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Form 1099 MISC IRS gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 1099 MISC IRS gov with ease

- Obtain Form 1099 MISC IRS gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form: email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 1099 MISC IRS gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 misc irs gov

Create this form in 5 minutes!

How to create an eSignature for the form 1099 misc irs gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 MISC IRS gov and why is it important?

Form 1099 MISC IRS gov is a tax form used to report various types of income other than wages, salaries, and tips. It is essential for businesses to accurately report payments made to independent contractors and other non-employees to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with Form 1099 MISC IRS gov?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Form 1099 MISC IRS gov documents. Our solution streamlines the process, ensuring that you can manage your tax forms quickly and securely, reducing the risk of errors.

-

What features does airSlate SignNow offer for managing Form 1099 MISC IRS gov?

With airSlate SignNow, you can easily customize Form 1099 MISC IRS gov templates, track document status, and automate reminders for signatures. These features enhance your workflow, making it easier to handle tax documentation efficiently.

-

Is airSlate SignNow cost-effective for small businesses needing Form 1099 MISC IRS gov?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. Our cost-effective solution allows you to manage Form 1099 MISC IRS gov without breaking the bank, ensuring you stay compliant while saving money.

-

Can I integrate airSlate SignNow with other software for Form 1099 MISC IRS gov?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, making it easy to manage Form 1099 MISC IRS gov alongside your other business processes. This integration helps streamline your workflow and maintain accurate records.

-

What are the benefits of using airSlate SignNow for Form 1099 MISC IRS gov?

Using airSlate SignNow for Form 1099 MISC IRS gov offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere.

-

How does airSlate SignNow ensure compliance with Form 1099 MISC IRS gov requirements?

airSlate SignNow is designed to help businesses comply with Form 1099 MISC IRS gov requirements by providing templates that meet IRS standards. Our platform also offers guidance on best practices for completing and submitting these forms accurately.

Get more for Form 1099 MISC IRS gov

- Filing the estate tax return maryland taxes comptroller of form

- Application for bulk transfer permit form

- Instructions for form 1 2020 instructions for form 1 2020

- Withholding kentucky income tax kentucky dor form

- Ty 2019 106 ty 2019 106 stop payment request form

- 1600010263 kentucky department of revenue form

- 740 line 32 form

- Maryland request for copy of tax return form

Find out other Form 1099 MISC IRS gov

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast