W9 Form Spanish

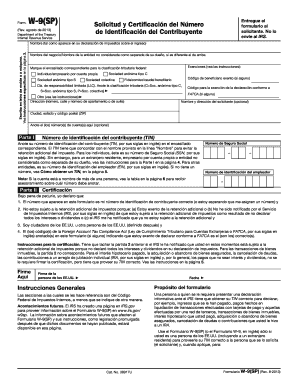

What is the W-9 Form in Spanish?

The W-9 form, known as the "Solicitation of Taxpayer Identification Number and Certification," is a crucial document used by the Internal Revenue Service (IRS) in the United States. It is primarily used to request the taxpayer identification number (TIN) of individuals and businesses. The W-9 form in Spanish serves the same purpose as its English counterpart, allowing Spanish-speaking individuals to provide their information accurately. This form is essential for freelancers, contractors, and other non-employees who need to report income to the IRS.

How to Use the W-9 Form in Spanish

Using the W-9 form in Spanish involves a straightforward process. First, download the form from a reliable source or obtain a physical copy. Fill out the required fields, including your name, business name (if applicable), address, and TIN. Ensure that you provide accurate information to avoid issues with tax reporting. Once completed, submit the form to the requester, typically a client or employer, who needs it for their records. This ensures that they can report any payments made to you accurately.

Steps to Complete the W-9 Form in Spanish

Completing the W-9 form in Spanish requires careful attention to detail. Follow these steps:

- Download the W-9 form in Spanish.

- Provide your full name as it appears on your tax return.

- If applicable, enter your business name.

- Fill in your address, including city, state, and ZIP code.

- Input your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

After completing these steps, ensure that you submit the form to the appropriate party.

Legal Use of the W-9 Form in Spanish

The W-9 form in Spanish holds legal significance as it certifies the taxpayer's identification information. It is essential for compliance with IRS regulations. By submitting a completed W-9, individuals and businesses confirm their TIN and certify that they are not subject to backup withholding. This legal acknowledgment is vital for maintaining accurate tax records and ensuring that the correct amount of taxes is reported.

Key Elements of the W-9 Form in Spanish

Understanding the key elements of the W-9 form in Spanish is essential for proper completion. The main components include:

- Name: The individual's or business's legal name.

- Business Name: If applicable, the name under which the business operates.

- Address: The complete mailing address.

- Taxpayer Identification Number (TIN): Either the SSN or EIN.

- Certification: A signature confirming the accuracy of the provided information.

Each of these elements plays a critical role in ensuring that the form is filled out correctly and meets IRS requirements.

IRS Guidelines for the W-9 Form in Spanish

The IRS provides specific guidelines for completing the W-9 form in Spanish. It is important to refer to these guidelines to ensure compliance. The IRS requires that all information be accurate and up-to-date. Additionally, the form must be signed and dated to be considered valid. The IRS also emphasizes the importance of submitting the form to the requester rather than sending it directly to them. This ensures that the information is kept confidential and used solely for tax reporting purposes.

Quick guide on how to complete w9 form spanish

Complete W9 Form Spanish effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage W9 Form Spanish on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign W9 Form Spanish without effort

- Obtain W9 Form Spanish and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign W9 Form Spanish and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 form spanish

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 form and why is it important?

A W9 form is a Certificate of Taxpayer Identification Number and Certification that is essential for businesses and freelancers in the U.S. to report income to the IRS. Having a properly completed W9 on file ensures that your tax information is accurate and helps avoid potential discrepancies when filing taxes.

-

How does airSlate SignNow simplify the process of collecting W9 forms?

AirSlate SignNow streamlines the process of collecting W9 forms by allowing you to create, send, and eSign documents easily. With user-friendly templates and automated workflows, you can gather necessary tax information efficiently and securely, saving both time and effort.

-

Can I integrate my existing accounting software with airSlate SignNow for W9 forms?

Yes, airSlate SignNow offers integrations with various accounting software platforms that allow you to seamlessly manage your W9 forms. This integration ensures that your data flows smoothly between systems, enhancing efficiency and accuracy in financial reporting.

-

What features does airSlate SignNow provide for eSigning W9 forms?

airSlate SignNow provides robust features for eSigning W9 forms, including secure electronic signatures, customizable templates, and real-time tracking of document status. These capabilities ensure that your W9 forms are completed promptly and adhere to legal standards.

-

Is airSlate SignNow a cost-effective solution for managing W9 forms?

Yes, airSlate SignNow is a cost-effective solution for managing W9 forms, offering various pricing plans tailored to businesses of all sizes. By reducing administrative burdens and paper costs, you can optimize your business processes economically.

-

How can I ensure the security of my W9 data with airSlate SignNow?

airSlate SignNow prioritizes data security by implementing robust encryption and compliance with industry standards. Rest assured that your W9 data is protected against unauthorized access, ensuring confidentiality and peace of mind.

-

Can I customize W9 templates in airSlate SignNow?

Absolutely! In airSlate SignNow, you can customize W9 templates to fit your business's branding and specific needs. This flexibility allows you to create a consistent client experience while ensuring that all required information is captured accurately.

Get more for W9 Form Spanish

- Mv 44 5 form

- Fingerprinting gizmo answer key form

- Social work supervision template pdf 405352195 form

- Notice of intent to dissolve llc georgia form

- Immigration consultant disclosure form

- Bill of sale vessel trailer english lee county tax collector form

- Archerycross country athlete docs navajo technical university navajotech form

- Goodwill agreement template form

Find out other W9 Form Spanish

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document