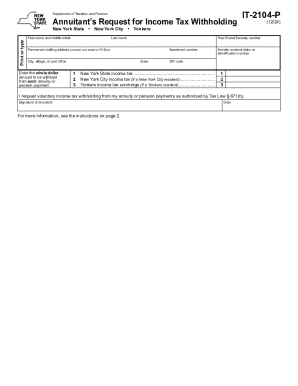

It 2104 Form

What is the IT-2104-P?

The IT-2104-P is a New York State form used by employees to claim their withholding allowances for state income tax. This form is essential for ensuring that the correct amount of state tax is withheld from an employee's paycheck. By accurately completing the IT-2104-P, individuals can manage their tax liabilities effectively and avoid underpayment or overpayment of state taxes. The form is particularly useful for those who may have multiple jobs or varying income levels throughout the year.

How to Use the IT-2104-P

Using the IT-2104-P involves a few straightforward steps. First, individuals need to download the form from the New York State Department of Taxation and Finance website or obtain a physical copy from their employer. Next, they should fill out the form by providing personal information, including their name, address, and Social Security number. It is also necessary to indicate the number of allowances being claimed, which directly affects the amount of state tax withheld. Once completed, the form should be submitted to the employer, who will then adjust the withholding accordingly.

Steps to Complete the IT-2104-P

Completing the IT-2104-P requires careful attention to detail. Here are the steps to follow:

- Obtain the IT-2104-P form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you wish to claim based on your personal tax situation.

- Review the instructions provided on the form to ensure accuracy.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer for processing.

Legal Use of the IT-2104-P

The IT-2104-P is legally recognized as a valid document for claiming state withholding allowances. To ensure compliance with New York State tax laws, it is crucial that the form is filled out accurately and submitted in a timely manner. Failure to complete the form correctly may result in incorrect withholding, which could lead to penalties or unexpected tax liabilities. It is advisable to keep a copy of the submitted form for personal records and future reference.

Key Elements of the IT-2104-P

Several key elements are essential for the IT-2104-P. These include:

- Personal Information: This includes your name, address, and Social Security number.

- Allowances Claimed: The number of allowances directly impacts the amount withheld from your paycheck.

- Signature: Your signature is required to validate the information provided on the form.

- Submission Details: Instructions on how and where to submit the form to your employer.

Filing Deadlines / Important Dates

While there are no specific filing deadlines for the IT-2104-P itself, it is important to submit the form to your employer as soon as you start a new job or experience a change in your tax situation. This ensures that the correct amount of state tax is withheld from your paychecks throughout the year. Additionally, keeping track of important tax deadlines, such as the annual tax return filing date, can help in managing overall tax obligations.

Quick guide on how to complete it 2104

Accomplish It 2104 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle It 2104 on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to alter and electronically sign It 2104 with ease

- Find It 2104 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign It 2104 while ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 2104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2104 p feature in airSlate SignNow?

The it 2104 p feature in airSlate SignNow enhances document signing by providing a secure and efficient way to manage electronic signatures. This feature allows users to streamline their workflow and ensure compliance with legal standards for digital signatures.

-

How does airSlate SignNow pricing work for the it 2104 p?

The pricing for airSlate SignNow with it 2104 p is designed to be cost-effective, catering to businesses of all sizes. You can choose from various subscription plans that offer flexibility based on the number of users and features required, ensuring you get the best value.

-

What benefits can businesses expect from using it 2104 p?

By using it 2104 p within airSlate SignNow, businesses can enjoy faster turnaround times on document processing and improved accuracy in signature collection. This efficiency not only saves time but also enhances the customer experience, leading to higher satisfaction.

-

Can it 2104 p integrate with other software tools?

Yes, it 2104 p in airSlate SignNow is designed to integrate seamlessly with various software tools and platforms. This integration capability allows for an enhanced workflow, enabling you to manage documents and signatures directly within your existing systems.

-

Is it secure to use it 2104 p for document signing?

Absolutely! The it 2104 p feature in airSlate SignNow utilizes advanced encryption protocols to ensure the highest level of security for your documents. Additionally, it complies with industry standards, providing peace of mind for businesses and their clients during the signing process.

-

What types of documents can be signed using it 2104 p?

Generally, any document that requires a signature can be processed using it 2104 p in airSlate SignNow. This includes contracts, agreements, and forms that are crucial for business operations, facilitating a broad range of applications across industries.

-

How intuitive is the user interface for it 2104 p?

The user interface for it 2104 p in airSlate SignNow is designed to be user-friendly, making it easy for anyone to adopt and use. With simple navigation and clear instructions, users can quickly learn how to send and eSign documents without any technical expertise.

Get more for It 2104

- Pte practice test form

- Amoeba sisters video recap monohybrid crosses mendelian inheritance answer key form

- Mcas reference sheet grade 10 101919567 form

- Acu application form pdf

- Adobe exhibit stamp download form

- Printable autism checklist for teachers form

- The eyes of nye human population worksheet answer key form

- Interconnection security agreement template form

Find out other It 2104

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation