Form 42a809 2006

What is the Form 42a809

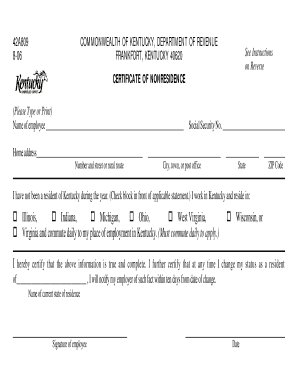

The Form 42a809 is a specific document used in Kentucky for various legal and administrative purposes. This form is often required for official transactions, including applications for permits, licenses, or other regulatory requirements. Understanding its purpose is crucial for individuals and businesses operating within the state.

How to use the Form 42a809

Using the Form 42a809 involves several steps to ensure proper completion and submission. First, gather all necessary information and documents required to fill out the form accurately. Next, complete each section of the form carefully, ensuring that all details are correct. After filling out the form, review it for any errors before submission. Depending on the specific requirements, you may need to submit the form online, by mail, or in person.

Steps to complete the Form 42a809

Completing the Form 42a809 can be straightforward if you follow these steps:

- Download the latest version of the form from a trusted source.

- Fill in your personal or business information as required.

- Provide any additional details requested, such as signatures or dates.

- Review the completed form for accuracy and completeness.

- Submit the form through the appropriate method as specified.

Legal use of the Form 42a809

The legal validity of the Form 42a809 hinges on its proper completion and adherence to state regulations. It is essential to ensure that the form is filled out accurately, as errors can lead to delays or rejections. When signed and submitted correctly, the form holds legal weight and can be used in various official capacities.

State-specific rules for the Form 42a809

Each state may have its own specific rules regarding the use and submission of the Form 42a809. In Kentucky, it is important to familiarize yourself with local regulations that govern the form's use. This includes understanding any deadlines for submission, required attachments, and the appropriate authorities to whom the form should be submitted.

Form Submission Methods (Online / Mail / In-Person)

The Form 42a809 can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate office.

- Delivering the form in person to the relevant agency.

Examples of using the Form 42a809

There are several scenarios in which the Form 42a809 may be utilized. For instance, a business may need to submit this form when applying for a new operating license, or an individual might use it to request a permit for a specific activity. Understanding these examples can help clarify when and why to use the form effectively.

Quick guide on how to complete form 42a809

Complete Form 42a809 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 42a809 on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related tasks today.

How to modify and eSign Form 42a809 effortlessly

- Locate Form 42a809 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method to send your form, such as email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 42a809 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 42a809

Create this form in 5 minutes!

How to create an eSignature for the form 42a809

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 42a809?

Form 42a809 is a specific document that businesses can easily manage using airSlate SignNow. This form allows for efficient electronic signatures, ensuring that your documentation is processed swiftly and securely. Understanding how to utilize form 42a809 can streamline your operations.

-

How much does airSlate SignNow cost for using form 42a809?

The pricing for using form 42a809 with airSlate SignNow is competitive and offers various plans to fit different business needs. You can choose a plan that scales according to your document volume and budget constraints. Visit our pricing page to find the best option for your organization.

-

What features does airSlate SignNow provide for form 42a809?

airSlate SignNow provides numerous features for form 42a809, including customizable templates, real-time document tracking, and secure eSigning capabilities. These features enhance the user experience and ensure that your forms are completed efficiently. The integration of automation tools further simplifies the process.

-

What are the benefits of using form 42a809 with airSlate SignNow?

Using form 42a809 with airSlate SignNow offers various benefits, such as reduced turnaround time and increased accuracy in document management. This solution not only saves you time but also minimizes errors associated with manual processing. Moreover, it enhances collaboration and accessibility for your team.

-

Can I integrate airSlate SignNow with other platforms for form 42a809?

Yes, airSlate SignNow seamlessly integrates with numerous platforms, making it easy to manage form 42a809 alongside your existing workflows. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure smooth data flow. This versatility enhances productivity and simplifies document handling.

-

Is airSlate SignNow secure for handling form 42a809?

Absolutely! airSlate SignNow employs advanced security measures and complies with industry-standard regulations to ensure that form 42a809 is handled securely. Your documents are protected with encryption and access controls, providing peace of mind as you eSign and manage sensitive information.

-

How can I get support for form 42a809 issues in airSlate SignNow?

Our dedicated support team is available to assist you with any issues related to form 42a809 in airSlate SignNow. You can access our help center for FAQs, tutorials, and live chat options to resolve your queries efficiently. We aim to ensure you have a smooth experience with our services.

Get more for Form 42a809

Find out other Form 42a809

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile