Form 1003

What is the Form 1003

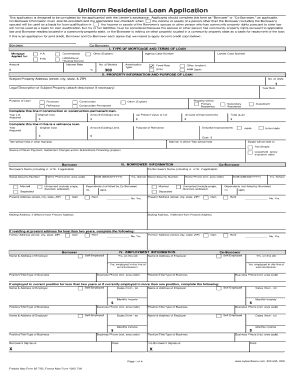

The Form 1003, also known as the Uniform Residential Loan Application, is a standardized document used by lenders to gather essential information from borrowers applying for a mortgage. This form captures details about the applicant’s financial status, employment history, and the property being financed. It serves as a critical tool in the mortgage application process, ensuring that lenders have a comprehensive understanding of the borrower's qualifications.

Steps to complete the Form 1003

Completing the Form 1003 involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Personal Information: Fill in your name, address, and contact information. Include details about any co-borrowers.

- Employment and Income: Provide information about your employment history, including your employer's name, address, and your position. Report your monthly income and any additional sources of income.

- Assets and Liabilities: List your assets, such as bank accounts, investments, and properties. Also, detail your liabilities, including existing loans and credit card debts.

- Property Information: Describe the property you intend to purchase or refinance, including its address, type, and estimated value.

- Declarations: Answer questions regarding your financial history, such as bankruptcy or foreclosure.

- Sign and Date: Ensure all parties sign and date the form to validate the application.

Legal use of the Form 1003

The Form 1003 is legally recognized in the United States as a valid document for mortgage applications. To ensure its legal standing, it must be filled out accurately and completely. The use of electronic signatures is permissible, provided that the signing process complies with the ESIGN Act and UETA. This means that the form can be signed digitally, which enhances convenience while maintaining legal integrity.

Key elements of the Form 1003

Understanding the key elements of the Form 1003 is crucial for a successful mortgage application. Important sections include:

- Borrower Information: Details about the primary borrower and any co-borrowers.

- Employment History: A comprehensive overview of the applicant's job history and income sources.

- Financial Information: A summary of assets, liabilities, and credit history.

- Property Details: Information on the property being financed, including its purpose and estimated value.

- Declarations: Questions that assess the borrower's financial responsibility and history.

How to obtain the Form 1003

The Form 1003 can be obtained through various channels. Many lenders provide the form directly on their websites, allowing for easy access and completion. Additionally, the form is available in printable PDF format, which can be filled out manually. For those preferring digital methods, utilizing a service like signNow can facilitate electronic completion and signing, ensuring a streamlined process.

Eligibility Criteria

To qualify for a Fannie Mae loan using the Form 1003, applicants must meet specific eligibility criteria. These typically include:

- Credit Score: A minimum credit score requirement, which varies by lender.

- Debt-to-Income Ratio: A ratio that reflects the borrower's ability to manage monthly payments.

- Employment Stability: A consistent employment history is often required.

- Down Payment: A minimum down payment, which may vary based on the loan type.

Quick guide on how to complete form 1003

Complete Form 1003 effortlessly on any device

Online document management has gained signNow popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 1003 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to edit and eSign Form 1003 with ease

- Locate Form 1003 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1003 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1003

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1003 form and how can airSlate SignNow help with it?

The 1003 form, also known as the Uniform Residential Loan Application, is essential for the mortgage application process. airSlate SignNow simplifies the completion and eSigning of the 1003, allowing users to fill out the form electronically and securely. This streamlined process saves time and reduces the likelihood of errors, making it easier for both borrowers and lenders.

-

Is there a free trial available for using airSlate SignNow for the 1003 form?

Yes, airSlate SignNow offers a free trial that allows users to experience its features firsthand, including the easy eSigning process for the 1003 form. During the trial, you can explore all the tools available for document management and eSigning. This no-obligation opportunity helps potential customers evaluate whether it meets their needs before committing.

-

What features does airSlate SignNow offer for managing the 1003 form?

airSlate SignNow provides features such as customizable templates, document sharing, and online storage, specifically designed for the 1003 form. Users can save frequently used data to expedite future applications and utilize security measures such as encryption to protect sensitive information. These features enhance the efficiency of the mortgage application process.

-

How does airSlate SignNow ensure the security of my 1003 documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the 1003 form. The platform uses advanced encryption protocols to protect your data both in transit and at rest. Additionally, legally binding eSignatures are compliant with eSignature laws, ensuring that your documents are secure and valid.

-

Can I integrate airSlate SignNow with other software to manage the 1003 form?

Absolutely! airSlate SignNow offers numerous integrations with popular CRM systems, cloud storage services, and more, facilitating the management of the 1003 form. These integrations allow for seamless workflows and enhanced productivity, enabling users to connect their existing tools with airSlate SignNow effortlessly.

-

What are the pricing options for using airSlate SignNow for the 1003?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes needing the 1003 form solution. The pricing is competitive and based on the features required, ensuring that users can find a plan that fits their budget and needs. Custom packages are also available for larger enterprises.

-

How can airSlate SignNow benefit lenders working with the 1003 form?

For lenders, airSlate SignNow enhances the 1003 form process by providing a faster and more streamlined application experience. Lenders can receive completed applications quickly, reducing delays and improving customer satisfaction. Moreover, the platform's tracking and management features help lenders stay organized and monitor application statuses efficiently.

Get more for Form 1003

Find out other Form 1003

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy