Ardd 100 Form

What is the Ardd 100

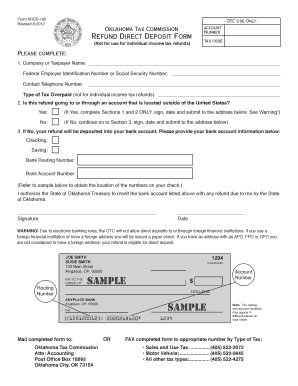

The Ardd 100 is a form used by the Oklahoma Tax Commission for requesting a credit or refund for overpaid taxes. This form is specifically designed for individuals and businesses seeking to reclaim excess tax payments. Understanding the purpose and requirements of the Ardd 100 is essential for ensuring accurate submissions and compliance with state tax regulations.

How to use the Ardd 100

Using the Ardd 100 involves several key steps to ensure proper completion and submission. First, gather all necessary documentation that supports your claim for a credit or refund. This may include previous tax returns, payment receipts, and any relevant correspondence with the tax authority. Next, fill out the form accurately, providing all required information, such as your name, address, and tax identification number. Finally, submit the completed form to the Oklahoma Tax Commission through the designated submission method, ensuring you keep a copy for your records.

Steps to complete the Ardd 100

Completing the Ardd 100 requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Ardd 100 from the Oklahoma Tax Commission website.

- Fill in your personal information, including your full name, address, and Social Security number or Employer Identification Number (EIN).

- Provide details of the tax period for which you are requesting a refund.

- Clearly state the amount of the overpayment and attach supporting documents.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Ardd 100

The Ardd 100 is legally recognized as a valid document for claiming tax refunds in Oklahoma, provided it is filled out correctly and submitted within the required timeframe. Compliance with state tax laws is crucial to ensure that your request is processed without delays. It is advisable to familiarize yourself with the Oklahoma Tax Commission's regulations regarding the use of this form to avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Ardd 100 are critical for ensuring your refund request is considered. Generally, taxpayers must submit their refund claims within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines can help you avoid missing out on potential refunds.

Required Documents

To successfully file the Ardd 100, certain documents are required to substantiate your claim. These may include:

- Copies of relevant tax returns for the periods in question.

- Proof of payment, such as canceled checks or bank statements.

- Any correspondence with the Oklahoma Tax Commission regarding your tax payments.

Having these documents ready will facilitate a smoother filing process and increase the likelihood of a favorable outcome.

Quick guide on how to complete ardd 100

effortlessly prepare Ardd 100 on any device

The management of online documents has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, revise, and eSign your documents promptly without any delays. Manage Ardd 100 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily modify and eSign Ardd 100

- Acquire Ardd 100 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your files or conceal sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Ardd 100 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ardd 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ardd 100 and how does it benefit businesses?

The ardd 100 is an innovative eSigning solution offered by airSlate SignNow that simplifies document workflows. By using the ardd 100, businesses can streamline their signing processes, reduce turnaround times, and improve overall efficiency. This leads to faster transactions and enhanced collaboration among teams.

-

How does pricing work for the ardd 100?

airSlate SignNow provides competitive pricing for the ardd 100, allowing businesses of all sizes to benefit from its features. Pricing varies depending on the chosen plan, with options for monthly or yearly subscriptions. Businesses can easily select a plan that meets their needs and budget.

-

What key features does the ardd 100 offer?

The ardd 100 includes several key features such as customizable signature fields, automated reminders, and secure cloud storage for documents. These features ensure that sending and signing documents is not only efficient but also compliant with regulatory standards. The user-friendly interface makes it accessible for everyone.

-

Can the ardd 100 integrate with other tools?

Yes, the ardd 100 seamlessly integrates with various business applications and tools, including CRMs and productivity software. This integration streamlines workflows and enhances user experience by allowing data to flow effortlessly between platforms. Businesses can connect disparate systems for improved efficiency.

-

Is the ardd 100 secure for sensitive documents?

Absolutely! The ardd 100 prioritizes security with advanced encryption and compliance with industry standards. This ensures that sensitive documents remain protected throughout the signing process. Businesses can trust the ardd 100 to maintain the confidentiality of their information.

-

How can the ardd 100 improve team collaboration?

The ardd 100 enhances team collaboration by allowing multiple users to access and sign documents simultaneously. With real-time tracking and notification features, team members can stay updated on the document's status. This collaborative approach leads to quicker decision-making and more efficient workflows.

-

What are the benefits of using the ardd 100 for small businesses?

Small businesses can experience signNow benefits from the ardd 100, including cost savings and increased efficiency. By eliminating paper-based processes, these businesses can reduce overhead costs and improve their response times. Furthermore, the simplicity of the ardd 100 enables small teams to maximize productivity.

Get more for Ardd 100

Find out other Ardd 100

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online