Mudra Loan Form

What is the Mudra Loan Form?

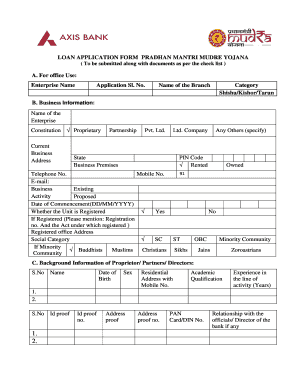

The Mudra Loan Form is an essential document for individuals and businesses seeking financial assistance under the Pradhan Mantri Mudra Yojana (PMMY) scheme in India. This scheme aims to provide loans to small and medium enterprises (SMEs) and micro-enterprises. The form collects vital information about the applicant, including personal details, business information, and the purpose of the loan. By filling out this form, applicants can access various types of loans, categorized into Shishu, Kishore, and Tarun, based on their funding needs.

How to Obtain the Mudra Loan Form

The Mudra Loan Form can be obtained from various sources. Applicants can visit the official websites of banks and financial institutions that offer Mudra loans. Additionally, the form may be available at local bank branches or through authorized agents. For convenience, many institutions provide a downloadable PDF version of the Mudra Loan Application Form, allowing applicants to fill it out digitally or print it for manual submission.

Steps to Complete the Mudra Loan Form

Completing the Mudra Loan Form involves several key steps:

- Gather Required Information: Collect all necessary documents, including identity proof, address proof, and business details.

- Fill Out the Form: Accurately enter personal and business information in the designated fields.

- Specify Loan Amount: Clearly indicate the amount of funding required and the purpose of the loan.

- Review for Accuracy: Double-check all entries to ensure correctness before submission.

- Submit the Form: Submit the completed form either online or in-person at the respective bank branch.

Legal Use of the Mudra Loan Form

The Mudra Loan Form serves as a legally binding document once it is completed and signed. It is crucial for applicants to understand that the information provided must be truthful and accurate, as any discrepancies may lead to legal consequences or loan rejection. Additionally, the form may require a signature that complies with eSignature laws, ensuring that the application is recognized as valid by financial institutions.

Key Elements of the Mudra Loan Form

Several key elements are essential to the Mudra Loan Form:

- Applicant Details: Name, address, contact information, and identification proof.

- Business Information: Type of business, registration details, and operational address.

- Loan Details: Requested loan amount, purpose of the loan, and repayment terms.

- Financial Statements: Recent financial documents that demonstrate the applicant's creditworthiness.

Required Documents

When applying for a Mudra loan, applicants must provide several documents to support their application. These typically include:

- Identity Proof: Such as a passport, driver's license, or government-issued ID.

- Address Proof: Utility bills, rental agreements, or bank statements.

- Business Registration Documents: Certificates of incorporation or registration, if applicable.

- Financial Statements: Profit and loss statements, balance sheets, and cash flow statements.

Quick guide on how to complete mudra loan form

Complete Mudra Loan Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Mudra Loan Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Mudra Loan Form with ease

- Obtain Mudra Loan Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mudra Loan Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mudra loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mudra loan?

Micro Units Development and Refinance Agency Ltd. [MUDRA] is an NBFC supporting development of micro enterprise sector in the country. MUDRA provides refinance support to Banks / MFIs / NBFCs for lending to micro units having loan requirement upto 10 lakh.

-

How to get a Mudra loan?

MUDRA does not lend directly to the micro entrepreneurs / individuals. Mudra loans under Pradhan Mantri Mudra Yojana (PMMY) can be availed of from nearby branch office of a bank, NBFC, MFIs etc. Borrowers can also now file online application for MUDRA loans on Udyamimitra portal (.udyamimitra.in).

-

What is the loan limit for PM Mudra?

Loan Limit Raised to ₹20 Lakh from ₹10 Lakh To strengthen support for aspiring entrepreneurs, the finance minister announced an increase in the loan limit to ₹20 lakh during the Union Budget 2024-25 on July 23, 2024.

-

How much loan can I get from PM Mudra?

Mudra Loan Key Highlights of Mudra Loan Loan FacilityCash Credit, Overdraft & Term Loan Loan Amount Up to Rs 10 lakhs (Up to Rs 20 lakhs proposed in Budget 2024) Tenure Depends on the bank's policy decisions Processing Fees For Shishu category (loans up to Rs 50,000) – No processing fee2 more rows • Nov 7, 2024

-

How to fill mudra form?

Know how to fill Mudra loan application form Personal details. ... Business information. ... Category selection. ... Financial details. ... Loan amount calculation. ... Collateral information. ... Documentation submission. ... Review and confirmation.

-

What is the interest of $1,000,000 in a Mudra loan?

MUDRA Loan Details Interest Rate9.30% p.a. onwards Loan Amount Up to Rs.10 lakh Loan Tenure Up to 7 years Processing Fee Subject to the lender

-

What is the highest Mudra loan?

The government on Friday doubled the limit of Mudra loan amount under the Pradhan Mantri Mudra Yojana (PMMY) to Rs 20 lakh from Rs 10 lakh under a new 'Tarun Plus' category to promote entrepreneurship in the country. “The increase aims to further the objective of the Mudra Scheme, which is to fund the unfunded.

-

What is the interest rate of PM Mudra loan?

What is the interest rate of Pradhan Mantri Mudra Loan? The interest rates for Pradhan Mantri Mudra Loan vary based on the category – Shishu, Kishor, or Tarun. Generally, they range from 8% to 12%.

Get more for Mudra Loan Form

- In pro per motion to change child support form

- Family health questionnaire form fhq

- Ohio snap application form

- 1446 withdrawal of a visa application 1446 withdrawal of a visa application form

- Dgc schedule 8 form

- Ppe 52261 cf vet fee 5728 11indd petplan equine form

- Affidavit of residence the purpose of this form is to verify that the children listed below resides within the boundaries for

- Sc 100 plaintiffs claim and order to go to small claims court form

Find out other Mudra Loan Form

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed