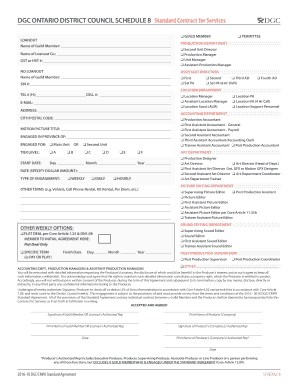

Dgc Schedule 8 2016-2026

What is the Dgc Schedule 8

The Dgc Schedule 8 is a specific form used in the United States for reporting certain tax-related information. This form is essential for individuals and businesses that need to disclose specific financial details to the Internal Revenue Service (IRS). It typically includes information about various deductions and credits that taxpayers may be eligible to claim. Understanding the purpose and requirements of the Dgc Schedule 8 is crucial for ensuring compliance with tax regulations and maximizing potential tax benefits.

How to use the Dgc Schedule 8

Using the Dgc Schedule 8 involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and receipts for deductible expenses. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided by the IRS for the Dgc Schedule 8 to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted along with your tax return, either electronically or by mail.

Steps to complete the Dgc Schedule 8

Completing the Dgc Schedule 8 requires careful attention to detail. Follow these steps for a smooth process:

- Gather documentation: Collect all relevant financial documents, such as W-2s, 1099s, and receipts for expenses.

- Read the instructions: Review the IRS guidelines for the Dgc Schedule 8 to understand what information is required.

- Fill out the form: Enter your information accurately, ensuring that all figures are correct and match your supporting documents.

- Review your work: Double-check all entries for accuracy and completeness before submission.

- Submit the form: File the Dgc Schedule 8 along with your tax return, either electronically or via mail, depending on your preference.

Legal use of the Dgc Schedule 8

The legal use of the Dgc Schedule 8 is governed by IRS regulations. This form must be completed accurately and submitted in accordance with federal tax laws. Failure to comply with these regulations can result in penalties, including fines or additional taxes owed. It is essential for taxpayers to understand their obligations when using the Dgc Schedule 8 to ensure they meet all legal requirements and protect themselves from potential legal issues.

Key elements of the Dgc Schedule 8

The Dgc Schedule 8 includes several key elements that are important for accurate reporting. These elements typically include:

- Taxpayer information: Name, address, and Social Security number or Employer Identification Number.

- Income details: Information about various sources of income that must be reported.

- Deductions and credits: Sections for detailing any deductions or credits the taxpayer is eligible to claim.

- Signature: A declaration that the information provided is true and accurate, requiring the taxpayer's signature.

Filing Deadlines / Important Dates

Filing deadlines for the Dgc Schedule 8 align with the standard tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these deadlines to avoid late fees and penalties associated with late submissions.

Quick guide on how to complete dgc schedule 8

Effortlessly Prepare Dgc Schedule 8 on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, as you can access the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Dgc Schedule 8 seamlessly on any device using airSlate SignNow's Android or iOS applications and improve any document-related process today.

How to Modify and eSign Dgc Schedule 8 with Ease

- Locate Dgc Schedule 8 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose, offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, SMS, sharing a link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Dgc Schedule 8 and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dgc schedule 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DGC Schedule 8?

DGC Schedule 8 refers to a specific document management protocol used in regulatory environments. With airSlate SignNow, you can manage DGC Schedule 8 documents efficiently by ensuring compliance and streamlined workflows.

-

How does airSlate SignNow support DGC Schedule 8 compliance?

airSlate SignNow provides tools designed for managing DGC Schedule 8 documents, ensuring you meet compliance requirements with secure eSignatures and audit trails. This feature signNowly reduces the risk of non-compliance in your document handling process.

-

What are the pricing plans for using airSlate SignNow for DGC Schedule 8?

Our pricing plans for airSlate SignNow are competitive and cater to various business needs. Depending on your requirements for handling DGC Schedule 8 and other documents, you can choose a plan that best fits your budget while ensuring robust document management features.

-

Can I integrate airSlate SignNow with other software for DGC Schedule 8?

Yes, airSlate SignNow offers various integrations with popular software applications. By integrating with your existing systems, you can streamline the management of DGC Schedule 8 documents and enhance productivity across all platforms.

-

What features does airSlate SignNow offer for DGC Schedule 8 management?

airSlate SignNow includes features such as customizable templates, collaboration tools, and secure storage, all tailored for managing DGC Schedule 8 documents. These features help simplify the signing process and improve overall efficiency.

-

Is airSlate SignNow easy to use for managing DGC Schedule 8 documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage DGC Schedule 8 documents. The intuitive interface allows users to quickly send, sign, and track documents without extensive training.

-

What are the benefits of using airSlate SignNow for DGC Schedule 8?

Using airSlate SignNow for DGC Schedule 8 offers numerous benefits, including improved efficiency, cost-effectiveness, and enhanced security. By digitizing your document processes, you can save time and reduce errors in your workflow.

Get more for Dgc Schedule 8

Find out other Dgc Schedule 8

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy