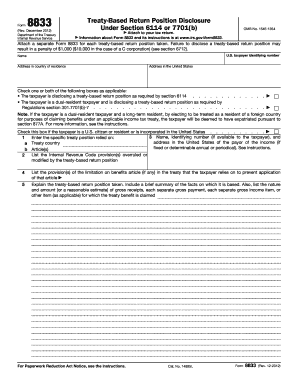

Form 8833 Irs

What is the Form 8833?

The Form 8833 is an IRS document used by taxpayers to disclose certain treaty-based positions. This form is particularly relevant for individuals or entities claiming benefits under an income tax treaty between the United States and another country. By completing this form, taxpayers can ensure compliance with IRS regulations while taking advantage of the provisions outlined in applicable tax treaties.

How to use the Form 8833

Using the Form 8833 involves several key steps. First, gather all necessary information regarding your treaty-based position, including details about the foreign country and the specific treaty provisions you are claiming. Next, accurately complete the form by providing information such as your name, taxpayer identification number, and the relevant treaty article. Finally, submit the form along with your tax return to the IRS to ensure that your claims are properly documented and considered.

Steps to complete the Form 8833

Completing the Form 8833 requires careful attention to detail. Follow these steps:

- Download the Form 8833 from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name and taxpayer identification number.

- Identify the specific tax treaty you are referencing and the benefits you are claiming.

- Provide a detailed explanation of your treaty-based position, including any relevant articles from the treaty.

- Review the completed form for accuracy and completeness.

- Attach the form to your tax return when filing with the IRS.

Legal use of the Form 8833

The legal use of the Form 8833 is crucial for taxpayers seeking to benefit from tax treaties. By accurately disclosing treaty-based positions, taxpayers can avoid potential penalties for non-compliance. The form serves as a formal declaration to the IRS, ensuring that the taxpayer's claims are recognized under U.S. tax law. Failure to file this form when required may result in the denial of treaty benefits and possible penalties.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 8833. Taxpayers should consult the IRS instructions accompanying the form to understand the requirements fully. These guidelines outline the necessary information to include, the deadlines for submission, and the consequences of failing to comply with the reporting requirements. Adhering to these guidelines is essential for ensuring that your treaty-based claims are valid and recognized by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8833 align with the general tax return deadlines. Typically, individual taxpayers must submit their tax returns, including the Form 8833, by April 15. If you are unable to meet this deadline, you may apply for an extension, but it is important to ensure that the form is submitted within the extended timeframe. Staying informed about these deadlines helps prevent unnecessary penalties and ensures timely compliance.

Quick guide on how to complete form 8833 irs

Effortlessly Prepare Form 8833 Irs on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without complications. Handle Form 8833 Irs on any device using airSlate SignNow apps for Android or iOS and enhance any document-oriented workflow today.

How to Edit and eSign Form 8833 Irs with Ease

- Obtain Form 8833 Irs and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 8833 Irs to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8833 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8833 and why is it important?

Form 8833 is a tax treaty-based return position disclosure form used by taxpayers to claim a tax benefit under a treaty. It's essential for ensuring compliance with IRS regulations while taking advantage of tax provisions. With airSlate SignNow, you can easily prepare and eSign form 8833, streamlining the reporting process.

-

How can airSlate SignNow help with completing form 8833?

AirSlate SignNow provides a user-friendly platform to create, edit, and eSign form 8833. Our template library simplifies the process, allowing you to fill out the necessary fields quickly and accurately. This ensures that your form 8833 is completed correctly, reducing the likelihood of errors.

-

Is airSlate SignNow cost-effective for managing form 8833?

Yes, airSlate SignNow offers a cost-effective solution for managing your documents, including form 8833. Our pricing plans are designed to fit various business needs and budgets, making it affordable for anyone needing to eSign essential tax documents without compromising on quality.

-

What features does airSlate SignNow offer for form 8833 processing?

AirSlate SignNow offers features like customizable templates, secure electronic signatures, and real-time collaboration, signNowly enhancing the form 8833 processing experience. Users can also track the status of their forms to ensure timely submissions and compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for form 8833 management?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, such as CRM and document management systems, to help you manage form 8833 more efficiently. This ensures that all your necessary documents are accessible in one place, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for form 8833?

Using airSlate SignNow for form 8833 simplifies the eSigning process, saves time, and enhances security. Our platform allows users to complete and send their forms quickly, ensuring that all necessary signatures are securely captured, which helps maintain compliance with tax requirements.

-

How secure is airSlate SignNow when submitting form 8833?

AirSlate SignNow prioritizes security with features like encryption, audit trails, and secure storage for all signed documents, including form 8833. We comply with industry standards to protect sensitive information throughout the signing process, giving users peace of mind.

Get more for Form 8833 Irs

Find out other Form 8833 Irs

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer