Form it 631 Claim for Security Officer Training Tax Credit Tax Year 2024-2026

Understanding the Form IT 631 Claim For Security Officer Training Tax Credit Tax Year

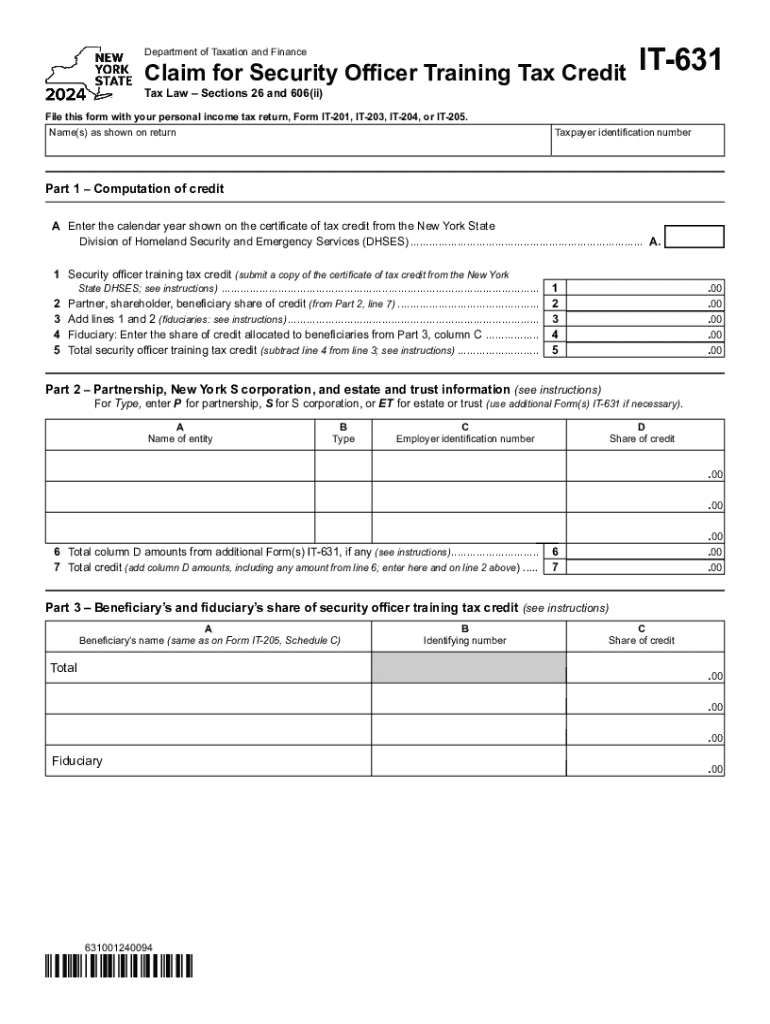

The Form IT 631 is a tax form used by eligible security officers in the United States to claim a tax credit for training expenses incurred during the tax year. This form is specifically designed to assist security personnel who have completed approved training programs, thereby encouraging professional development within the industry. The tax credit aims to reduce the financial burden on security officers by providing a means to offset training costs through tax savings.

Steps to Complete the Form IT 631 Claim For Security Officer Training Tax Credit Tax Year

Completing the Form IT 631 involves several key steps:

- Gather all necessary documentation, including proof of training completion and any associated costs.

- Fill out personal information such as your name, address, and Social Security number.

- Detail the training programs you completed, including dates and costs.

- Calculate the total amount of the tax credit you are eligible for based on the training expenses.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria for the Form IT 631 Claim For Security Officer Training Tax Credit Tax Year

To qualify for the tax credit using Form IT 631, security officers must meet specific eligibility criteria:

- Must be employed as a security officer in the United States.

- Must have completed an approved training program during the tax year.

- Must provide documentation of training expenses incurred.

Required Documents for Form IT 631 Submission

When submitting the Form IT 631, it is essential to include the following documents:

- Proof of completion of the training program, such as a certificate or transcript.

- Receipts or invoices for all training-related expenses.

- Any additional documentation required by state tax authorities, if applicable.

Filing Deadlines for Form IT 631

It is important to adhere to filing deadlines to ensure you receive your tax credit. Typically, the Form IT 631 must be submitted by the tax filing deadline, which is usually April 15 of the following year. If you are filing for an extension, ensure that the form is submitted by the extended deadline.

Form Submission Methods for IT 631

The Form IT 631 can be submitted through various methods:

- Online submission through the appropriate state tax authority's website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices, where available.

Create this form in 5 minutes or less

Find and fill out the correct form it 631 claim for security officer training tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 631 claim for security officer training tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 631 Claim For Security Officer Training Tax Credit Tax Year?

Form IT 631 Claim For Security Officer Training Tax Credit Tax Year is a tax form used by businesses to claim a credit for expenses incurred in training security officers. This form helps organizations reduce their tax liability while ensuring their security personnel are well-trained. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Form IT 631 Claim For Security Officer Training Tax Credit Tax Year?

airSlate SignNow streamlines the process of preparing and submitting Form IT 631 Claim For Security Officer Training Tax Credit Tax Year by providing an easy-to-use platform for document management. With our eSigning capabilities, you can quickly gather necessary signatures and ensure compliance. This efficiency saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing Form IT 631?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for managing Form IT 631 Claim For Security Officer Training Tax Credit Tax Year. These tools enhance your workflow, making it easier to prepare and submit your claims accurately. Additionally, our platform ensures that all documents are stored securely.

-

Is there a cost associated with using airSlate SignNow for Form IT 631?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when managing Form IT 631 Claim For Security Officer Training Tax Credit Tax Year. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that fits your budget while still benefiting from our comprehensive document management solutions.

-

What are the benefits of using airSlate SignNow for tax credit claims?

Using airSlate SignNow for your Form IT 631 Claim For Security Officer Training Tax Credit Tax Year provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your business rather than administrative tasks. Additionally, our secure eSigning feature ensures that your documents are protected.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow can be integrated with various accounting and tax management software to facilitate the handling of Form IT 631 Claim For Security Officer Training Tax Credit Tax Year. This integration allows for seamless data transfer and improved workflow efficiency. By connecting your tools, you can streamline your tax preparation process.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents, including those related to Form IT 631 Claim For Security Officer Training Tax Credit Tax Year. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your data remains confidential and secure.

Get more for Form IT 631 Claim For Security Officer Training Tax Credit Tax Year

- Ethekwini rates rebate form pdf

- Dd 2569 third party collection programmedical services account crdamc amedd army form

- Form 6198 example

- Prn list form

- Simple mortgage form

- Health savings account hsa application optum bank form

- Apartment to sub lease share agreement template form

- Assignment of lease agreement template form

Find out other Form IT 631 Claim For Security Officer Training Tax Credit Tax Year

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast