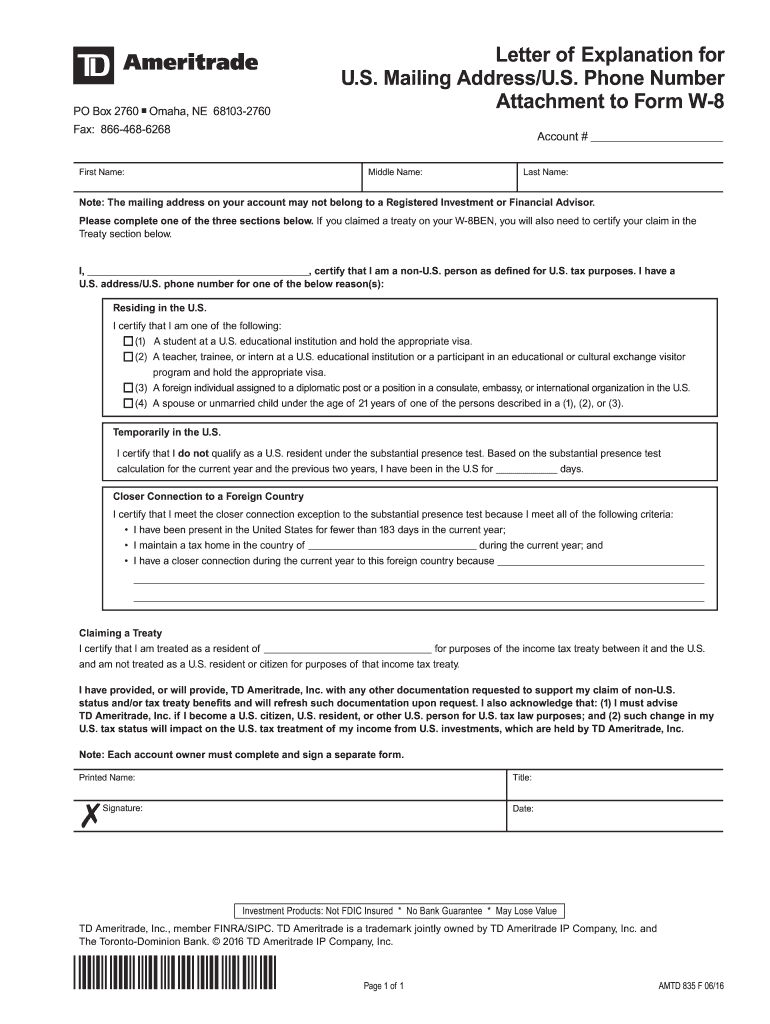

W8ben Td Ameritrade Form

What is the W-8BEN Form for TD Ameritrade?

The W-8BEN form is a tax document required by the IRS for foreign individuals and entities to certify their foreign status. When dealing with TD Ameritrade, this form is essential for non-U.S. persons to claim tax treaty benefits and avoid higher withholding tax rates on dividends and interest income. By submitting the W-8BEN, investors can ensure they are taxed at the correct rate according to applicable tax treaties between the United States and their country of residence.

Steps to Complete the W-8BEN Form for TD Ameritrade

Completing the W-8BEN form involves several key steps:

- Provide your name and country of citizenship.

- Include your permanent address outside the U.S.

- Enter your mailing address if it differs from your permanent address.

- Fill in your U.S. taxpayer identification number (if applicable) or foreign tax identifying number.

- Sign and date the form to certify that the information provided is accurate.

It is important to ensure that all information is accurate and complete to avoid delays in processing.

Legal Use of the W-8BEN Form for TD Ameritrade

The legal use of the W-8BEN form is crucial for compliance with U.S. tax laws. By submitting this form, you affirm your status as a foreign individual or entity, which allows you to benefit from reduced withholding rates on U.S. income. This form must be kept up to date, as it is only valid for a specific period, typically three years. Failure to submit an accurate W-8BEN can result in higher withholding rates and potential penalties.

Eligibility Criteria for the W-8BEN Form

To be eligible to use the W-8BEN form, you must meet the following criteria:

- You are a non-U.S. person (individual or entity).

- You are not a resident alien for tax purposes in the United States.

- You are claiming a reduced rate of withholding under a tax treaty.

Understanding these criteria helps ensure that you are correctly utilizing the W-8BEN form for your investments with TD Ameritrade.

Required Documents for the W-8BEN Form

When completing the W-8BEN form, you may need to provide supporting documents to verify your identity and foreign status. These documents can include:

- Passport or government-issued identification.

- Proof of residency in your home country.

- Tax identification number from your country of residence.

Having these documents ready can facilitate the completion and submission process of the W-8BEN form.

Form Submission Methods for the W-8BEN Form

TD Ameritrade allows for several methods to submit the W-8BEN form:

- Online submission through your TD Ameritrade account.

- Mailing a physical copy to TD Ameritrade's designated address.

- In-person submission at a local TD Ameritrade branch.

Choosing the right submission method can help ensure that your form is processed efficiently and accurately.

Quick guide on how to complete w8ben td ameritrade

Finish W8ben Td Ameritrade effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without interruptions. Handle W8ben Td Ameritrade on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign W8ben Td Ameritrade without hassle

- Find W8ben Td Ameritrade and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign W8ben Td Ameritrade and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w8ben td ameritrade

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form W-8BEN for TD Ameritrade clients?

The IRS Form W-8BEN is a document used by non-US residents to signNow their foreign status and claim tax treaty benefits for income received from entities like TD Ameritrade. By completing this form, clients can avoid unnecessary tax withholdings on their investments. Ultimately, understanding the IRS Form W-8BEN is essential for maximizing your investment returns should you choose to trade with TD Ameritrade.

-

How do I fill out the IRS Form W-8BEN for TD Ameritrade?

Filling out the IRS Form W-8BEN for TD Ameritrade involves providing your personal details, identifying your country of citizenship, and claiming any applicable tax treaty benefits. Ensure all information is accurate and complete to avoid complications. You can find detailed guidance on the form's sections on the TD Ameritrade website.

-

What are the potential benefits of submitting the IRS Form W-8BEN to TD Ameritrade?

Submitting the IRS Form W-8BEN to TD Ameritrade can help you benefit from favorable tax treatment on US-source income, including dividends and interest. This form allows non-resident clients to claim reduced withholding rates based on tax treaties. Ultimately, it contributes to maximizing your overall investment yields.

-

Does airSlate SignNow assist in the eSigning of the IRS Form W-8BEN for TD Ameritrade?

Yes, airSlate SignNow provides an efficient platform for eSigning the IRS Form W-8BEN needed for TD Ameritrade. Our user-friendly interface allows you to fill out, sign, and send the document securely, ensuring compliance and simplicity in your transactions. This streamlines the process of managing necessary documents for your investments.

-

What features does airSlate SignNow offer for managing IRS Form W-8BEN submissions?

airSlate SignNow offers features like customizable templates, secure cloud storage, and automated workflows to streamline the process of submitting IRS Form W-8BEN to TD Ameritrade. Our platform enhances efficiency by allowing multiple users to collaborate and sign documents in real-time. This ensures that you can manage your documentation with ease.

-

Are there any costs associated with using airSlate SignNow for IRS Form W-8BEN?

AirSlate SignNow offers a range of pricing plans to accommodate various business needs, ensuring that you can find a budget-friendly option to eSign documents such as the IRS Form W-8BEN. Our solutions provide excellent value, considering the time and resources saved in document handling. Check our pricing page for detailed plans and their features.

-

Can I integrate airSlate SignNow with TD Ameritrade for form submissions?

Yes, airSlate SignNow can be integrated with TD Ameritrade to facilitate seamless submission of IRS Form W-8BEN and other documents. This integration ensures that you can manage your compliance documents efficiently and securely within the same platform. It's a key benefit for streamlining trading and investment processes.

Get more for W8ben Td Ameritrade

- Directed reading for content mastery overview solutions answer key form

- Vacation budget plan form

- New student housing application south carolina state university scsu form

- Toronto general hospital liver clinic form

- Revisions forms pdf utah state tax commission

- Direct deposit form 481309830

- Tier ii qualified facility spcc plan template form

- Standard vendor agreement template form

Find out other W8ben Td Ameritrade

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors