GENERAL STANDARDS Alberta Veterinary Medical Association 2014-2026

Understanding the General Standards for Veterinary Practice

The General Standards set forth by the Alberta Veterinary Medical Association provide essential guidelines for veterinary practices. These standards ensure that all veterinary professionals maintain a high level of care and comply with ethical practices. They cover various aspects, including animal welfare, client communication, and professional conduct. Adhering to these standards is crucial for maintaining trust and credibility within the veterinary community and with clients.

Steps to Implement the General Standards in Your Practice

To effectively implement the General Standards in your veterinary practice, consider the following steps:

- Review the standards thoroughly to understand all requirements.

- Conduct a self-assessment of your current practices against these standards.

- Identify areas for improvement and develop a plan to address them.

- Train your staff on the importance of these standards and how to adhere to them.

- Regularly evaluate your practice to ensure ongoing compliance.

Legal Implications of the General Standards

Compliance with the General Standards is not just a matter of professional ethics; it also has legal implications. Failing to adhere to these standards can result in disciplinary actions by the veterinary medical association, including fines, license suspension, or revocation. It is essential to understand the legal framework surrounding veterinary practices and ensure that your operations are fully compliant to avoid potential legal issues.

Examples of Compliance with the General Standards

Examples of how veterinary practices can comply with the General Standards include:

- Implementing a client feedback system to improve service quality.

- Ensuring all staff members are trained in animal handling and welfare.

- Maintaining accurate and up-to-date medical records for all patients.

- Establishing protocols for emergency care and client communication.

Required Documentation for Veterinary Practices

Veterinary practices must maintain specific documentation to demonstrate compliance with the General Standards. This includes:

- Patient medical records detailing treatments and outcomes.

- Staff training records to ensure all personnel are adequately prepared.

- Client consent forms for treatments and procedures.

- Incident reports for any adverse events that occur in the practice.

Eligibility Criteria for Veterinary Practices

To operate in compliance with the General Standards, veterinary practices must meet certain eligibility criteria, which typically include:

- Licensure by the appropriate veterinary medical board.

- Completion of required continuing education courses.

- Adherence to local and state regulations regarding animal care.

Application Process for Veterinary Practices

When applying to operate under the General Standards, veterinary practices must follow a structured application process. This generally involves:

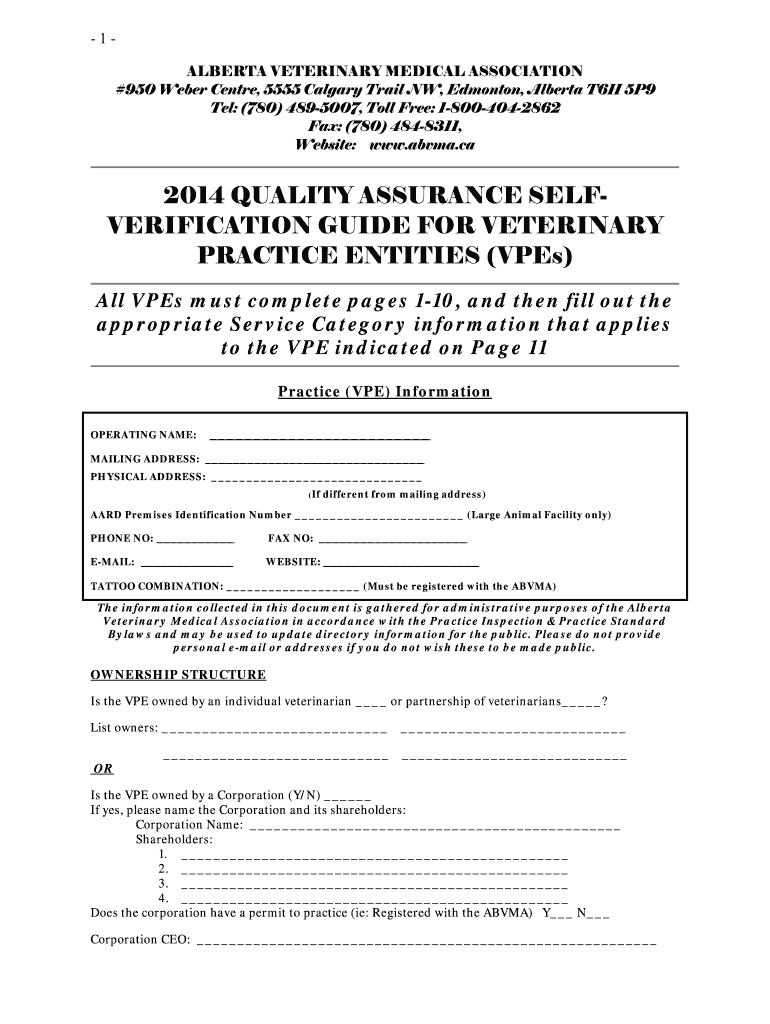

- Submitting an application form to the Alberta Veterinary Medical Association.

- Providing documentation of compliance with the General Standards.

- Undergoing an inspection or audit by the association.

- Receiving approval before commencing operations.

Quick guide on how to complete general standards alberta veterinary medical association

A brief guide on how to prepare your GENERAL STANDARDS Alberta Veterinary Medical Association

Finding the appropriate template can turn into a task when you are required to submit official international documents. Even if you possess the necessary form, it might be difficult to swiftly fill it out in accordance with all the stipulations if you are using hard copies rather than completing everything digitally. airSlate SignNow is the digital eSignature platform that assists you in overcoming those hurdles. It allows you to choose your GENERAL STANDARDS Alberta Veterinary Medical Association and swiftly complete and sign it on the spot without having to reprint documents if you make a mistake.

Follow these steps to prepare your GENERAL STANDARDS Alberta Veterinary Medical Association with airSlate SignNow:

- Press the Get Form button to upload your document to our editor without delay.

- Begin with the first empty box, enter your information, and proceed with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar at the top.

- Choose the Highlight or Line features to emphasize the most critical information.

- Click on Image and upload one if your GENERAL STANDARDS Alberta Veterinary Medical Association requires it.

- Make use of the right-side panel to add more sections for you or others to fill out if necessary.

- Review your responses and finalize the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by pressing the Done button and choosing your file-sharing preferences.

After your GENERAL STANDARDS Alberta Veterinary Medical Association is prepared, you can share it however you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely archive all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual document completion; explore airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the general standards alberta veterinary medical association

How to generate an eSignature for the General Standards Alberta Veterinary Medical Association in the online mode

How to create an eSignature for your General Standards Alberta Veterinary Medical Association in Chrome

How to generate an electronic signature for putting it on the General Standards Alberta Veterinary Medical Association in Gmail

How to make an electronic signature for the General Standards Alberta Veterinary Medical Association right from your mobile device

How to create an eSignature for the General Standards Alberta Veterinary Medical Association on iOS

How to make an eSignature for the General Standards Alberta Veterinary Medical Association on Android devices

People also ask

-

What is airSlate SignNow for veterinary practice vpes?

AirSlate SignNow is a comprehensive eSigning solution designed specifically for veterinary practice vpes. It enables veterinary professionals to easily send, sign, and manage important documents, streamlining workflows and improving efficiency. The platform is user-friendly, allowing practices to focus on their patients rather than paperwork.

-

How much does airSlate SignNow cost for veterinary practice vpes?

The pricing for airSlate SignNow varies based on the specific needs of your veterinary practice vpes. With flexible plans available, you can choose a subscription that fits your practice size and budget. Contact our sales team for a custom quote tailored to your veterinary practice vpes.

-

What features does airSlate SignNow offer for veterinary practice vpes?

AirSlate SignNow offers a variety of features beneficial for veterinary practice vpes, including customizable templates, secure document storage, and easy document sharing. Additionally, it offers audit trails and compliance features to ensure the integrity of your veterinary practice vpes documentation. All of these features help enhance the efficiency of your practice.

-

How can airSlate SignNow improve my veterinary practice vpes workflow?

AirSlate SignNow improves your veterinary practice vpes workflow by automating document management tasks. With its eSigning capabilities, you can reduce the time spent on paperwork, allowing you to dedicate more time to patient care. This streamlined process enhances your overall operational efficiency in veterinary practice vpes.

-

Is airSlate SignNow secure for veterinary practice vpes?

Yes, airSlate SignNow prioritizes security, making it a safe choice for your veterinary practice vpes. The platform employs advanced encryption and security protocols to protect sensitive information, ensuring compliance with legal standards. Your veterinary practice vpes data is secure while you streamline your documentation process.

-

Can airSlate SignNow integrate with other software for veterinary practice vpes?

Absolutely! AirSlate SignNow supports integrations with a range of software applications commonly used in veterinary practice vpes. This interoperability allows you to connect your eSigning solution seamlessly with your practice management system, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for veterinary practice vpes?

The primary benefits of using airSlate SignNow for veterinary practice vpes include increased efficiency, reduced administrative costs, and improved patient experience. By digitizing and automating your document processes, your practice can minimize errors and speed up transactions. This leads to better service delivery and overall satisfaction among your clients.

Get more for GENERAL STANDARDS Alberta Veterinary Medical Association

- Bad check notice form

- Correction statement and agreement virginia form

- Closing statement virginia form

- Flood zone statement and authorization virginia form

- Name affidavit of buyer virginia form

- Name affidavit of seller virginia form

- Non foreign affidavit under irc 1445 virginia form

- Owners or sellers affidavit of no liens virginia form

Find out other GENERAL STANDARDS Alberta Veterinary Medical Association

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later