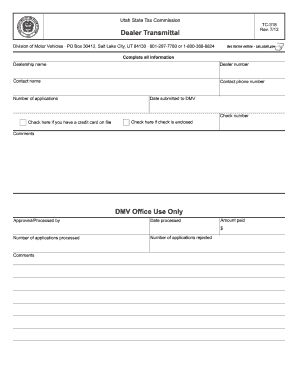

Tax Commission Form

What is the Tax Commission?

The Tax Commission plays a crucial role in managing tax-related matters for individuals and businesses. In the United States, it is responsible for overseeing tax collection, compliance, and enforcement of tax laws. This includes the administration of various tax forms, such as the tc 318, which is essential for reporting and remitting sales tax for dealers. The Tax Commission ensures that all tax regulations are followed, providing guidance and resources to help taxpayers fulfill their obligations.

Steps to Complete the Tax Commission Form tc 318

Filling out the tc 318 form requires careful attention to detail to ensure compliance with tax regulations. Here are the steps to follow:

- Gather necessary information, including your business details, sales records, and any applicable deductions.

- Access the tc 318 form, which can be completed digitally or printed for manual entry.

- Fill in the required fields, ensuring accuracy in reporting sales and tax collected.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the Tax Commission's platform or mail it to the appropriate address.

Legal Use of the Tax Commission Form

The tc 318 form is legally binding when completed correctly and submitted in accordance with state regulations. To ensure its legality, it must be signed by the authorized representative of the business. Additionally, compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act is essential when submitting forms electronically. This act ensures that electronic signatures are recognized as valid, provided that the signer demonstrates intent to sign.

Required Documents for the Tax Commission

When completing the tc 318 form, certain documents may be required to support your submission. These documents typically include:

- Sales records that detail all transactions made during the reporting period.

- Proof of tax collected from customers, which may include receipts or invoices.

- Any relevant deductions or exemptions that apply to your business.

Having these documents ready can streamline the process and help avoid delays in processing your form.

Form Submission Methods

The tc 318 form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission via the Tax Commission's secure portal, which allows for immediate processing.

- Mailing a printed version of the form to the designated address, which may take longer for processing.

- In-person submission at local Tax Commission offices, providing an opportunity for direct assistance if needed.

Penalties for Non-Compliance

Failure to submit the tc 318 form accurately and on time can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to stay informed about filing deadlines and ensure that all information is reported correctly to avoid these consequences. Regularly reviewing compliance guidelines can help mitigate risks associated with non-compliance.

Quick guide on how to complete tax commission

Effortlessly Complete Tax Commission on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Handle Tax Commission on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Tax Commission with Ease

- Obtain Tax Commission and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to preserve your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow manages all your needs in document handling with just a few clicks from your preferred device. Modify and electronically sign Tax Commission, ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 318 and how does it relate to airSlate SignNow?

The tc 318 is a crucial compliance requirement that many businesses need to adhere to when handling electronic signatures. airSlate SignNow meets these compliance standards by providing secure eSigning solutions that are fully compliant with tc 318 regulations.

-

How much does airSlate SignNow cost for users interested in tc 318 compliance?

Pricing for airSlate SignNow varies based on the features chosen, but it remains competitive for businesses focused on tc 318 compliance. Our plans are designed to provide cost-effective solutions without compromising on quality, making it accessible for companies of all sizes.

-

What features does airSlate SignNow offer for tc 318 compliance?

airSlate SignNow offers features such as secure document storage, detailed audit trails, and customizable workflows, all essential for tc 318 compliance. These features help ensure that your electronic signature processes are not only efficient but also legally compliant.

-

How can airSlate SignNow help businesses benefit from tc 318 compliance?

By utilizing airSlate SignNow for tc 318 compliance, businesses can streamline their eSigning processes, reduce paperwork, and improve overall efficiency. This also enhances trust with clients, ensuring they know their documents are signed and stored securely.

-

Can airSlate SignNow integrate with other tools while ensuring tc 318 compliance?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications, enabling a smooth workflow that adheres to tc 318 compliance. Integrations with platforms like CRM systems ensure that businesses can maintain compliance while enhancing productivity.

-

Is training available for using airSlate SignNow for tc 318 compliance?

Absolutely! airSlate SignNow offers comprehensive training resources and support for users focused on achieving tc 318 compliance. This will ensure that you and your team are equipped with the knowledge to effectively use the platform while maintaining compliance standards.

-

What types of documents can be signed using airSlate SignNow with tc 318 in mind?

airSlate SignNow supports the eSigning of various document types, including contracts, agreements, and forms, all compliant with tc 318 regulations. This versatility allows businesses to manage their document signing needs effectively while ensuring all processes are compliant.

Get more for Tax Commission

- Wit06 animal transport certificate ahvla defra gov form

- Wyd swimathon pledge form whatcom family ymca whatcomymca

- Please review this picture of the medicare card form

- Vetconnex form

- Yokohama rebate form

- Credit for tax paid to other statespdf form

- Use tax questions and answers form

- I just realised you can use the spacebar on your keyboard form

Find out other Tax Commission

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe