I Just Realised You Can Use the Spacebar on Your Keyboard 2023-2026

IRS Guidelines

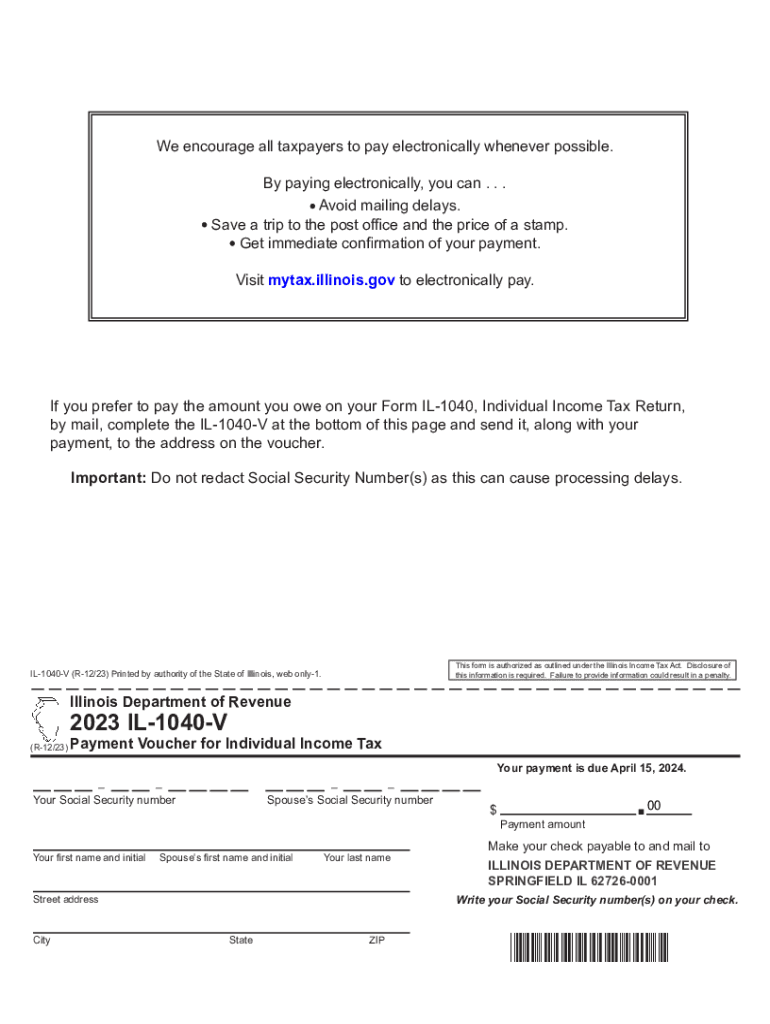

The 2 V payment voucher is an important document for taxpayers in the United States who need to submit a payment along with their tax return. This voucher is specifically designed for individuals who are filing their federal income tax returns using Form 1040. It serves as a method to ensure that payments are processed correctly and applied to the taxpayer's account. The IRS provides guidelines on how to fill out this form, including the necessary information that must be included, such as the taxpayer's name, address, and Social Security number.

Filing Deadlines / Important Dates

For the tax year 2020, the deadline for filing your federal income tax return and submitting the 2 V payment voucher was April 15, 2021. However, taxpayers could apply for an extension, which typically allows an additional six months to file the return. It is crucial to pay any taxes owed by the original deadline to avoid penalties and interest. Keeping track of these important dates helps ensure compliance with IRS regulations.

Required Documents

When completing the 2 V payment voucher, taxpayers should gather several key documents. These include the completed Form 1040, any W-2 forms from employers, 1099 forms for other income, and documentation for any deductions or credits being claimed. Having these documents on hand will facilitate accurate completion of the voucher and ensure that all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

The 2 V payment voucher can be submitted through various methods. Taxpayers have the option to file their tax returns electronically and make payments online through the IRS website. Alternatively, they can print the voucher and mail it along with their tax return to the appropriate IRS address. In-person submission is also possible at designated IRS offices, although this is less common. Choosing the right method depends on individual preferences and circumstances.

Penalties for Non-Compliance

Failing to submit the 2 V payment voucher or not paying the owed taxes by the deadline can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, interest accrues on any unpaid tax from the due date until the tax is paid in full. Understanding these penalties emphasizes the importance of timely and accurate submissions.

Taxpayer Scenarios (e.g., self-employed, retired, students)

The 2 V payment voucher is relevant for various taxpayer scenarios. Self-employed individuals must ensure they are making estimated tax payments and may use this voucher to submit payments. Retired individuals receiving pension income may also need to file and pay taxes, depending on their total income. Students who earn income while attending school are likewise required to file and may use the 1040 V voucher if they owe taxes. Each scenario has unique considerations that can affect the completion and submission of the voucher.

Quick guide on how to complete i just realised you can use the spacebar on your keyboard

Accomplish I Just Realised You Can Use The Spacebar On Your Keyboard effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage I Just Realised You Can Use The Spacebar On Your Keyboard on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign I Just Realised You Can Use The Spacebar On Your Keyboard with ease

- Find I Just Realised You Can Use The Spacebar On Your Keyboard and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, an invite link, or download it to your computer.

Say goodbye to missing or lost documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign I Just Realised You Can Use The Spacebar On Your Keyboard while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i just realised you can use the spacebar on your keyboard

Create this form in 5 minutes!

How to create an eSignature for the i just realised you can use the spacebar on your keyboard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 il 1040v and how does it relate to airSlate SignNow?

The 2022 il 1040v is a payment voucher used for individual income tax payments in Illinois. With airSlate SignNow, you can easily eSign and send your 2022 il 1040v and other tax documents securely, simplifying the filing process.

-

How can I use airSlate SignNow to manage my 2022 il 1040v?

You can utilize airSlate SignNow to upload, eSign, and share your 2022 il 1040v quickly and efficiently. The platform allows for seamless collaboration with accountants or tax professionals, ensuring your documents are accurate and filed on time.

-

What are the pricing options for using airSlate SignNow for my 2022 il 1040v?

airSlate SignNow offers various pricing plans that cater to different business needs, making it cost-effective for handling documents like the 2022 il 1040v. You can choose a plan that fits your budget and comes with essential features for document management.

-

Does airSlate SignNow provide templates for the 2022 il 1040v?

Yes, airSlate SignNow provides customizable templates that can help streamline the process of filling out the 2022 il 1040v. You can save time and ensure accuracy by using our templates specifically designed for tax-related documents.

-

What security features does airSlate SignNow offer for 2022 il 1040v documents?

airSlate SignNow includes robust security features such as encryption and secure storage to protect your 2022 il 1040v documents. These measures ensure that sensitive information remains confidential while being signed and shared electronically.

-

Can I integrate airSlate SignNow with other software for handling the 2022 il 1040v?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to connect your workflow for managing the 2022 il 1040v with tools you already use, like accounting or financial software. This flexibility enhances your document management process.

-

What are the benefits of using airSlate SignNow for the 2022 il 1040v?

Using airSlate SignNow for your 2022 il 1040v offers several benefits, including fast eSigning, reduced paperwork, and increased accuracy. The user-friendly interface makes it easy for anyone to manage their tax documents efficiently.

Get more for I Just Realised You Can Use The Spacebar On Your Keyboard

- Texas vs 2318 form

- Texas disposition form

- Texas central file maintenance form

- Vaccine management plan templates routine vaccine storage and handling planemergency vaccine storage and handling plan form

- Restorative nursing program template form

- Tattoo studio initialrenewal license or change of dshs texas form

- Medication aide renewal form

- Texas department of insurance form dwc 82

Find out other I Just Realised You Can Use The Spacebar On Your Keyboard

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile