Credit for Tax Paid to Other StatesPDF 2024-2026

Understanding the 2024 IL 1040 ES Form

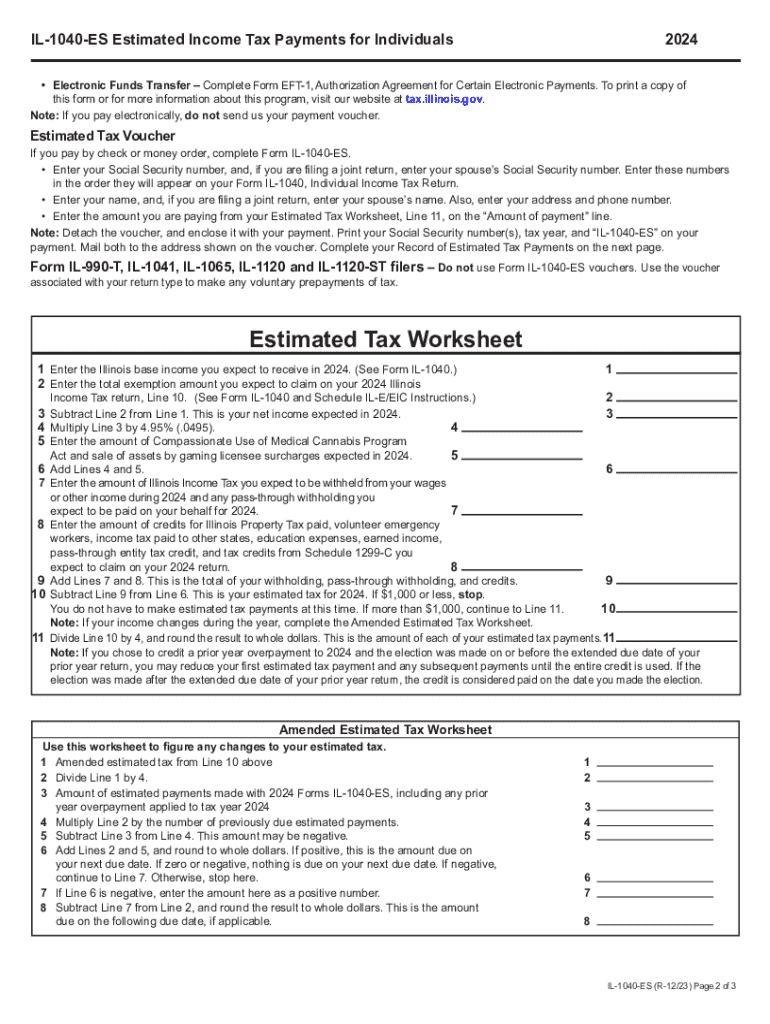

The IL 1040 ES form is essential for Illinois taxpayers who need to make estimated income tax payments. This form is specifically designed for individuals who expect to owe tax of $1,000 or more when they file their annual return. The 2024 version of this form allows taxpayers to calculate their estimated tax obligations based on their expected income, deductions, and credits for the year. By using this form, individuals can avoid underpayment penalties and ensure compliance with state tax regulations.

Steps to Complete the 2024 IL 1040 ES Form

Completing the IL 1040 ES form involves several key steps:

- Gather Financial Information: Collect your income records, including wages, self-employment income, and any other sources of income.

- Estimate Your Tax Liability: Use the tax tables or worksheets provided by the Illinois Department of Revenue to estimate your total tax liability for the year.

- Calculate Estimated Payments: Divide your estimated tax liability by four to determine your quarterly payment amounts.

- Complete the Form: Fill out the IL 1040 ES form with your calculated payment amounts and personal information.

- Submit the Form: Send the completed form and payment to the appropriate address as indicated in the form instructions.

Filing Deadlines for the IL 1040 ES Form

It is crucial to be aware of the filing deadlines for the IL 1040 ES form to avoid penalties. For the 2024 tax year, estimated payments are generally due on the following dates:

- April 15, 2024

- June 15, 2024

- September 15, 2024

- January 15, 2025

Taxpayers should ensure that payments are made by these dates to remain compliant with Illinois tax laws.

Required Documents for Filing the IL 1040 ES Form

To complete the IL 1040 ES form accurately, taxpayers should have the following documents ready:

- Previous year’s tax return for reference

- Income statements such as W-2s and 1099s

- Records of any deductions or credits you plan to claim

- Any other relevant financial documents

Having these documents on hand will facilitate a smoother filing process.

Penalties for Non-Compliance with Estimated Tax Payments

Failing to submit the IL 1040 ES form or making insufficient estimated tax payments can result in penalties. The Illinois Department of Revenue may impose a penalty if:

- You do not pay at least 90% of your current year’s tax liability.

- You do not pay at least 100% of your previous year’s tax liability (if it was greater than $1,000).

It is important to stay informed about these requirements to avoid unexpected costs.

Eligibility Criteria for Using the IL 1040 ES Form

To use the IL 1040 ES form, you must meet specific eligibility criteria, including:

- You are an individual taxpayer who expects to owe $1,000 or more in tax for the current year.

- You are not a corporation or partnership, as they have different filing requirements.

Understanding these criteria can help ensure that you are using the correct form for your tax situation.

Quick guide on how to complete credit for tax paid to other statespdf

Complete Credit For Tax Paid To Other StatesPDF effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly, without any hold-ups. Manage Credit For Tax Paid To Other StatesPDF on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Credit For Tax Paid To Other StatesPDF without any hassle

- Find Credit For Tax Paid To Other StatesPDF and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Credit For Tax Paid To Other StatesPDF and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for tax paid to other statespdf

Create this form in 5 minutes!

How to create an eSignature for the credit for tax paid to other statespdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 1040 es 2024 and how does it work?

Il 1040 es 2024 is a simplified tax form used for electronic filing of income tax returns. With airSlate SignNow, you can easily eSign and send il 1040 es 2024 forms digitally, ensuring a quick and hassle-free process. This solution streamlines the filing procedure, helping users save time and avoid errors.

-

How does airSlate SignNow ensure the security of my il 1040 es 2024 documents?

AirSlate SignNow employs robust security measures to protect your il 1040 es 2024 documents. With bank-level encryption and compliant security protocols, you can trust that your sensitive information is safe during transmission and storage. Our platform prioritizes user privacy and data integrity.

-

What features does airSlate SignNow offer for managing il 1040 es 2024 forms?

AirSlate SignNow offers a suite of features designed to facilitate the management of il 1040 es 2024 forms. You can automate workflows, set reminders for important deadlines, and easily track document statuses. These features enhance productivity and ensure that your tax filings are completed on time.

-

Is airSlate SignNow cost-effective for filing il 1040 es 2024?

Yes, airSlate SignNow offers cost-effective plans tailored to various business needs, making it affordable to file il 1040 es 2024. With our competitive pricing, you can enjoy powerful eSigning capabilities without breaking the bank. Explore our options to find the best fit for your budget.

-

Can I integrate airSlate SignNow with other tools for il 1040 es 2024 management?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of applications, enhancing your il 1040 es 2024 management experience. You can connect with popular productivity tools, cloud storage services, and more to streamline your document workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for il 1040 es 2024?

Using airSlate SignNow for il 1040 es 2024 offers numerous benefits, including increased efficiency, reduced paperwork, and simplified collaboration. Users can quickly eSign and share documents securely, ensuring that everyone involved has access to the necessary information during the filing process. It's designed for ease of use and effectiveness.

-

How can I get help with filling out il 1040 es 2024 on airSlate SignNow?

If you need assistance with filling out il 1040 es 2024 on airSlate SignNow, our support team is available to help. You can access tutorials, FAQs, and customer service contacts directly from our platform for prompt guidance. We are committed to ensuring that our users have the support they need to successfully navigate the process.

Get more for Credit For Tax Paid To Other StatesPDF

- P 3111 waukesha county waukeshacounty form

- Wisconsin marriage certificate application waukesha county waukeshacounty form

- Wv ss188a form

- Electronic funds transfer authorization form for

- Ate of alaska reease of information form

- Alaska department of health and social services clearance form 06 9437

- A a well child check up epsdt the purpose of epsdt services is medicaid alabama form

- What does a typical prior authorization form look like for prescription medicine 2008

Find out other Credit For Tax Paid To Other StatesPDF

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement