T1 Cra Form

What is the T1 CRA?

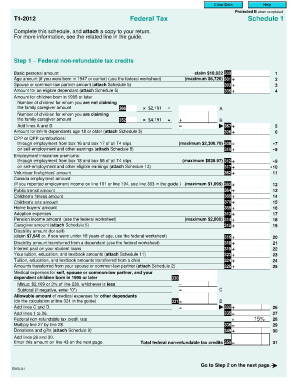

The T1 CRA, also known as the T1 General, is a tax form used by individuals in Canada to report their income, claim deductions, and calculate their tax obligations for the year. This form is essential for filing personal income taxes and is submitted to the Canada Revenue Agency (CRA). The T1 General includes various sections to capture different types of income, such as employment, self-employment, and investment income. Understanding this form is crucial for ensuring compliance with tax laws and maximizing potential refunds.

How to complete the T1 CRA

Completing the T1 CRA requires careful attention to detail. Start by gathering all necessary documents, including T4 slips from employers, receipts for deductions, and any other relevant financial statements. Follow these steps:

- Fill out personal information, including your name, address, and social insurance number.

- Report all sources of income in the appropriate sections, ensuring accuracy to avoid penalties.

- Claim eligible deductions, such as medical expenses and charitable contributions, to reduce taxable income.

- Calculate your total tax payable and any credits you may be eligible for.

- Review the completed form for errors before submission.

Key elements of the T1 CRA

The T1 CRA consists of several key elements that taxpayers must understand. These include:

- Income Reporting: Individuals must report all forms of income, including wages, self-employment earnings, and investment income.

- Deductions: Taxpayers can claim various deductions that reduce taxable income, such as RRSP contributions and childcare expenses.

- Tax Credits: Non-refundable and refundable tax credits can help lower the overall tax burden or provide refunds.

- Signature: The form must be signed and dated to validate the submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the T1 CRA is crucial for compliance. The typical deadline for individuals to file their T1 General is April 30 of the following tax year. If you or your spouse is self-employed, the deadline extends to June 15, but any taxes owed must still be paid by April 30 to avoid interest charges. Keeping track of these dates ensures timely submissions and helps avoid penalties.

Required Documents

When preparing to file the T1 CRA, gather the following required documents:

- T4 slips from employers detailing income and deductions.

- Receipts for any eligible deductions, such as medical expenses and tuition fees.

- Statements for investment income, including T5 slips.

- Any additional forms relevant to specific tax situations, such as T2202 for educational expenses.

Form Submission Methods

The T1 CRA can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online: Use certified tax software to file electronically, which is often faster and may provide instant confirmation.

- Mail: Print and send the completed form to the appropriate CRA address based on your province.

- In-Person: Some individuals may choose to file in person at designated CRA offices, although this option may be limited.

Quick guide on how to complete t1 cra

Complete T1 Cra effortlessly on any device

Online document management has become popular with businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage T1 Cra on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign T1 Cra with ease

- Obtain T1 Cra and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your files or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Design your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign T1 Cra and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1 cra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t1 general sample, and how can airSlate SignNow help?

A t1 general sample is a specific type of document often used in various business transactions. With airSlate SignNow, you can easily create, send, and eSign your t1 general sample without any hassle, ensuring a streamlined process for your team.

-

How much does airSlate SignNow cost for handling t1 general samples?

airSlate SignNow offers competitive pricing plans tailored for businesses that frequently handle documents like the t1 general sample. Our plans provide access to essential features at cost-effective rates, helping you save while maximizing efficiency.

-

What features does airSlate SignNow offer for managing t1 general samples?

airSlate SignNow provides a variety of features ideal for managing t1 general samples, including customizable templates, advanced editing tools, and real-time tracking. These capabilities simplify document management and enhance your workflow.

-

Can I integrate airSlate SignNow with other software for t1 general samples?

Yes, airSlate SignNow easily integrates with many popular software applications, allowing you to manage your t1 general samples alongside your existing tools. This integration ensures a seamless experience and improves overall productivity.

-

What are the benefits of using airSlate SignNow for t1 general samples?

Using airSlate SignNow for your t1 general samples provides numerous benefits, including quicker turnaround times, reduced errors, and enhanced security. Our platform ensures that your documents are always secure and accessible.

-

Is it easy to customize a t1 general sample using airSlate SignNow?

Absolutely! airSlate SignNow offers user-friendly customization options for your t1 general samples. You can easily edit, add fields, and personalize your documents to meet your specific needs without any technical expertise.

-

How secure is my data when using airSlate SignNow for t1 general samples?

Security is a priority at airSlate SignNow. When you use our platform for your t1 general samples, you can rest assured that your data is protected with advanced encryption and compliance with industry standards.

Get more for T1 Cra

- Download application form sanima bank

- Accident amp sickness application associated admin com form

- Deschutes county sheriffs office sheriff deschutes form

- Marriage worksheet town of boxford ma form

- Permiso de construccion regularizacion solicitud y memoria imcanelones gub form

- Begin date period form

- Voluntary inspection of rabbits and edible products thereof form

- It is the policy of wake forest university to ensure that relationships in the workplace do not raise concerns about form

Find out other T1 Cra

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy