Printable W 4p Form

What is the Printable W-4P Form

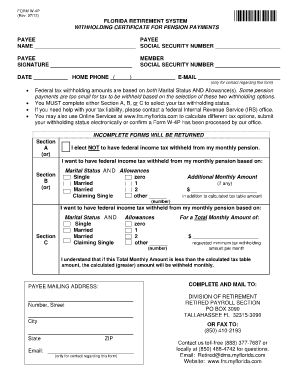

The Printable W-4P form is a tax form used in the United States for withholding purposes. Specifically, it is designed for pension or annuity payments. The W-4P allows recipients of these payments to instruct the payer on how much federal income tax to withhold from their distributions. This form is essential for ensuring that individuals do not face unexpected tax liabilities when they file their annual returns.

How to Use the Printable W-4P Form

Using the Printable W-4P form involves several steps. First, individuals must obtain the form, which can be downloaded from the IRS website or printed directly. Once the form is in hand, recipients should fill out their personal information, including their name, address, and Social Security number. Next, they will need to indicate their filing status and the amount of withholding they desire. Finally, signing and dating the form is crucial, as it validates the information provided.

Steps to Complete the Printable W-4P Form

Completing the Printable W-4P form requires careful attention to detail. Here are the steps to follow:

- Download or print the W-4P form from a reliable source.

- Fill in your personal information, including your name and Social Security number.

- Select your filing status (single, married, etc.) and indicate the amount you wish to have withheld.

- Review the form for accuracy to avoid any mistakes.

- Sign and date the form to confirm that the information is correct.

- Submit the completed form to the payer of your pension or annuity.

Legal Use of the Printable W-4P Form

The Printable W-4P form is legally binding when completed accurately and submitted to the appropriate payer. It complies with IRS regulations regarding tax withholding for pension and annuity payments. By using this form, individuals ensure that they are meeting their tax obligations and can prevent under-withholding, which may lead to penalties during tax season.

Key Elements of the Printable W-4P Form

Understanding the key elements of the Printable W-4P form is vital for effective completion. Important sections include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Withholding Amount: The amount of federal income tax to be withheld from payments.

- Signature and Date: Required to validate the form.

Who Issues the Form

The Printable W-4P form is issued by the Internal Revenue Service (IRS). It is essential for taxpayers receiving pension or annuity payments to use this form to communicate their withholding preferences to the payer. Payers, such as retirement plan administrators or insurance companies, rely on this form to ensure compliance with federal tax laws.

Quick guide on how to complete printable w 4p form

Effortlessly Prepare Printable W 4p Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it digitally. airSlate SignNow provides you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Handle Printable W 4p Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

Easily Modify and eSign Printable W 4p Form Without Any Hassle

- Locate Printable W 4p Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and then click the Done button to store your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Update and eSign Printable W 4p Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable w 4p form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4P form?

A W4P form is a type of tax form used by the IRS for employees to indicate their withholding preferences based on their expected annual tax obligation. It helps employers accurately withhold federal income tax from employees' paychecks. Understanding what a W4P form is can streamline the tax process and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with W4P forms?

airSlate SignNow provides a seamless platform for businesses to send and eSign W4P forms efficiently. With its user-friendly interface, employees can quickly complete and submit their W4P forms from any location. This digital solution accelerates the process and minimizes errors in tax form submissions.

-

What are the benefits of using airSlate SignNow for W4P forms?

Using airSlate SignNow for W4P forms offers several benefits, including reduced processing time and improved accuracy. The platform ensures that all forms are securely stored and easily accessible for future reference. Additionally, electronic signatures enhance the efficiency of obtaining necessary approvals while maintaining compliance.

-

Are there any costs associated with using airSlate SignNow for W4P forms?

airSlate SignNow offers a cost-effective solution for managing W4P forms, with various pricing plans to suit different business needs. Depending on the plan chosen, businesses can access a range of features, including unlimited eSigning and document storage. Evaluating the pricing options ensures you find the right fit for your organization.

-

Can I integrate airSlate SignNow with other applications for W4P forms?

Yes, airSlate SignNow allows integration with various applications to simplify the handling of W4P forms. This compatibility helps streamline workflows by connecting with tools like CRMs and HR software. These integrations enhance productivity and ensure a smooth exchange of documentation between systems.

-

Is airSlate SignNow secure for managing W4P forms?

Absolutely! airSlate SignNow prioritizes security, employing encryption and authentication measures to protect sensitive information on W4P forms. The digital solution complies with industry standards, ensuring that your employees' data remains safe throughout the signing and storage processes.

-

How quickly can I implement airSlate SignNow for W4P forms?

Implementing airSlate SignNow for W4P forms is quick and straightforward, typically requiring just a few minutes to get started. Users can easily set up their accounts and begin sending documents for eSignature immediately. This fast onboarding allows businesses to enhance their document management processes without delays.

Get more for Printable W 4p Form

- Standard form to confirm account balance osa sc

- Teachers loan society keywords form

- T s u bbq cook off rules texas southern university tsu form

- College knowledge assessment pre survey form

- F 1 and j 1 student transfer form isso columbia university

- Driving test evaluation form sdstate

- Respiratory protection program office of the vice president for research uthscsa form

- 8 transcript request northwest florida state college form

Find out other Printable W 4p Form

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT