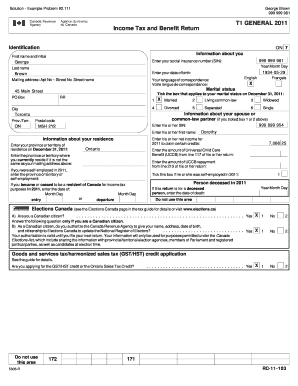

T1 General Sample Form

What is the T1 General Sample

The T1 General Sample is a standardized form used by individuals in the United States to report their income and calculate their taxes. This form is essential for taxpayers, as it consolidates various income sources, deductions, and credits into one document, streamlining the filing process. The T1 General is typically utilized by self-employed individuals, employees, and those with various income streams, making it a versatile tool for tax reporting.

How to Use the T1 General Sample

To effectively use the T1 General Sample, begin by gathering all necessary documentation, including W-2s, 1099s, and records of any other income. Next, carefully fill out the form, ensuring that all income sources are accurately reported. It is important to include any eligible deductions and credits to minimize tax liability. After completing the form, review it for accuracy before submission. Utilizing electronic tools, such as signNow, can facilitate the signing and submission process, ensuring compliance with eSignature laws.

Steps to Complete the T1 General Sample

Completing the T1 General Sample involves several key steps:

- Collect all relevant income documents, such as W-2 and 1099 forms.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Apply any deductions and credits you qualify for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the T1 General Sample

The T1 General Sample is legally recognized as a valid document for tax reporting, provided it is completed accurately and in accordance with IRS guidelines. It is crucial to adhere to all relevant tax laws to ensure the legality of the submission. Utilizing an electronic signature platform, such as signNow, can enhance the legal validity of your submission by providing an audit trail and ensuring compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the T1 General Sample typically align with the annual tax season in the United States. Generally, individual taxpayers must submit their forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to stay informed about any changes to deadlines and to plan accordingly to avoid penalties.

Required Documents

To complete the T1 General Sample, several documents are required:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts for business expenses or medical expenses.

- Proof of any tax credits claimed.

Who Issues the Form

The T1 General Sample is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to file their taxes accurately and on time.

Quick guide on how to complete t1 general sample

Complete T1 General Sample seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage T1 General Sample on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign T1 General Sample effortlessly

- Locate T1 General Sample and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document administration needs in just a few clicks from any device of your choosing. Modify and eSign T1 General Sample and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1 general sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t1 general sample and how is it used?

The t1 general sample is a standard tax document used in Canada for filing individual income taxes. It provides detailed information on your taxable income, deductions, and credits. By utilizing airSlate SignNow, you can easily create, send, and eSign your t1 general sample securely, ensuring compliance with tax regulations.

-

How does airSlate SignNow make handling t1 general samples easier?

airSlate SignNow streamlines the process of managing t1 general samples by offering features like intuitive document editing, electronic signatures, and secure storage. You can quickly generate and customize your t1 general sample, making it more efficient to collect necessary signatures and submit your tax documents. This solution minimizes errors and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for t1 general samples?

Yes, airSlate SignNow offers a variety of pricing plans suitable for different business needs. Whether you require basic features for individual use or advanced functionalities for a team, there's an option designed to help you efficiently manage your t1 general samples without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing t1 general samples?

Absolutely! airSlate SignNow integrates with various third-party applications, including cloud storage services, CRMs, and accounting software. This capability allows you to streamline the process of sending and eSigning your t1 general sample alongside other essential business functions, helping you maintain productivity.

-

What are the benefits of using airSlate SignNow for t1 general samples?

Using airSlate SignNow for your t1 general sample offers multiple benefits, including enhanced security, ease of use, and increased efficiency. With our platform, you can securely send, track, and store your tax documents, ensuring that all your information is protected. Additionally, the digital nature of the service speeds up the entire process of document management.

-

Is it safe to eSign my t1 general sample using airSlate SignNow?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive data. When you eSign your t1 general sample through our platform, you can trust that your personal information and signed documents are kept confidential and secure.

-

Can I store my t1 general samples in airSlate SignNow?

Yes, airSlate SignNow allows you to store your t1 general samples securely within the platform. With our cloud storage feature, you can easily access, manage, and retrieve your important tax documents whenever needed, ensuring that you never lose track of your essential paperwork.

Get more for T1 General Sample

Find out other T1 General Sample

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe