Dr 0252 Form

What is the DR 0252?

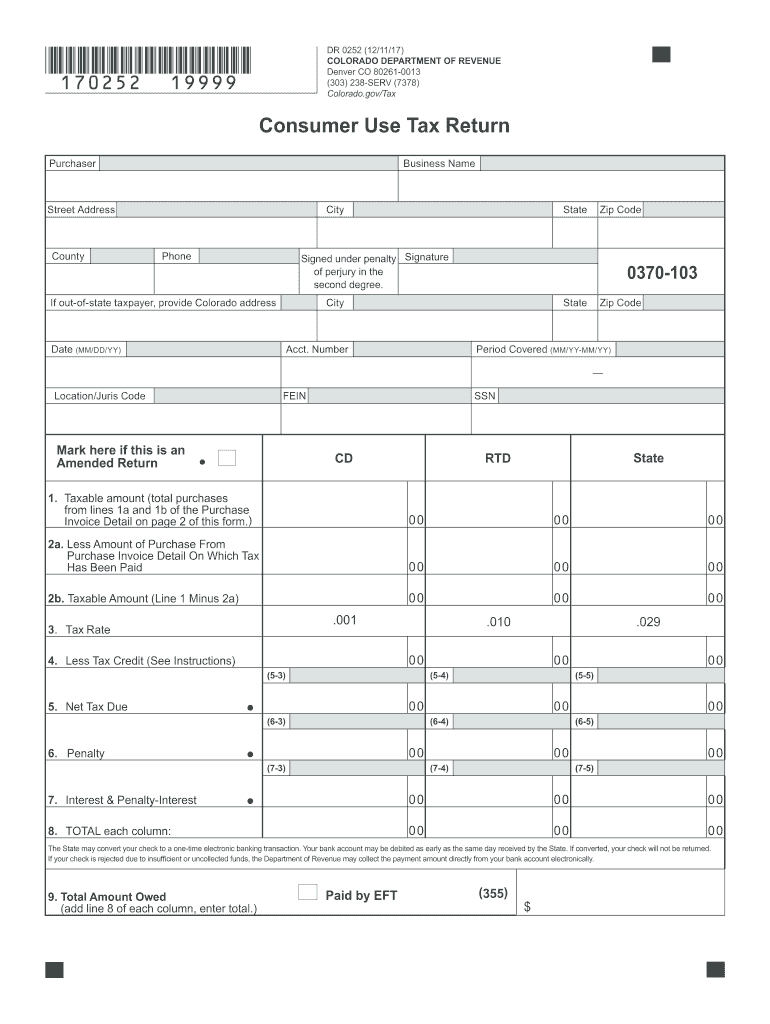

The DR 0252 is a form used in Colorado for specific tax-related purposes, particularly concerning the reporting of certain transactions. This form is essential for individuals and businesses who need to comply with state tax regulations. It serves as a declaration of specific information that may affect tax liabilities or obligations. Understanding the purpose and requirements of the DR 0252 is crucial for accurate and timely tax reporting.

How to Use the DR 0252

Using the DR 0252 involves several key steps to ensure proper completion and submission. First, gather all necessary information related to the transactions you are reporting. This includes details about the parties involved, the nature of the transaction, and any relevant financial data. Next, fill out the form accurately, ensuring that all fields are completed as required. Finally, submit the form through the appropriate channels, whether online or via mail, depending on the specific instructions provided by the Colorado Department of Revenue.

Steps to Complete the DR 0252

Completing the DR 0252 requires careful attention to detail. Follow these steps:

- Gather necessary documentation related to the transaction.

- Fill in the form with accurate information, ensuring clarity and correctness.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form according to the guidelines provided by the state.

Legal Use of the DR 0252

The DR 0252 is legally binding when completed and submitted according to state regulations. It is important to adhere to the guidelines set forth by the Colorado Department of Revenue to ensure that the form is accepted and processed without issues. Failure to comply with the legal requirements can result in penalties or delays in processing.

Key Elements of the DR 0252

Understanding the key elements of the DR 0252 is essential for proper completion. The form typically includes:

- Identification of the parties involved in the transaction.

- Details regarding the nature and date of the transaction.

- Financial information pertinent to the transaction.

- Signature lines for verification and compliance.

Who Issues the Form

The DR 0252 is issued by the Colorado Department of Revenue. This department is responsible for overseeing tax compliance and ensuring that all forms are correctly utilized by taxpayers within the state. For any inquiries regarding the form, individuals can contact the department directly for assistance.

Quick guide on how to complete dr 0252 coloradogov colorado

Complete Dr 0252 effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Handle Dr 0252 on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The simplest way to alter and eSign Dr 0252 without hassle

- Obtain Dr 0252 and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize crucial areas of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you choose. Alter and eSign Dr 0252 and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you find out where to vote in Colorado?

Colorado has a system where you can request and receive a mail ballot, and you don’t have to actually go vote in person. Lots of people find it convenient. One warning: it takes 2 First Class Stamps to mail it back. Cheaper and easier than gas and parking and lines and such.Go here to learn about mail-in ballots: Mail-in Ballots FAQsIf you want to vote in person, you can go here and learn more, including about requirements for identification:Election Day FAQsAnd here is where you can both check on your registration and find your polling place:Colorado Secretary of State -Good luck!

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

How was Sol Pais able to purchase a shotgun in Colorado if she had an out of state ID?

“How was Sol Pais able to purchase a shotgun in Colorado if she had an out of state ID?”Who? Sol Pais? Rapper? Hippie? That’s a Democratic name if I ever heard it.OH, the fruit loop who wanted to honor Columbine with another shooting. Well, ten to one, she’s one of the love struck nutjobs who wrote to the mother of one of the shooters, professing her love to him.Well, until her stunt, it was perfectly legal to purchase a rifle or shotgun out of state, IF you passed a background check. And, as you can see, she had no criminal record. Now, maybe if her letters had been reported to the police and the police had checked into each and every one of them, she might have been caught before the threat was made? Then, with a meeting, her mental illness might have been caught and she wouldn’t have been able to purchase anything. And, this would make a nice case for the DNC increasing surveillance on EVERYONE in the US, by increasing the NSA’s power. Opening every letter mailed, to read and censor it, reading every email, watching every download, all to make America more secure.You see, background checks only work if you have a criminal record. Or, in some cases, if you’re declared dangerous, which is much, much easier in our corrupted system. One lie, a moron for a pretend judge, and a person’s life is ruined. But, with the right connections, you can be insane and still purchase firearms.Now, handguns are a different story, thanks to the paranoia of concealed weapons, the DNCs first attack, before “assault rifles.” And, my guess is, the hype over “assault rifles” is why she picked a shotgun, since the DNC hasn’t targeted them, yet. She couldn’t get a handgun, being under 21 and out of state. But, a shotgun, something that even the most controlling of governments don’t worry too much about, is something else. Especially with the recoil issues, that make them “unfit for women to use.”Of course, given the hype over this anniversary of the shooting anyway, it could be expected. That’s all that has been on my news page, how sad and upsetting it was. This only helps give ideas to such mentally ill people. If they want 15 minutes of fame, how about 20 years of fame?

-

How long does it take to find out whether you got accepted as a transfer student to Colorado State University?

It really depends on many factors like the college/department, which month and etc. you are applying.If you are applying to a graduate program, it varies a lot from department to department. Since the decision is taken by graduate committee formed with teaching staff in the department, it takes time for them to meet and decide.If you are applying for undergrad program, one can generally expect a decision within ten business days. This also might vary due to the loads of applications and such.

-

How is Colorado school District 27J's decision to go to 4 days actually going to work out for the students?

I am not sure. My gut feeling as a former teacher is that they will adapt. I don't know the particulars of this plan. So I would ask about how long the school days will be? How does this affect extracurricular activities - sports, drama, music programs, clubs - ?How long will the school year be? I ask this because the Colorado Department of Education defines school years not on days, but on number of ' contact hours' with students. Elementary has so many hours required; middle School so many hours; and high schools so many hours per year. And if I remember correctly, you can't count things like lunch periods or passing times between classes. And most districts try to put in extra hours to plan for emergency closures, around here that usually means snow days! So if you are trying to get all your hours in a four day week, what does that do to the length of the year? I once worked a non-teaching job on a four/ten schedule. It was great having three day weekends every week. But for teaching, it looks good on paper - but…..?

-

I'm a lease-holder subletting to some people in Colorado and it is not working out - how do I go about getting them out?

Inform them that you will not be renewing at the end of their lease. If thy aren't damaging the property or the source of frequent police calls, you should probably just be patient.this is not a substitute for legal advice. As a landlord, you should have a lawyer who can answer these questions for you.

-

Aurora, Colorado Shooting (July 2012): How does it feel to be a neuroscientist and then find out that James Holmes was studying neuroscience?

It feels the same as it feels for everybody else who woke up and heard about this horrible news. You feel sad and outraged that something like this could happen but I certainly don't feel any sort of extra connection to him because he dropped out of a neuroscience PhD.I doubt very much that his motivations had anything to do with neuroscience. Perhaps the only way it could have contributed was the fact that he had to drop out which could have been part of the trigger for his actions. Most likely we will never know why he did what he did though.As for how it will affect the field of neuroscience, it won't.Here is a list of serial killers and their occupations:Ted Bundy- Law student, suicide hotline volunteer, legal aid, political campaignerJohn Wayne Gasey- Building contractorJeffrey Dahmer- Chocolate factory workerGary Ridgeway (Green River Killer)- Industrial truck painterDennis Rader (BTK)- City employee (maintenance, dog catching, etc.) and church presidentRichard Ramirez (Night Stalker)- Professional burglarDavid Berkowitz (Son of Sam)- Postal workerPeter Sutcliffe (Yorkshire Ripper)- Truck driverAileen Wuornoss- ProstituteCary Stayner (Yosemite Park Killer)- Hotel handyman [1]None of these professions have been negatively affected by the horrible act of individuals that happened to work in these fields.As a side note the negative attribution to the postal workers "going postal" was not caused by David Berkowitz. It was a result of repeated violent outburst by postal workers over a number of years.The expression derives from a series of incidents from 1983 onward in which United States Postal Service (USPS) workers shot and killed managers, fellow workers, and members of the police or general public in acts of mass murder. Between 1986 and 1997, more than forty people were gunned down by spree killers in at least twenty incidents of workplace rage. [2][1] http://forum.casebook.org/archiv...[2] http://en.wikipedia.org/wiki/Goi...

Create this form in 5 minutes!

How to create an eSignature for the dr 0252 coloradogov colorado

How to generate an eSignature for the Dr 0252 Coloradogov Colorado in the online mode

How to create an eSignature for your Dr 0252 Coloradogov Colorado in Chrome

How to create an eSignature for putting it on the Dr 0252 Coloradogov Colorado in Gmail

How to create an eSignature for the Dr 0252 Coloradogov Colorado right from your mobile device

How to create an eSignature for the Dr 0252 Coloradogov Colorado on iOS devices

How to generate an electronic signature for the Dr 0252 Coloradogov Colorado on Android OS

People also ask

-

What is dr 0252 and how does it relate to airSlate SignNow?

dr 0252 is a critical feature within the airSlate SignNow platform that enhances document management and eSigning processes. This feature allows users to streamline their workflow by integrating advanced functionalities that improve efficiency and compliance.

-

How much does airSlate SignNow cost with dr 0252 features?

Pricing for airSlate SignNow with dr 0252 features varies based on your specific business needs and volume of usage. We offer various plans, ensuring that all features related to dr 0252 are priced competitively, providing excellent value for businesses of any size.

-

What are the key features of airSlate SignNow associated with dr 0252?

The dr 0252 feature set includes functionalities such as customizable templates, real-time tracking, and comprehensive analytics. These features are designed to enhance the overall signing experience and ensure that documents are managed efficiently throughout their lifecycle.

-

What benefits does using airSlate SignNow with dr 0252 offer?

By utilizing dr 0252 within airSlate SignNow, businesses can signNowly reduce turnaround times for document processing and improve their operational efficiency. The ease of use and powerful integrations also ensure that teams can focus more on their core tasks rather than being bogged down by paperwork.

-

Can I integrate dr 0252 with other applications?

Yes, airSlate SignNow offers seamless integrations with numerous applications, allowing you to easily connect dr 0252 functionalities with your existing tools. This extends the power of dr 0252 and enhances your document workflow, creating a unified solution for your business.

-

Is training available for using dr 0252 in airSlate SignNow?

Absolutely! We provide comprehensive training resources for users to get the most out of dr 0252 in airSlate SignNow. Our support team is also available to assist with specific queries, ensuring you can efficiently leverage the capabilities of dr 0252.

-

How secure is the document process with dr 0252 in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the dr 0252 feature includes advanced security protocols like encryption and access controls. This ensures that your documents are protected and compliant with industry standards, providing peace of mind for your business.

Get more for Dr 0252

- 13 plan fillable form

- Chapter 13 plan washington form

- Chapter 13 plan fillable form

- Reaffirmation agreement washington form

- Reaffirmation agreement washington 497429896 form

- Verification of creditors matrix washington form

- Verification of creditors matrix washington 497429898 form

- Correction statement and agreement washington form

Find out other Dr 0252

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors