Il 1040 Form

What is the IL 1040?

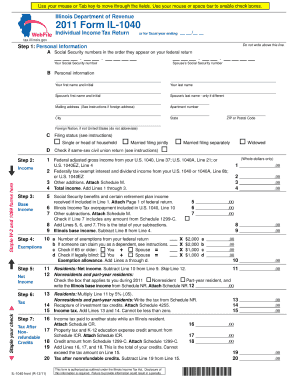

The IL 1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state tax liability. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws. The form collects various types of income information, deductions, and credits that may apply to the taxpayer's situation. Understanding the IL 1040 is crucial for anyone looking to fulfill their tax obligations in Illinois.

How to use the IL 1040

Using the IL 1040 involves several steps to ensure that the form is completed accurately. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals should follow the instructions on the form, filling in personal information, income details, and any applicable deductions or credits. It is important to double-check all entries for accuracy before submission. Finally, taxpayers can file the IL 1040 electronically or by mail, depending on their preference.

Steps to complete the IL 1040

Completing the IL 1040 involves a systematic approach:

- Gather all necessary documentation, including income statements and deduction records.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as property tax or education credits.

- Calculate your total tax liability and any refund or amount due.

- Review the form for accuracy and completeness.

- Submit the form either electronically or via mail.

Legal use of the IL 1040

The IL 1040 must be completed and filed in accordance with Illinois state tax laws to be considered legally valid. This includes ensuring that all information is accurate and that any required signatures are included. Failure to comply with these regulations can result in penalties or legal consequences. Utilizing a reliable eSignature solution can help ensure that the form is signed appropriately and in compliance with legal standards.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines related to the IL 1040. Typically, the filing deadline for individual income tax returns in Illinois aligns with the federal tax deadline, usually falling on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, as late submissions can incur penalties and interest on owed taxes.

Required Documents

To complete the IL 1040 accurately, taxpayers need to gather several important documents:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance or contract income.

- Records of any additional income, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or property tax receipts.

- Any relevant tax credit documentation.

Quick guide on how to complete il 1040 100007671

Effortlessly prepare Il 1040 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Il 1040 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Il 1040 without hassle

- Locate Il 1040 and click on Get Form to begin.

- Use the tools we offer to submit your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specially provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Il 1040 and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1040 100007671

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the il 1040 form?

The il 1040 form is a key document used for filing individual income tax returns in Illinois. It's important for taxpayers to accurately complete this form to report their income, calculate taxes owed, and claim any applicable deductions or credits. Understanding how to fill out the il 1040 can help ensure compliance and optimize tax liabilities.

-

How can airSlate SignNow assist with signing the il 1040?

airSlate SignNow provides a seamless way to eSign the il 1040 form electronically, giving you the ability to sign documents securely from anywhere. With its user-friendly interface, you can quickly add signatures, initials, and even store your completed forms efficiently. This saves time and simplifies the filing process.

-

What features does airSlate SignNow offer for handling the il 1040?

airSlate SignNow offers several features that facilitate the management of the il 1040, including document templates, automated workflows, and real-time tracking. These features help streamline the signing process and reduce the risk of errors. Additionally, you can easily collaborate with others who need to sign the form.

-

Is airSlate SignNow cost-effective for small businesses filing the il 1040?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to file the il 1040. With affordable subscription plans, it allows organizations to manage documents without the overhead costs associated with traditional methods. This makes it a practical choice for businesses looking to save on administrative expenses.

-

Can I integrate airSlate SignNow with other software for filing the il 1040?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including accounting and tax software, making it easy to manage the il 1040 alongside other financial documents. This integration helps streamline workflows and ensures that all your data is synchronized and accessible when needed.

-

How does airSlate SignNow ensure the security of my il 1040 documents?

airSlate SignNow takes security seriously by utilizing advanced encryption and compliance measures to protect your il 1040 documents. All signed documents are stored securely, ensuring that sensitive information remains confidential. You can trust that your data is safe while using our platform.

-

Are there any customer support options if I have questions about the il 1040?

Yes, airSlate SignNow offers multiple customer support options, including live chat, email support, and a comprehensive knowledge base. If you have any questions about the il 1040 form or our eSigning process, our support team is ready to assist you promptly. This ensures you can navigate any challenges you face.

Get more for Il 1040

Find out other Il 1040

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement