Formulario Cpt 2018

What is the Formulario CPT?

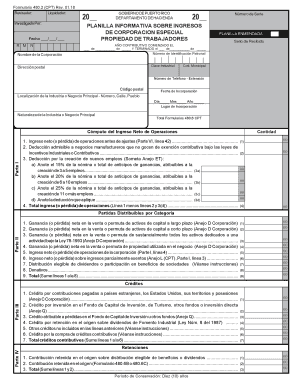

The Formulario CPT, also known as planilla 480 2, is a crucial document used in the United States, primarily for tax reporting purposes. It is designed for individuals and businesses to report specific income types, deductions, and credits. Understanding the purpose of this form is essential for compliance with tax regulations and for ensuring accurate financial reporting. The Formulario CPT helps to streamline the tax filing process by providing a standardized format for reporting various types of income, making it easier for both taxpayers and the IRS to process information efficiently.

Steps to Complete the Formulario CPT

Completing the Formulario CPT involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant financial records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to calculations and totals, as errors can lead to complications or delays in processing. After completing the form, review it thoroughly for any mistakes before submitting it. Finally, choose your preferred submission method, whether online, by mail, or in person, to finalize the process.

Legal Use of the Formulario CPT

The legal use of the Formulario CPT is governed by various tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. Compliance with IRS guidelines is essential to avoid penalties or legal issues. Additionally, eSignatures can be used to enhance the legal standing of the form when submitting electronically. Utilizing a reliable eSignature solution ensures that the document meets all legal requirements, providing peace of mind during the filing process.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for timely submission of the Formulario CPT. Typically, the IRS sets specific dates each year for tax filings, which can vary based on individual circumstances. It is essential to mark these dates on your calendar to avoid late submissions, which could result in penalties or interest charges. Additionally, understanding any extensions available for filing can provide extra time if needed, but it is important to adhere to the revised deadlines to maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Formulario CPT, each offering different benefits. Submitting online is often the fastest and most efficient option, allowing for immediate processing and confirmation. Alternatively, mailing the form provides a traditional approach, but it may take longer for processing. For those who prefer a personal touch, in-person submissions are also an option at designated IRS offices. Each method has its own requirements and timelines, so it is important to choose the one that best fits your needs.

Required Documents

When completing the Formulario CPT, certain documents are required to ensure accurate reporting. These typically include income statements, such as W-2s or 1099s, as well as any supporting documentation for deductions or credits claimed. Keeping these documents organized and readily accessible can streamline the completion process and help avoid potential errors. It is advisable to review the IRS guidelines to confirm all necessary documents are gathered before starting the form.

Quick guide on how to complete formulario cpt

Prepare Formulario Cpt effortlessly on every device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed forms, allowing you to access the necessary document and securely store it online. airSlate SignNow provides all the tools you need to create, adjust, and electronically sign your documents quickly without delays. Manage Formulario Cpt on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to adjust and electronically sign Formulario Cpt with ease

- Find Formulario Cpt and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to share your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Formulario Cpt and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formulario cpt

Create this form in 5 minutes!

How to create an eSignature for the formulario cpt

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is planilla 480 2?

Planilla 480 2 is a form used for tax reporting in Puerto Rico, specifically for the declaration of certain income. It’s essential for businesses and individuals to accurately report their earnings to ensure compliance with local tax laws. Understanding how to use this form can help streamline your tax filing process.

-

How can airSlate SignNow help with planilla 480 2?

AirSlate SignNow offers a convenient platform that allows users to easily fill out and eSign the planilla 480 2 electronically. With its user-friendly interface, you can manage and store your documents securely, ensuring that your submissions are both accurate and compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for planilla 480 2?

AirSlate SignNow provides various pricing plans tailored to different business needs, ensuring cost-effectiveness. Whether you’re a small business or a larger organization, you can find a plan that fits your budget while offering the necessary features to manage documents like planilla 480 2 efficiently.

-

What features does airSlate SignNow offer for managing planilla 480 2?

AirSlate SignNow offers features like templates, eSigning, and real-time tracking specifically for documents like planilla 480 2. With these tools, you can streamline the signing process, reduce manual errors, and enhance overall efficiency in handling your tax forms.

-

Are there any integrations available for planilla 480 2 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing users to enhance their workflow for managing planilla 480 2. These integrations include popular tools for accounting, CRM, and document management, further simplifying your tax preparation and submission processes.

-

What are the benefits of using airSlate SignNow for planilla 480 2?

Using airSlate SignNow for planilla 480 2 offers numerous benefits, including time savings, enhanced security, and ease of use. The electronic signature process helps eliminate the hassle of paper documents and improves collaboration among team members, making tax season less stressful.

-

How secure is airSlate SignNow when handling planilla 480 2?

AirSlate SignNow prioritizes security and employs robust encryption measures to protect sensitive documents, including planilla 480 2. You can have peace of mind knowing that your information is stored securely and that your documents are handled in compliance with industry standards.

Get more for Formulario Cpt

- Healthplex dental claim form

- B1 form download

- Ps form 1723

- Activity prescription form 100121513

- Letter of engagement form

- Claim for dependent relative tax credit form dr1 revenue

- Prohibited waste removal record form eqp state of michigan michigan

- Authorization request for inpatient psychiatric or form

Find out other Formulario Cpt

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF