Ri 1040x Tax 2016-2026

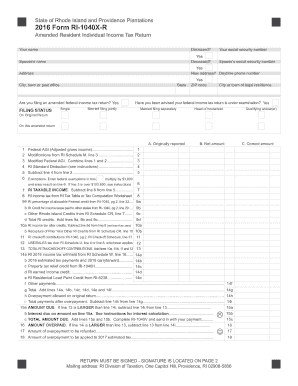

What is the RI 1040X Tax?

The RI 1040X tax form, officially known as the Rhode Island Amended Tax Return, is used by taxpayers in Rhode Island to correct errors on their previously filed state income tax returns. This form allows individuals to amend their original RI 1040 tax return, ensuring that any discrepancies, such as changes in income, deductions, or credits, can be accurately reported. The RI 1040X is essential for maintaining compliance with state tax laws and ensuring that taxpayers fulfill their obligations correctly.

Steps to Complete the RI 1040X Tax

Completing the RI 1040X tax form involves several key steps:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making.

- Clearly indicate the changes you are making on the form. This includes providing the corrected amounts and explaining the reasons for the amendments.

- Ensure that all calculations are accurate to avoid further complications with your tax status.

- Sign and date the form to validate your submission.

- Submit the completed form either online or by mail to the Rhode Island Division of Taxation.

Legal Use of the RI 1040X Tax

The RI 1040X tax form is legally recognized as a valid method for amending a state tax return. To ensure its legal standing, it must be filled out accurately and submitted within the designated time frame. The form must include a signature, which can be done electronically if submitted online. Compliance with Rhode Island tax laws is crucial, and using the RI 1040X correctly helps avoid potential penalties or legal issues.

Filing Deadlines / Important Dates

Timely filing of the RI 1040X is critical. Generally, the amended return must be filed within three years of the original return's due date, including any extensions. It's important to check specific deadlines for the tax year you are amending, as these dates may vary. Being aware of these deadlines helps ensure that your amendments are processed without delays or penalties.

Form Submission Methods

The RI 1040X can be submitted through various methods, providing flexibility for taxpayers:

- Online submission via the Rhode Island Division of Taxation's website, which allows for a quicker processing time.

- Mailing a paper form to the appropriate tax office, ensuring that you send it to the correct address to avoid processing delays.

- In-person submission at designated tax offices, which may be beneficial for those who prefer face-to-face assistance.

Required Documents

When filing the RI 1040X, certain documents are necessary to support your amendments:

- Your original RI 1040 tax return.

- Any relevant documentation that justifies the changes, such as W-2 forms, 1099s, or other income statements.

- Supporting documents for any new deductions or credits you are claiming.

Examples of Using the RI 1040X Tax

Common scenarios for using the RI 1040X include:

- Correcting income amounts due to overlooked W-2 or 1099 forms.

- Adjusting deductions or credits based on newly acquired information or tax law changes.

- Addressing mistakes in filing status that may affect tax liability.

Quick guide on how to complete ri 1040x tax

Prepare Ri 1040x Tax effortlessly on any device

Online document management has gained traction among both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Handle Ri 1040x Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Ri 1040x Tax with ease

- Locate Ri 1040x Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Ri 1040x Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1040x tax

Create this form in 5 minutes!

How to create an eSignature for the ri 1040x tax

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a Rhode Island amended tax return?

A Rhode Island amended tax return is a form submitted to correct errors on a previously filed state tax return. It allows taxpayers to adjust their reported income, deductions, credits, or filing status. Understanding how to properly amend your return can help ensure compliance and optimize your tax situation.

-

How can airSlate SignNow assist with filing a Rhode Island amended tax return?

airSlate SignNow simplifies the process of preparing and submitting a Rhode Island amended tax return by allowing you to electronically sign and send documents securely. Our platform provides an easy-to-use interface for managing tax documents and ensures that you can file amendments quickly and efficiently. This saves you time and reduces the hassle of paperwork.

-

What are the benefits of using airSlate SignNow for my Rhode Island amended tax return?

Using airSlate SignNow for your Rhode Island amended tax return offers several benefits, including enhanced security for sensitive tax information and a seamless eSignature process. You can track document status in real-time and receive notifications when your amendments are completed. Additionally, our platform is cost-effective, making it a smart option for individuals and businesses alike.

-

Are there any fees associated with using airSlate SignNow for Rhode Island amended tax returns?

airSlate SignNow offers a variety of pricing plans, including options that cater to small businesses and individuals preparing a Rhode Island amended tax return. Most plans include unlimited eSignatures and document management features at a competitive price. It's advisable to review our pricing page to find a plan that fits your needs.

-

Is airSlate SignNow compliant with Rhode Island tax regulations?

Yes, airSlate SignNow complies with the necessary regulations and requirements for submitting a Rhode Island amended tax return. We take data security seriously, ensuring that all documents and user information are protected. Our platform supports compliance with state tax laws, making it easier for you to manage your tax amendments correctly.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a wide range of features tailored for managing tax documents, including customizable templates for Rhode Island amended tax returns and extensive document tracking capabilities. You'll benefit from an intuitive drag-and-drop interface and the ability to invite team members for collaboration. These features help streamline the tax filing process.

-

Can I use airSlate SignNow on my mobile device for filing a Rhode Island amended tax return?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing you to manage your Rhode Island amended tax return on-the-go. Whether you are using a smartphone or a tablet, our mobile application ensures that you can securely sign, send, and track documents from anywhere, making tax filing convenient.

Get more for Ri 1040x Tax

Find out other Ri 1040x Tax

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF