Private Mortgage Payoff Letter Template Word Form

What is the Private Mortgage Payoff Letter Template Word

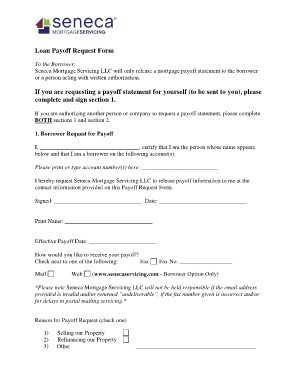

The private mortgage payoff letter template is a formal document used to confirm the total amount required to pay off a private mortgage. This letter serves as a crucial tool for borrowers seeking to settle their mortgage obligations. It outlines the remaining balance, any applicable fees, and the final payment date. The template is designed to ensure that all necessary information is included, making it easier for borrowers to communicate with their lenders effectively.

How to Use the Private Mortgage Payoff Letter Template Word

Using the private mortgage payoff letter template is straightforward. Begin by downloading the template in a Word format, which allows for easy customization. Fill in the required fields, including your name, the lender's name, the mortgage account number, and the total payoff amount. Ensure that you review the details for accuracy before sending the letter to your lender. This template streamlines the process and helps ensure that all pertinent information is provided.

Key Elements of the Private Mortgage Payoff Letter Template Word

A well-structured private mortgage payoff letter template should include several key elements to ensure clarity and completeness. These elements typically consist of:

- Borrower Information: Full name and contact details.

- Lender Information: Name and address of the lending institution.

- Mortgage Account Number: Unique identifier for the loan.

- Total Payoff Amount: The exact amount needed to settle the mortgage.

- Payment Instructions: Details on how to submit the payment.

- Deadline for Payment: Date by which the payment should be made.

Steps to Complete the Private Mortgage Payoff Letter Template Word

Completing the private mortgage payoff letter template involves a few essential steps. First, download the template in Word format. Next, input your personal information and the lender's details accurately. Then, specify the mortgage account number and the total payoff amount. After filling in all required fields, review the document for any errors or omissions. Finally, save the completed letter and send it to your lender through your preferred method, whether by email or postal mail.

Legal Use of the Private Mortgage Payoff Letter Template Word

The private mortgage payoff letter template is legally binding once it is completed and signed. To ensure its legality, it is important to comply with relevant regulations regarding eSignatures if the document is sent electronically. This includes ensuring that the document is signed using a compliant eSignature solution, which verifies the identity of the signer and maintains the integrity of the document. Adhering to these legal standards helps protect both the borrower and the lender in the transaction.

Examples of Using the Private Mortgage Payoff Letter Template Word

There are various scenarios in which the private mortgage payoff letter template can be utilized. For instance, a homeowner may use it to request a final payoff amount when selling their property. Alternatively, a borrower may need it to confirm the payoff amount when refinancing their mortgage. In both cases, the template provides a clear and professional means of communication with the lender, ensuring that all necessary details are conveyed effectively.

Quick guide on how to complete private mortgage payoff letter template word

Complete Private Mortgage Payoff Letter Template Word effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Private Mortgage Payoff Letter Template Word on any device with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to modify and eSign Private Mortgage Payoff Letter Template Word seamlessly

- Obtain Private Mortgage Payoff Letter Template Word and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Private Mortgage Payoff Letter Template Word and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private mortgage payoff letter template word

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a private mortgage payoff letter template word?

A private mortgage payoff letter template word is a pre-designed document that helps borrowers request a final payoff amount for their mortgage. This template simplifies the process and ensures that all necessary details are included, making it easier for both borrowers and lenders to understand the mortgage payoff requirements.

-

How can I customize the private mortgage payoff letter template word?

You can easily customize the private mortgage payoff letter template word by using word processing software like Microsoft Word. Simply replace the placeholder text with your specific information, such as borrower details and mortgage account numbers, to create a personalized document that meets your needs.

-

Are there any fees associated with using the private mortgage payoff letter template word?

The private mortgage payoff letter template word itself is typically free to use, but any fees may arise from the issuing lender for processing the payoff request. It's best to check with your lender regarding any potential charges associated with processing your payoff request.

-

What benefits does using a private mortgage payoff letter template word offer?

Using a private mortgage payoff letter template word provides a streamlined way to prepare your payoff request. It ensures that all essential information is included while saving you time and reducing the likelihood of errors in your correspondence with the lender.

-

Can I share a private mortgage payoff letter template word with others?

Yes, you can share the private mortgage payoff letter template word with others, such as family members or colleagues who may need to request a mortgage payoff letter. This ensures they have a reliable format to follow when drafting their requests.

-

Is the private mortgage payoff letter template word compatible with e-signature solutions?

Absolutely! The private mortgage payoff letter template word can easily be integrated with e-signature solutions, like airSlate SignNow. This allows you to electronically sign the document, making the process faster and more efficient.

-

How do I download the private mortgage payoff letter template word?

To download the private mortgage payoff letter template word, simply visit the airSlate SignNow website and navigate to the templates section. You can find the specific template you need and download it directly to your computer for easy access.

Get more for Private Mortgage Payoff Letter Template Word

- Widerruf eines sepa lastschrift mandats sparkasse bamberg form

- Refer to the hospital discharge summary form instructions for information on how to complete this form

- Chapter 8 section 1 religion sparks reform answer key

- Assigned counsel plan 722 c services expert voucher nycourts form

- University of memphis transfer credit request form

- Southwest regional solid waste commission solid waste form

- Www nh govsafetydivisionsnew hampshire department of safety form

- Contact us greater dover chamber of commerce nh form

Find out other Private Mortgage Payoff Letter Template Word

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document