Declaration of Independent Contractor Status Form

What is the Declaration of Independent Contractor Status Form

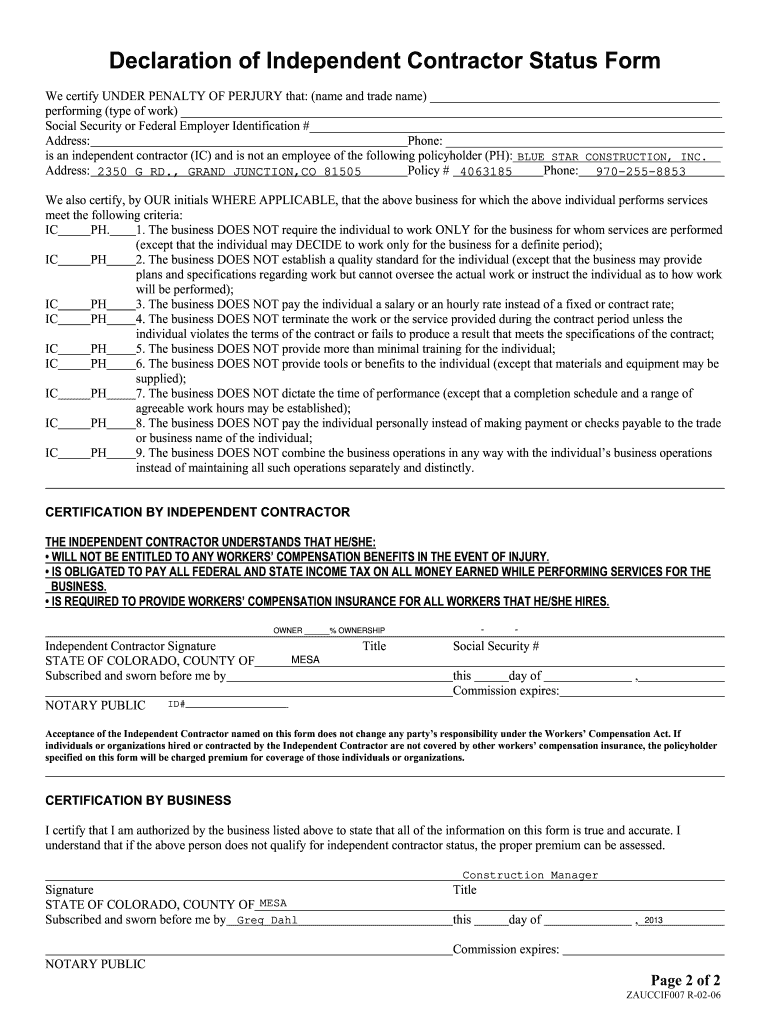

The declaration of independent contractor status form is a crucial document used to establish the working relationship between a business and an independent contractor. This form outlines the nature of the work being performed and clarifies that the contractor is not an employee of the business. By completing this form, both parties can ensure compliance with tax regulations and labor laws, reducing the risk of misclassification. It is essential for protecting the rights of independent contractors and providing them with the necessary documentation for tax purposes.

Steps to Complete the Declaration of Independent Contractor Status Form

Filling out the declaration of independent contractor status form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including the contractor's name, address, and Social Security number or Employer Identification Number (EIN). Next, clearly describe the services to be provided, including the duration of the contract and payment terms. Once all information is filled in, both the contractor and the business representative should sign and date the form. It is advisable to keep a copy for both parties' records.

Legal Use of the Declaration of Independent Contractor Status Form

This form serves as a legal document that helps define the relationship between the contractor and the business. It is vital for ensuring that both parties understand their rights and obligations. The declaration can protect businesses from potential legal issues related to employee misclassification, which can lead to penalties and back taxes. Additionally, having a properly completed form can assist in disputes regarding the nature of the working relationship, providing clarity and legal backing if needed.

Key Elements of the Declaration of Independent Contractor Status Form

Essential components of the declaration of independent contractor status form include the identification of the contractor and the business, a detailed description of the services to be provided, and the terms of payment. Important clauses may outline the independent nature of the work, indicating that the contractor has control over how the work is performed. Additionally, the form should include signature lines for both parties, signifying their agreement to the terms outlined within the document.

How to Obtain the Declaration of Independent Contractor Status Form

The declaration of independent contractor status form can typically be obtained through various sources. Many businesses provide their own version of the form tailored to their specific needs. Additionally, templates can be found online, allowing for customization to fit individual circumstances. It is important to ensure that any form used complies with current legal standards and includes all necessary elements to avoid potential issues.

Examples of Using the Declaration of Independent Contractor Status Form

Common scenarios for utilizing the declaration of independent contractor status form include freelance work, consulting services, and contract-based projects. For instance, a graphic designer hired by a marketing firm would use this form to clarify their independent status. Similarly, a software developer contracted by a company to build an application would complete the form to establish the terms of their engagement. These examples highlight the versatility of the form in various industries and roles.

Eligibility Criteria for Independent Contractors

To qualify as an independent contractor, individuals must meet specific criteria set by the IRS and other regulatory bodies. These criteria typically include the ability to control how and when work is performed, the provision of their own tools and resources, and the opportunity for profit or loss. Understanding these eligibility requirements is crucial for both contractors and businesses to ensure compliance and avoid misclassification issues.

Quick guide on how to complete declaration of independent contractor status form blue star homes

Complete Declaration Of Independent Contractor Status Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Declaration Of Independent Contractor Status Form on any device using airSlate SignNow's Android or iOS applications, simplifying any document-related task today.

The easiest way to alter and eSign Declaration Of Independent Contractor Status Form without hassle

- Obtain Declaration Of Independent Contractor Status Form and click on Get Form to begin.

- Make use of the features we provide to complete your form.

- Select important sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Declaration Of Independent Contractor Status Form to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Being a girl, if you have to get out of your home for the first time with girls who you don't know and they have already formed groups of their own and you are just alone, how do you stay independent in this entire office trip of a week or two?

Your age is not really clear.I assume you are an adult, not a girl, since you are going on an office trip.I wouldn’t worry about it, it is not a social trip, so you don’t have to have friends around you.If you want to be independent, do some research on the destination and find some activities and attractions nearby you can check out during the free time in your schedule.But there are usually more than one person who doesn’t buddy up with coworkers. You may find others looking for company on the trip.

Create this form in 5 minutes!

How to create an eSignature for the declaration of independent contractor status form blue star homes

How to create an eSignature for your Declaration Of Independent Contractor Status Form Blue Star Homes in the online mode

How to create an eSignature for your Declaration Of Independent Contractor Status Form Blue Star Homes in Google Chrome

How to make an electronic signature for signing the Declaration Of Independent Contractor Status Form Blue Star Homes in Gmail

How to make an eSignature for the Declaration Of Independent Contractor Status Form Blue Star Homes straight from your smartphone

How to make an electronic signature for the Declaration Of Independent Contractor Status Form Blue Star Homes on iOS devices

How to create an electronic signature for the Declaration Of Independent Contractor Status Form Blue Star Homes on Android

People also ask

-

What is a declaration of independent contractor status form?

A declaration of independent contractor status form is a legal document that outlines the terms under which an individual is classified as an independent contractor rather than an employee. This form helps clarify the relationship between the contractor and the hiring entity, ensuring compliance with tax and labor laws.

-

How does airSlate SignNow help with the declaration of independent contractor status form?

airSlate SignNow streamlines the process of creating, sending, and signing the declaration of independent contractor status form. With user-friendly features, businesses can efficiently manage documents, ensuring that all parties can eSign the form securely and promptly.

-

Is airSlate SignNow cost-effective for managing the declaration of independent contractor status form?

Yes, airSlate SignNow offers a cost-effective solution for managing the declaration of independent contractor status form. The pricing plans are designed to cater to various business sizes, ensuring that even small businesses can afford to utilize our features without compromising on quality.

-

What features does airSlate SignNow offer for the declaration of independent contractor status form?

airSlate SignNow offers several features for the declaration of independent contractor status form, including customizable templates, secure eSigning, real-time tracking, and document storage. These features ensure that users can efficiently manage their documents while maintaining compliance and security.

-

Can I integrate airSlate SignNow with other software for the declaration of independent contractor status form?

Absolutely! airSlate SignNow integrates seamlessly with various popular software applications, allowing you to streamline the workflow associated with the declaration of independent contractor status form. This integration enhances efficiency by centralizing your document management and communication in one platform.

-

What are the benefits of using airSlate SignNow for my declaration of independent contractor status form?

Using airSlate SignNow for your declaration of independent contractor status form provides several benefits, including increased efficiency, reduced paperwork, and improved accuracy. The platform enables quick turnaround times for document completion and ensures that all legal requirements are met effectively.

-

How secure is the declaration of independent contractor status form when using airSlate SignNow?

The declaration of independent contractor status form is secured with industry-standard encryption when using airSlate SignNow. Our platform implements advanced security measures to protect your documents and personal information, ensuring that your contracts remain confidential and safe from unauthorized access.

Get more for Declaration Of Independent Contractor Status Form

- Name change notification form wisconsin

- Wi lease form

- Wisconsin relative caretaker legal documents package wisconsin form

- Wisconsin standby form

- Wisconsin response form

- Wisconsin eastern bankruptcy form

- Wisconsin western district bankruptcy guide and forms package for chapters 7 or 13 wisconsin

- Bill of sale with warranty by individual seller wisconsin form

Find out other Declaration Of Independent Contractor Status Form

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast