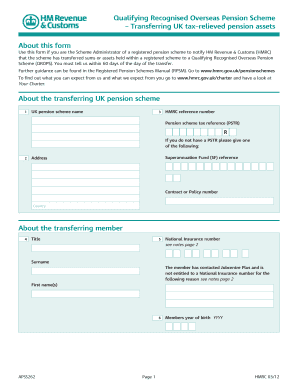

Apss262 Form

What is the Apss262

The Apss262 is a specific form utilized primarily for tax purposes within the United States. It is often associated with reporting certain financial information, particularly for individuals and businesses engaged in specific transactions. Understanding the Apss262 is crucial for compliance with U.S. tax regulations, as it helps ensure that all necessary information is accurately reported to the relevant authorities.

How to use the Apss262

Using the Apss262 involves several key steps to ensure proper completion and submission. First, gather all necessary personal and financial information required to fill out the form accurately. Next, carefully complete each section of the form, ensuring that all entries are correct and consistent with your records. After filling out the form, review it for any errors or omissions before submission. Finally, submit the Apss262 according to the guidelines provided for your specific situation, whether online or by mail.

Steps to complete the Apss262

Completing the Apss262 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant documents, including financial statements and personal identification.

- Fill in your personal information, ensuring it matches your official records.

- Provide detailed financial information as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the completed form according to the specified submission method.

Legal use of the Apss262

The Apss262 is legally recognized when completed and submitted according to the guidelines set forth by the IRS and other relevant authorities. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions, including fines or audits. Utilizing the Apss262 correctly can help maintain compliance with U.S. tax laws and regulations.

Key elements of the Apss262

Several key elements are essential for the Apss262 to be considered valid and complete. These include:

- Accurate identification of the filer, including name and address.

- Detailed financial information relevant to the specific reporting requirements.

- Proper signatures and dates to validate the form's authenticity.

- Compliance with all applicable IRS guidelines and requirements.

Form Submission Methods

The Apss262 can be submitted through various methods, depending on the specific requirements. Common submission methods include:

- Online submission through the IRS website or designated platforms.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete apss262

Complete Apss262 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Apss262 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Apss262 effortlessly

- Find Apss262 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the document or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and then click the Done button to preserve your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes requiring you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Apss262 and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the apss262

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is apss262 and how does it benefit businesses?

apss262 is a powerful feature of airSlate SignNow that streamlines the process of sending and eSigning documents. It enables businesses to manage their paperwork more efficiently, saving both time and money. By utilizing apss262, companies can enhance their workflow, making document handling faster and more secure.

-

How much does airSlate SignNow cost with apss262 features?

The pricing for airSlate SignNow varies depending on the subscription plan chosen, but features including apss262 are typically included in all plans. This ensures that users can access the full suite of functionalities without hidden fees. For detailed pricing information, it’s best to visit the airSlate SignNow pricing page.

-

What key features does apss262 offer?

apss262 includes features like customizable templates, automatic reminders, and secure encryption for document security. It helps users streamline their document workflows and enhances collaboration among team members. These robust features collectively improve productivity and efficiency for businesses.

-

Can apss262 integrate with other software and tools?

Yes, apss262 can seamlessly integrate with a variety of software and tools such as CRM systems, project management apps, and cloud storage solutions. This integration capability allows users to connect their existing tools with airSlate SignNow, further enhancing their digital workflows. By leveraging these integrations, businesses can work more efficiently across platforms.

-

Is airSlate SignNow user-friendly for those using apss262 for the first time?

Absolutely! airSlate SignNow, including the apss262 features, is designed with user experience in mind, making it approachable for first-time users. The intuitive interface and step-by-step guide provide an easy onboarding experience. Users can quickly learn to navigate the platform and start sending and signing documents without hassle.

-

How does apss262 ensure the security of my documents?

apss262 employs industry-leading encryption and security protocols to protect sensitive documents. airSlate SignNow follows compliance regulations to ensure that all transactions are secure. Users can have peace of mind knowing that their documents are safe when using the apss262 features.

-

What types of documents can I send using apss262?

With apss262 in airSlate SignNow, you can send various types of documents including contracts, agreements, forms, and more. The platform supports numerous file formats, making it versatile for different industry needs. Businesses can easily adapt apss262 to fit their specific documentation requirements.

Get more for Apss262

- Option to purchase package montana form

- Amendment of lease package montana form

- Annual financial checkup package montana form

- Montana bill sale form

- Living wills and health care package montana form

- Last will and testament package montana form

- Subcontractors package montana form

- Montana identity form

Find out other Apss262

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors