Oklahoma Sales Tax Form Sts 20002 a 2021

What is the Oklahoma Sales Tax Form STS 20002 A

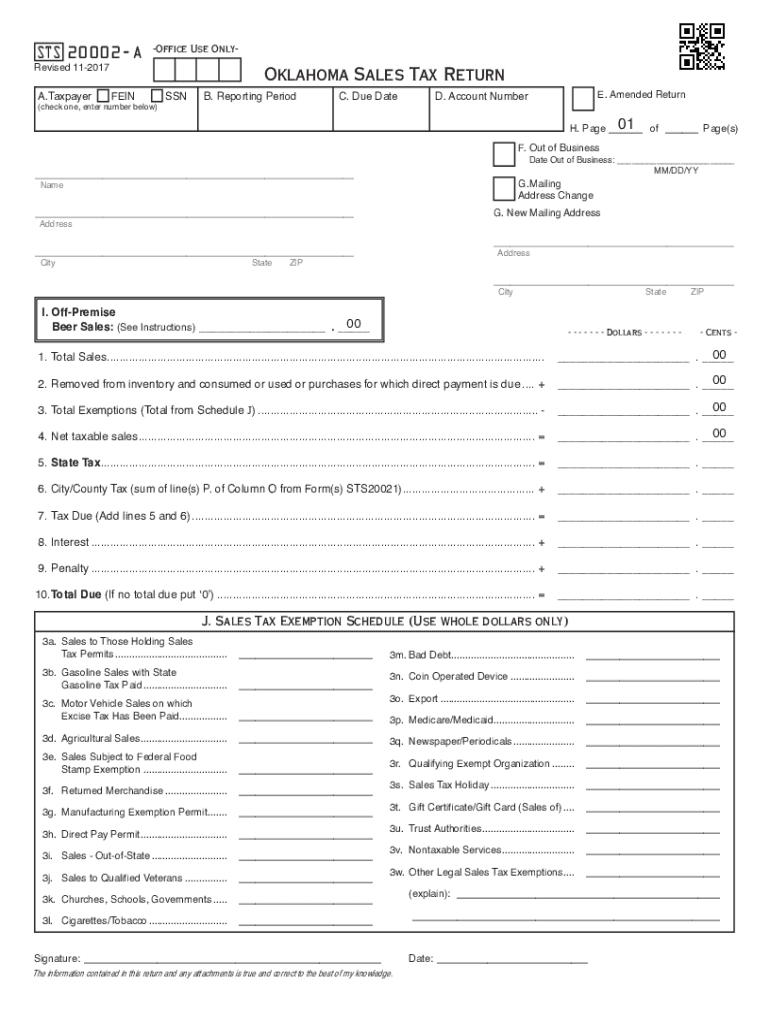

The Oklahoma Sales Tax Form STS 20002 A is a document used by businesses to report and remit sales tax collected on taxable sales within the state of Oklahoma. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately. The form captures various details, including the total sales amount, tax collected, and any exemptions that may apply. Understanding the purpose and requirements of this form is crucial for maintaining good standing with state tax authorities.

How to use the Oklahoma Sales Tax Form STS 20002 A

Using the Oklahoma Sales Tax Form STS 20002 A involves several steps to ensure accurate reporting. First, gather all necessary sales records for the reporting period. Next, calculate the total sales and the corresponding sales tax collected. Enter these figures into the appropriate sections of the form. It's important to review the form for accuracy before submission, as errors can lead to penalties or delays in processing. Finally, submit the completed form to the Oklahoma Tax Commission by the designated deadline.

Steps to complete the Oklahoma Sales Tax Form STS 20002 A

Completing the Oklahoma Sales Tax Form STS 20002 A requires careful attention to detail. Follow these steps:

- Gather sales records for the reporting period, including invoices and receipts.

- Calculate the total taxable sales and the total sales tax collected.

- Fill in the form with the calculated amounts, ensuring that all required fields are completed.

- Review the form for accuracy, checking for any discrepancies or missing information.

- Submit the form to the Oklahoma Tax Commission either online, by mail, or in person, depending on your preference.

Legal use of the Oklahoma Sales Tax Form STS 20002 A

The legal use of the Oklahoma Sales Tax Form STS 20002 A is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the required deadlines. Compliance with these regulations ensures that businesses avoid penalties and maintain their good standing with the Oklahoma Tax Commission. Additionally, electronic submissions are legally recognized, provided they meet the necessary eSignature requirements, ensuring that the form is both secure and binding.

Key elements of the Oklahoma Sales Tax Form STS 20002 A

Several key elements are essential to the Oklahoma Sales Tax Form STS 20002 A. These include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Data: Total sales amount, sales tax collected, and any exemptions claimed.

- Signature: The signature of the person responsible for the accuracy of the information provided.

- Filing Period: The specific period for which the sales tax is being reported.

Form Submission Methods

The Oklahoma Sales Tax Form STS 20002 A can be submitted through various methods to accommodate different preferences. Businesses can choose to file online through the Oklahoma Tax Commission's website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the tax authority. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own processing times and requirements, so it is advisable to select the one that best suits your needs.

Quick guide on how to complete oklahoma sales tax form sts 20002 a

Prepare Oklahoma Sales Tax Form Sts 20002 A effortlessly on any device

Online document management has grown in popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Oklahoma Sales Tax Form Sts 20002 A on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Oklahoma Sales Tax Form Sts 20002 A effortlessly

- Find Oklahoma Sales Tax Form Sts 20002 A and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Oklahoma Sales Tax Form Sts 20002 A and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma sales tax form sts 20002 a

Create this form in 5 minutes!

How to create an eSignature for the oklahoma sales tax form sts 20002 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sts 20002 a and how can it benefit my business?

The sts 20002 a is a powerful feature within airSlate SignNow that enables businesses to streamline their document signing processes. By utilizing this feature, companies can improve efficiency, reduce turnaround times, and enhance overall productivity. It provides an easy-to-use platform that simplifies eSigning and document management.

-

How much does the sts 20002 a cost?

AirSlate SignNow's pricing for the sts 20002 a varies based on the subscription plan selected. Our plans are designed to be cost-effective and scalable, ensuring that businesses of all sizes can access this valuable feature. Visit our pricing page for detailed information to find the plan that best fits your needs.

-

Is the sts 20002 a easy to integrate with other applications?

Yes, the sts 20002 a seamlessly integrates with a variety of applications, including popular platforms like Salesforce, Google Workspace, and Microsoft Office. This interoperability allows you to enhance your existing workflows without disruption. Easy integration ensures that you can leverage the full potential of airSlate SignNow.

-

What features are included with the sts 20002 a?

The sts 20002 a includes features such as customizable templates, automated workflows, and advanced security options. These features enable users to manage their document workflow efficiently while ensuring compliance with regulatory standards. The comprehensive functionality makes it an ideal choice for businesses looking to optimize their document processes.

-

Can I try the sts 20002 a before committing to a purchase?

Absolutely! AirSlate SignNow offers a free trial for users interested in exploring the capabilities of the sts 20002 a. This allows prospective customers to assess its features and determine how it fits their needs without any financial commitment first. Sign up today and experience the benefits firsthand.

-

How does the sts 20002 a ensure document security?

The sts 20002 a prioritizes document security with features such as SSL encryption, secure cloud storage, and advanced authentication methods. These security measures are designed to protect sensitive information and ensure that your documents are safe from unauthorized access. You can trust airSlate SignNow to keep your data secure.

-

What kind of support is available for the sts 20002 a?

AirSlate SignNow provides extensive support for users of the sts 20002 a, including a dedicated help center, tutorials, and live chat assistance. Our knowledgeable support team is available to address any questions or concerns you might have. We are committed to ensuring that you have a smooth experience with our services.

Get more for Oklahoma Sales Tax Form Sts 20002 A

- Tnb tutup akaun fill online printable fillable blank form

- Snap recertification application online ny snap recertification application online ny form

- Z1a request for leave of absence form

- Postal vote application form

- For mediate use only mediates co zac l a i m f o form

- Medicine management form

- National rural youth service corps narysec application form

- Drivewalk thru rabies clinics madison county ny form

Find out other Oklahoma Sales Tax Form Sts 20002 A

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe