Bank of Baroda Annexure 1 Form

What is the Bank Of Baroda Annexure 1

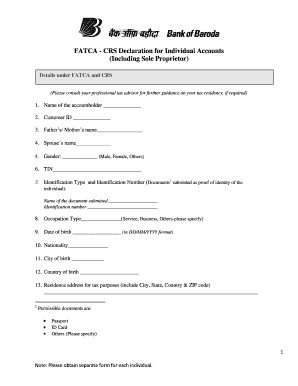

The Bank Of Baroda Annexure 1 is a crucial document used primarily for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is essential for individuals and entities who maintain accounts with the Bank Of Baroda, especially those who are classified as U.S. persons. The annexure serves to declare the account holder's tax status and ensures that the bank complies with international tax regulations. It is a part of the broader effort to combat tax evasion by requiring financial institutions to report information about accounts held by U.S. taxpayers.

Steps to complete the Bank Of Baroda Annexure 1

Completing the Bank Of Baroda Annexure 1 involves several key steps to ensure accuracy and compliance:

- Gather necessary personal information, including your full name, address, and taxpayer identification number.

- Identify your account type and provide details about the account held with the Bank Of Baroda.

- Complete the certification section, confirming your status as a U.S. person or specifying other relevant classifications.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your declarations.

Legal use of the Bank Of Baroda Annexure 1

The legal use of the Bank Of Baroda Annexure 1 is governed by U.S. tax laws and international agreements aimed at preventing tax evasion. When filled out correctly, this form serves as a legally binding declaration of your tax status. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal repercussions. The form must be submitted to the Bank Of Baroda to comply with FATCA requirements, ensuring that the bank can report your financial information to the IRS as mandated.

How to obtain the Bank Of Baroda Annexure 1

The Bank Of Baroda Annexure 1 can be obtained directly from the bank's official website or by visiting a local branch. The form is typically available in PDF format, making it easy to download and print. If you prefer a digital format, you may also request the form through the bank's customer service channels. Ensure that you have the latest version of the form to comply with current regulations.

Required Documents

When filling out the Bank Of Baroda Annexure 1, you may need to provide supporting documents to verify your identity and tax status. Commonly required documents include:

- Proof of identity, such as a government-issued ID or passport.

- Taxpayer Identification Number (TIN) or Social Security Number (SSN).

- Any relevant tax documents that support your claims, such as prior tax returns.

Form Submission Methods

The Bank Of Baroda Annexure 1 can be submitted through various methods to suit your convenience:

- Online submission through the Bank Of Baroda's secure portal, if available.

- Mailing the completed form to your local Bank Of Baroda branch.

- In-person submission at a Bank Of Baroda branch, where staff can assist with any questions.

Quick guide on how to complete bank of baroda annexure 1

Effortlessly Prepare Bank Of Baroda Annexure 1 on Any Device

Digital document management has gained increased traction among companies and individuals. It offers an ideal environmentally conscious alternative to conventional printed and signed documents, as you can obtain the necessary file and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Bank Of Baroda Annexure 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign Bank Of Baroda Annexure 1 with Ease

- Acquire Bank Of Baroda Annexure 1 and tap on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or censor sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Bank Of Baroda Annexure 1 and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of baroda annexure 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bank FATCA CRS declaration sole?

The bank FATCA CRS declaration sole refers to a specific document that individuals or entities must submit to comply with the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). This declaration ensures that financial institutions report relevant information to tax authorities, facilitating global tax compliance.

-

How does airSlate SignNow simplify the bank FATCA CRS declaration sole process?

airSlate SignNow streamlines the bank FATCA CRS declaration sole process by providing an intuitive platform for drafting, signing, and managing these documents. With features like electronic signatures and automated workflows, users can efficiently handle declarations without tedious paperwork or lengthy delays.

-

What pricing plans are available for airSlate SignNow when handling bank FATCA CRS declaration sole?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for those focusing on the bank FATCA CRS declaration sole. Our cost-effective solutions ensure that businesses can choose a plan that best fits their documentation and compliance requirements.

-

Can I integrate airSlate SignNow with other financial tools for bank FATCA CRS declaration sole?

Yes, airSlate SignNow integrates seamlessly with various financial tools and systems, making it easier to manage your bank FATCA CRS declaration sole alongside your other financial documentation. These integrations help streamline workflows and maintain compliance without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for bank FATCA CRS declaration sole?

The primary benefits of using airSlate SignNow for bank FATCA CRS declaration sole include increased efficiency, improved accuracy, and enhanced security. By automating the declaration process, businesses can save time, reduce errors, and safeguard sensitive information with industry-leading encryption.

-

Is airSlate SignNow secure for submitting sensitive bank FATCA CRS declaration sole documents?

Absolutely! airSlate SignNow prioritizes security by employing advanced encryption methods and security protocols to protect all documents, including bank FATCA CRS declaration sole submissions. Your data remains confidential and secure throughout the entire signing and submission process.

-

How can I get started with airSlate SignNow for bank FATCA CRS declaration sole?

Getting started with airSlate SignNow for bank FATCA CRS declaration sole is simple! You can sign up for a free trial on our website, allowing you to explore all the features and tools we offer. Once registered, you can begin creating, signing, and managing your FATCA CRS declarations with ease.

Get more for Bank Of Baroda Annexure 1

- Application for certificate faa faa form

- Review petition review petition form

- P shamo conditional rezoning agreement form w legal desc docx

- Form dl 13

- Supfl 1104 form

- Microsoft word 1099 w 2g specifications draft docx form

- Maine income tax rate fill out ampamp sign online form

- Utah sales tax account number form

Find out other Bank Of Baroda Annexure 1

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself