St 12 Wisconsin 2013

What is the St 12 Wisconsin

The St 12 form, officially known as the Wisconsin Sales and Use Tax Exemption Certificate, is a document used by businesses in Wisconsin to claim exemption from sales tax on certain purchases. This form is particularly relevant for organizations that are purchasing items for resale or for specific exempt purposes, such as non-profit organizations or government entities. By filling out the St 12, businesses can ensure compliance with state tax regulations while avoiding unnecessary tax expenses.

Steps to complete the St 12 Wisconsin

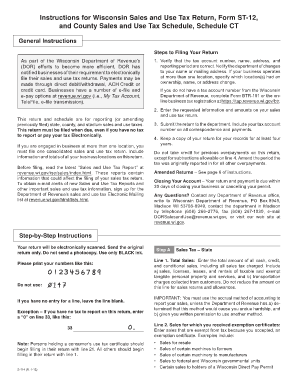

Completing the St 12 form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including the purchaser's name, address, and tax identification number. Next, clearly indicate the reason for the exemption by checking the appropriate box on the form. It is essential to provide a detailed description of the items being purchased and confirm that they are eligible for tax exemption. Finally, the form must be signed and dated by an authorized representative of the purchasing entity to validate the exemption claim.

How to obtain the St 12 Wisconsin

The St 12 form can be easily obtained from the Wisconsin Department of Revenue's website. It is available as a downloadable PDF, allowing businesses to print and fill it out at their convenience. Additionally, many tax professionals and accounting software platforms provide access to the form for their clients. It is advisable to ensure that the most current version of the form is used to comply with any changes in tax regulations.

Legal use of the St 12 Wisconsin

The legal use of the St 12 form hinges on its proper completion and adherence to Wisconsin tax laws. The form must be used solely for eligible purchases, and misuse can result in penalties or fines. Businesses should maintain accurate records of all transactions involving the St 12 to substantiate their claims during audits. Understanding the specific exemptions allowed under Wisconsin law is crucial for ensuring that the form is used correctly and legally.

Form Submission Methods (Online / Mail / In-Person)

The St 12 form can be submitted in various ways, depending on the preferences of the purchasing entity. While the form itself does not require submission to the Wisconsin Department of Revenue, it should be provided to the seller at the time of purchase. This can be done electronically if the seller accepts digital forms, or it can be printed and handed over in person. Some businesses may also choose to keep a copy on file for their records. It is important to confirm with the seller regarding their preferred method of receiving the St 12 form.

Key elements of the St 12 Wisconsin

Several key elements are essential to the St 12 form to ensure its validity. These include the purchaser's name and address, the seller's name and address, and the reason for the exemption. Additionally, a detailed description of the items being purchased is required, along with the signature of an authorized representative. The form must also include the date of the transaction and the purchaser’s tax identification number. Ensuring that all these elements are accurately filled out is crucial for the form's acceptance.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the St 12 form can lead to significant penalties. If a business improperly claims an exemption, it may be liable for the unpaid sales tax, along with interest and potential fines. Additionally, repeated misuse of the form can result in further legal consequences, including audits and increased scrutiny from tax authorities. It is essential for businesses to understand their obligations and ensure that they are using the St 12 form correctly to avoid these penalties.

Quick guide on how to complete st 12 wisconsin

Effortlessly Prepare St 12 Wisconsin on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without any interruptions. Handle St 12 Wisconsin on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The Easiest Way to Modify and eSign St 12 Wisconsin with Ease

- Obtain St 12 Wisconsin and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form hunting, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign St 12 Wisconsin to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 12 wisconsin

Create this form in 5 minutes!

How to create an eSignature for the st 12 wisconsin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to form st 12 instructions wi?

airSlate SignNow offers a variety of features to streamline your form st 12 instructions wi process. With an intuitive interface, customizable templates, and electronic signature capabilities, users can easily manage their forms. This ensures that all necessary instructions are clear and accessible, enhancing efficiency.

-

How does airSlate SignNow simplify the process of filling out form st 12 instructions wi?

With airSlate SignNow, you can fill out and sign form st 12 instructions wi electronically, eliminating paper waste and reducing the time spent on manual tasks. The platform allows users to create reusable templates, ensuring consistent and accurate completion of forms every time. This simplifies the overall document management process for businesses.

-

Is airSlate SignNow affordable for small businesses needing form st 12 instructions wi?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small businesses seeking to handle form st 12 instructions wi. The cost-effective solution provides all necessary features without breaking the bank, ensuring that budget constraints do not hinder operational efficiency.

-

Can I integrate airSlate SignNow with other applications for form st 12 instructions wi?

Absolutely! airSlate SignNow seamlessly integrates with a variety of business applications, allowing you to streamline the workflow for form st 12 instructions wi. Whether you use CRM systems, document management tools, or cloud storage services, our platform can enhance functionality by working alongside the tools you already use.

-

How secure is airSlate SignNow when managing form st 12 instructions wi?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while managing form st 12 instructions wi. Users can trust that their sensitive information remains confidential and secure throughout the signing and submission process.

-

What support options does airSlate SignNow offer for form st 12 instructions wi users?

airSlate SignNow provides comprehensive support options for users handling form st 12 instructions wi. Customers can access a knowledge base with guides, video tutorials, and FAQs, as well as personalized customer support through live chat and email. This ensures you receive the help you need whenever necessary.

-

Can I track the progress of my form st 12 instructions wi submissions in airSlate SignNow?

Yes, airSlate SignNow allows users to easily track the status of their form st 12 instructions wi submissions. You will receive real-time notifications and updates, so you can see when documents have been sent, viewed, or signed. This feature helps streamline workflows and ensures timely completion of necessary documents.

Get more for St 12 Wisconsin

- Anser ifx adatest req ada13046 08142013 indd prometheus form

- Printable luminaria form

- Reg 496 form

- Tdlr massage intake form

- Solving systems by elimination worksheet pdf form

- V112 form 101961651

- Hipaa permits disclosure to health care professionals and authorized decision makers for treatment form

- Medical office manager contract template form

Find out other St 12 Wisconsin

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online