Instructions for Wisconsin Sales and Use Tax Return, Form 2020

What is the Instructions for Wisconsin Sales and Use Tax Return, Form

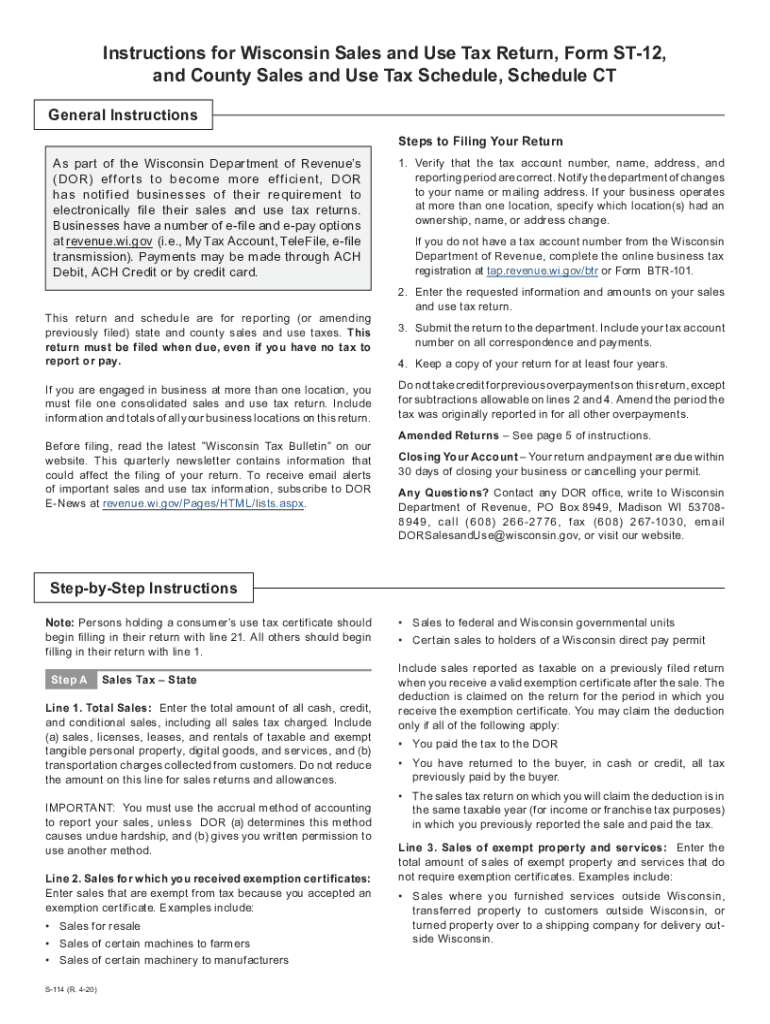

The Instructions for Wisconsin Sales and Use Tax Return provide essential guidance for businesses and individuals who need to report and remit sales and use tax in Wisconsin. This document outlines the necessary steps to complete the sales and use tax return accurately, ensuring compliance with state tax laws. It includes definitions of key terms, explanations of taxable and exempt sales, and details on how to calculate the tax owed. Understanding these instructions is crucial for maintaining good standing with the Wisconsin Department of Revenue.

Steps to Complete the Instructions for Wisconsin Sales and Use Tax Return, Form

Completing the Wisconsin Sales and Use Tax Return involves several key steps:

- Gather necessary documentation, including sales records and purchase invoices.

- Determine the total sales and use tax collected during the reporting period.

- Identify any exempt sales and ensure proper documentation is available.

- Calculate the total tax due based on applicable rates.

- Complete the return form accurately, ensuring all required fields are filled.

- Review the completed form for accuracy before submission.

Key Elements of the Instructions for Wisconsin Sales and Use Tax Return, Form

The key elements of the Instructions for Wisconsin Sales and Use Tax Return include:

- Tax Rates: Information on current sales and use tax rates applicable in Wisconsin.

- Exemptions: Detailed explanations of what sales are exempt from taxation.

- Filing Frequency: Guidelines on how often businesses must file their returns.

- Payment Options: Instructions on how to remit payment for the taxes owed.

Legal Use of the Instructions for Wisconsin Sales and Use Tax Return, Form

The legal use of the Instructions for Wisconsin Sales and Use Tax Return is crucial for ensuring compliance with state tax regulations. These instructions are designed to help taxpayers understand their obligations under Wisconsin law. Following the guidelines helps avoid penalties and ensures that all taxable transactions are reported accurately. Additionally, using the instructions correctly can protect businesses from audits and legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Sales and Use Tax Return are essential for maintaining compliance. Typically, returns are due on the last day of the month following the end of the reporting period. For example, if a business operates on a quarterly basis, the return for the first quarter (January to March) would be due by April 30. It is important to mark these dates on your calendar to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin Sales and Use Tax Return can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers prefer to file electronically through the Wisconsin Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address specified in the instructions.

- In-Person: Taxpayers may also submit their returns in person at designated Department of Revenue offices.

Quick guide on how to complete instructions for wisconsin sales and use tax return form

Prepare Instructions For Wisconsin Sales And Use Tax Return, Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Instructions For Wisconsin Sales And Use Tax Return, Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Instructions For Wisconsin Sales And Use Tax Return, Form without hassle

- Find Instructions For Wisconsin Sales And Use Tax Return, Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign Instructions For Wisconsin Sales And Use Tax Return, Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for wisconsin sales and use tax return form

Create this form in 5 minutes!

People also ask

-

What are the instructions for filing a sales use tax return?

To file a sales use tax return, you must first collect all relevant sales data for the reporting period. Follow the specific instructions for your state regarding the type of sales included and any eligible deductions. It's essential to complete the return accurately to avoid penalties and ensure compliance with local regulations.

-

How can airSlate SignNow help with my sales use tax return process?

airSlate SignNow streamlines the documentation required for filing your sales use tax return by allowing you to eSign and send necessary forms easily. This reduces paperwork and simplifies the collection of signatures from authorized parties, ensuring that your tax return is submitted on time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as document templates, secure eSigning, and the ability to track the status of your documents. These features are particularly useful when gathering signatures for your sales use tax return, creating a more efficient workflow for your business.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers tiered pricing plans that cater to various business needs. While there is a cost involved, the platform is designed to save you time and resources, making it a cost-effective solution for managing your sales use tax return documentation.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and finance software platforms. This integration enables you to automate the flow of information related to your sales use tax return, further streamlining your tax filing process.

-

What benefits does eSigning provide for sales use tax returns?

eSigning through airSlate SignNow offers numerous benefits, such as faster turnaround times and reduced processing delays. By utilizing the eSigning feature, your sales use tax return can be completed more swiftly and securely, ensuring compliance and efficiency in your documentation process.

-

How does airSlate SignNow improve compliance for sales use tax returns?

By using airSlate SignNow, you can ensure that all documents related to your sales use tax return are properly signed and securely stored. This helps maintain an organized record that makes it easier to demonstrate compliance during audits or reviews by tax authorities.

Get more for Instructions For Wisconsin Sales And Use Tax Return, Form

- Mediation intake form 328552388

- Health science academy volunteer log form

- Valic payroll deduction forms

- Medical proforma

- Requisition for what to know about abortion in nc education handbook form

- Registered agency affiliated counselor application packet form

- Counseling facility license application form

- Request for passport waiver letter form

Find out other Instructions For Wisconsin Sales And Use Tax Return, Form

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT