Sales Tax Forms DOR 2025-2026

Understanding Sales Tax Forms DOR

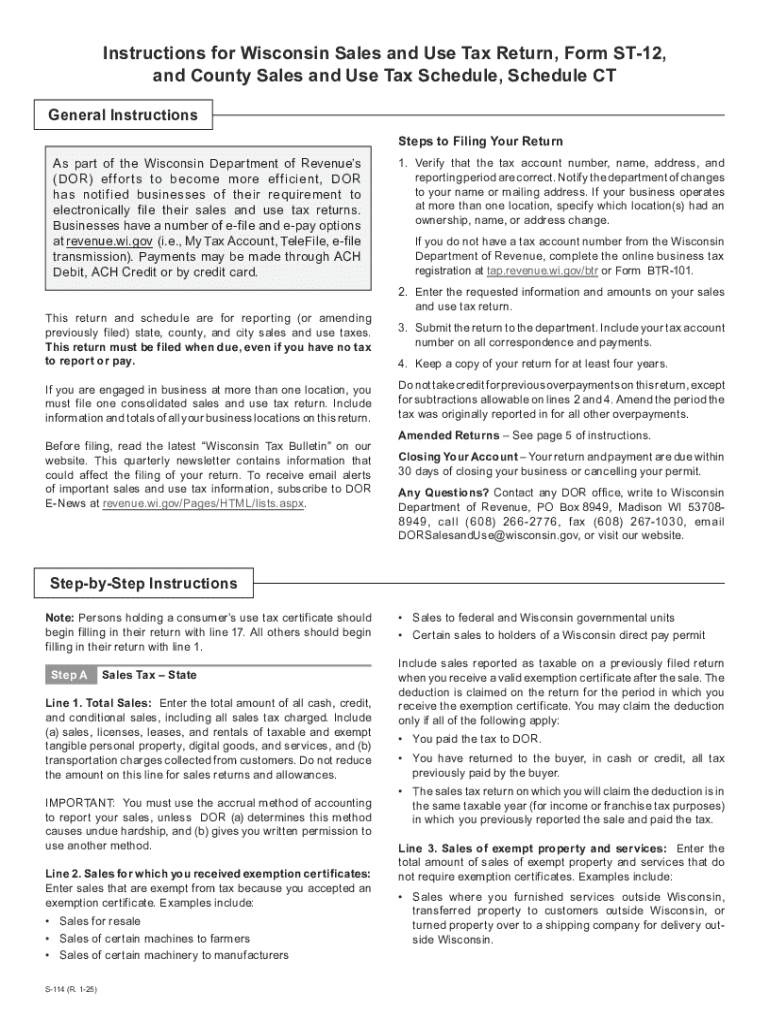

The Sales Tax Forms DOR are essential documents used by businesses and individuals to report and pay sales tax to the Department of Revenue (DOR) in their respective states. These forms vary by state, reflecting local tax rates and regulations. Typically, they are required for businesses that sell goods or services subject to sales tax, ensuring compliance with state tax laws.

Steps to Complete the Sales Tax Forms DOR

Completing the Sales Tax Forms DOR involves several key steps:

- Gather necessary information, including sales figures, exemptions, and tax rates applicable to your business.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total sales tax owed based on your sales and the applicable tax rate.

- Review the form for errors before submission to avoid penalties.

- Submit the completed form by the specified deadline, either online, by mail, or in person, depending on state requirements.

Obtaining the Sales Tax Forms DOR

Sales Tax Forms DOR can typically be obtained through the official website of your state’s Department of Revenue. Most states provide downloadable versions of the forms in PDF format, allowing for easy access and printing. Additionally, some states may offer the option to complete the forms online, streamlining the process for users.

Filing Deadlines and Important Dates

Each state has specific deadlines for filing Sales Tax Forms DOR, which can vary based on the frequency of tax collection (monthly, quarterly, or annually). It is crucial to stay informed about these dates to avoid late fees or penalties. Generally, deadlines are set for the end of the month following the reporting period, but checking your state’s DOR website for precise dates is recommended.

Legal Use of the Sales Tax Forms DOR

The Sales Tax Forms DOR are legally binding documents that must be completed and submitted as part of compliance with state tax laws. Incorrect or fraudulent submissions can lead to significant penalties, including fines and audits. Businesses must ensure that they understand the legal implications of these forms and maintain accurate records to support their filings.

Examples of Using the Sales Tax Forms DOR

Sales Tax Forms DOR are used in various scenarios, such as:

- A retail store reporting sales made during a specific period.

- An online business calculating sales tax for items sold to customers in different states.

- A service provider documenting taxable services rendered to clients.

Each example highlights the importance of accurate reporting to ensure compliance with state tax regulations.

Required Documents for Sales Tax Forms DOR

To complete the Sales Tax Forms DOR, businesses typically need to provide supporting documentation, which may include:

- Sales records and receipts.

- Exemption certificates for tax-exempt sales.

- Invoices issued during the reporting period.

Having these documents ready can facilitate a smoother filing process and help validate the information reported on the forms.

Create this form in 5 minutes or less

Find and fill out the correct sales tax forms dor

Create this form in 5 minutes!

How to create an eSignature for the sales tax forms dor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Sales Tax Forms DOR and why are they important?

Sales Tax Forms DOR are essential documents required for reporting sales tax to the Department of Revenue. They help businesses comply with tax regulations and avoid penalties. Using airSlate SignNow, you can easily manage and eSign these forms, ensuring timely submissions.

-

How can airSlate SignNow help with Sales Tax Forms DOR?

airSlate SignNow streamlines the process of completing and submitting Sales Tax Forms DOR. Our platform allows you to fill out, sign, and send these forms electronically, reducing paperwork and saving time. This efficiency helps ensure that your tax submissions are accurate and on schedule.

-

Is there a cost associated with using airSlate SignNow for Sales Tax Forms DOR?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that simplify the management of Sales Tax Forms DOR. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for handling Sales Tax Forms DOR?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for Sales Tax Forms DOR. These tools enhance your workflow and ensure that all necessary documents are completed accurately. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for Sales Tax Forms DOR?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software. This integration allows you to manage Sales Tax Forms DOR alongside your other financial documents, creating a cohesive workflow that enhances productivity.

-

What are the benefits of using airSlate SignNow for Sales Tax Forms DOR?

Using airSlate SignNow for Sales Tax Forms DOR offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your business rather than paperwork. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow when handling Sales Tax Forms DOR?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your Sales Tax Forms DOR and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for Sales Tax Forms DOR

- Alabama form a 4 rev 100

- Zorunlu staj belgesi form

- Certificate of organization california pdf form

- Lyme disease symptom checklist pdf form

- Job search log sccsnet form

- Public affairs pa 2 review nc dhhs online publications info dhhs state nc form

- 5 team double elimination printyourbrackets com form

- Shelbycity oh govhist pres app for certificatehist pres app for certificate of appropriatenessrevised form

Find out other Sales Tax Forms DOR

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History