Wisconsin Sales & Use Tax Guide 2023

Understanding the Wisconsin Sales & Use Tax Guide

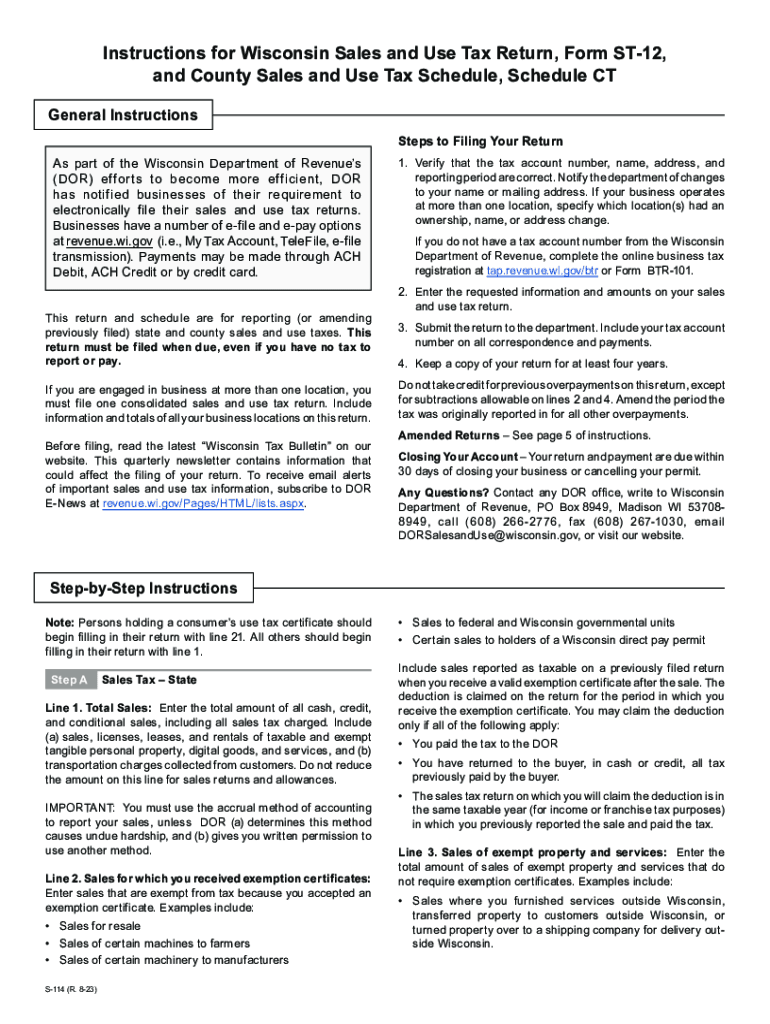

The Wisconsin Sales & Use Tax Guide provides essential information for businesses and individuals regarding the state's sales and use tax regulations. This guide outlines the tax rates, exemptions, and specific rules applicable to various goods and services. It is crucial for compliance and helps taxpayers understand their obligations under Wisconsin law.

Steps to Complete the Wisconsin Sales & Use Tax Guide

Completing the Wisconsin Sales & Use Tax Guide involves several key steps:

- Gather all necessary financial records, including sales receipts and purchase invoices.

- Determine the applicable tax rates for the products or services sold or purchased.

- Identify any exemptions that may apply to your transactions.

- Fill out the guide accurately, ensuring all calculations reflect the correct tax amounts.

- Review the completed guide for accuracy before submission.

Legal Use of the Wisconsin Sales & Use Tax Guide

The legal use of the Wisconsin Sales & Use Tax Guide ensures compliance with state tax laws. Taxpayers must use the guide to report sales and use tax correctly, as failure to do so can result in penalties. Understanding the legal implications of the guide helps businesses avoid audits and fines.

Filing Deadlines and Important Dates

Timely filing is essential for compliance with Wisconsin tax regulations. Important deadlines include:

- Monthly filing deadlines for businesses with high sales volumes.

- Quarterly and annual filing deadlines for smaller businesses.

- Specific dates for submitting any amendments or corrections to previously filed returns.

Required Documents for Filing

To complete the Wisconsin Sales & Use Tax Guide, certain documents are necessary:

- Sales records that detail all transactions made during the reporting period.

- Purchase invoices that support any claimed exemptions.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Examples of Using the Wisconsin Sales & Use Tax Guide

Understanding practical applications of the Wisconsin Sales & Use Tax Guide can enhance compliance. For instance:

- A retailer must calculate sales tax on taxable goods sold to customers.

- A contractor may use the guide to determine tax obligations on materials purchased for a project.

- Non-profit organizations can refer to the guide to identify exempt purchases.

Quick guide on how to complete wisconsin sales ampamp use tax guide

Complete Wisconsin Sales & Use Tax Guide effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Wisconsin Sales & Use Tax Guide on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Wisconsin Sales & Use Tax Guide effortlessly

- Find Wisconsin Sales & Use Tax Guide and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Sales & Use Tax Guide and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin sales ampamp use tax guide

Create this form in 5 minutes!

How to create an eSignature for the wisconsin sales ampamp use tax guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to st 12 Wisconsin?

airSlate SignNow is an electronic signature platform that allows businesses to send and eSign documents efficiently. It is particularly beneficial for users in st 12 Wisconsin who need a reliable and cost-effective solution for document management and signature collection.

-

What are the pricing plans available for airSlate SignNow in st 12 Wisconsin?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses in st 12 Wisconsin. These plans include a free trial and scalable options based on the number of users and features required, ensuring accessibility for all organizations.

-

What features does airSlate SignNow provide for users in st 12 Wisconsin?

Users in st 12 Wisconsin benefit from features such as customizable templates, mobile accessibility, and advanced security options. These functionalities enhance the efficiency of document signing processes, making it easier for businesses to operate smoothly.

-

How can airSlate SignNow improve document workflow for st 12 Wisconsin businesses?

With airSlate SignNow, st 12 Wisconsin businesses can streamline their document workflows by automating signature collection and reducing turnaround times. This not only saves time but also improves overall productivity by minimizing manual tasks.

-

Is airSlate SignNow compliant with legal standards in st 12 Wisconsin?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures in st 12 Wisconsin. This ensures that documents signed using the platform are legally binding and can be trusted in various business transactions.

-

Can I integrate airSlate SignNow with other tools I use in st 12 Wisconsin?

Absolutely! airSlate SignNow allows integration with various tools and platforms, making it easy for businesses in st 12 Wisconsin to sync their existing workflows. Popular integrations include Google Drive, Salesforce, and Microsoft Office.

-

What are the benefits of using airSlate SignNow for eSigning documents in st 12 Wisconsin?

Using airSlate SignNow for eSigning documents in st 12 Wisconsin provides signNow benefits, such as faster turnaround times and enhanced document security. Additionally, businesses can save costs by reducing the need for paper and physical storage.

Get more for Wisconsin Sales & Use Tax Guide

Find out other Wisconsin Sales & Use Tax Guide

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors